3 Top Aluminum Stocks to Consider Buying Now

Aluminum isn't some new space-age material suddenly bursting onto the global scene. In fact, industry bellwether Alcoa Corp (NYSE: AA) traces its history back to the late 1800s. Aluminum has pretty much always been prized for the same general traits over time, a mixture of light weight and strength. But as the world gets more and more concerned with energy efficiency, those two variables are becoming increasingly important. And that paints a solid long-term picture for the metal -- and those that produce it -- across the aluminum value chain. Here's a quick background on aluminum and some names you might want to consider looking at today.

It's a process

Although aluminum is an element, it isn't found in nature the way you find might find a gold nugget just sitting in a river or stream. Aluminum is always combined with other elements and needs to be processed before you can make the lightweight metal cans from which you've probably sipped a soda or two in your lifetime.

Image source: Getty Images.

In fact, while Alcoa is one of the world's largest aluminum makers, it is also the largest producer of bauxite and one of the largest producers of alumina. Those are key precursors to making aluminum. Alcoa's position straddling the entire aluminum value chain is a key reason it has remained so influential in the aluminum market for so long.

Of course, the real value of aluminum is the final product. The beauty of the metal is its mixture of light weight and strength. For example, Kaiser Aluminum Corp (NASDAQ: KALU), which uses aluminum it buys from others to make specialized parts for its customers, highlights two trends in aviation that are expected to drive long-term demand. The core story is the inherent need for strong and lightweight materials when you are talking about building things that fly in the air. But the big news is the mixture of increasing demand for airplanes as nations around the world move up the socioeconomic ladder, and the increasing content share of each plane that has been going to aluminum.

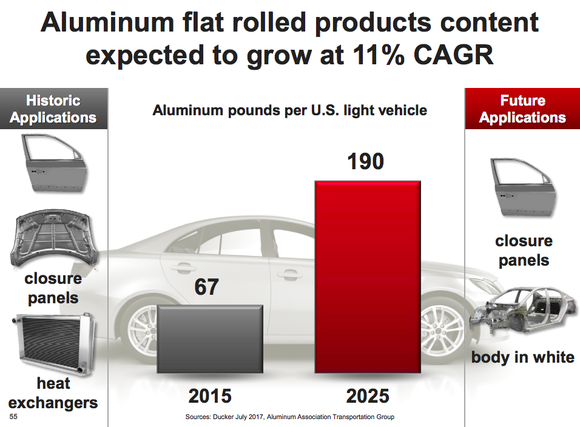

That mixture should lead to long-term demand growth for aluminum and the companies that make it (or make parts out of it). But there's a similar story taking shape in the automobile space. While weight isn't as much of an issue for a ground-based vehicle, lighter cars use less fuel because they require less energy to move. And that's expected to be a key demand driver in the auto sector, which is increasingly focused on energy efficiency. To provide just one small example, Kaiser Aluminum expects flat-rolled aluminum to go from 67 pounds per passenger car in 2015 to 190 pounds in 2025, largely displacing heavier steel along the way.

Aluminum demand projections for light vehicles is a huge opportunity for parts makers. Image source: Kaiser Aluminum.

Just like the multistep process that's required to make aluminum, though, none of this demand is expected to show up overnight. It will take time. A big part of that is the fact that aluminum tends to be relatively expensive to make compared to alternatives like steel. And there are limitations to the metal's strength -- twist a soda can, and see how easy it is to crumble up even though you can stack can atop can without fear of structural failure. But as technology advances and energy conservation demands increase, the long-term trend for aluminum demand appears very solid.

The aluminum game

If that sounds good to you, the next question is clearly, "How should you look to invest in aluminum?" The answer, though, isn't exactly clear. For example, if you want the broadest exposure to the metal, then a company like Alcoa might be the best option. With huge operations at every step of the aluminum production process, it is a heavyweight when it comes to this lightweight metal.

Company | Ticker | Market Cap (billions) | Dividend Yield |

|---|---|---|---|

Alcoa | NYSE: AA | $9.7 | Nil |

Arconic Inc | (NYSE: ARNC) | $14.5 | 0.8% |

Kaiser Aluminum | Nasdaq: KALU | $1.8 | 2% |

That said, Alcoa isn't the same company it was just a few years ago. In late 2016, Alcoa separated from specialty parts maker Arconic Inc. So, the current incarnation of Alcoa is only just proving what it's capable of achieving and doesn't provide material exposure to specialty parts. Alcoa's first year as a stand-alone company, though, was a good one, with revenues up nearly 25% in 2017 and adjusted EBITDA roughly doubling year over year. It has been working hard to keep its costs low and leverage modest.

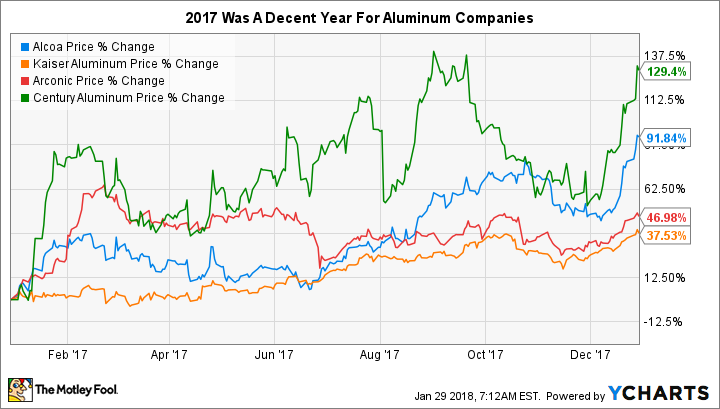

As Motley Fool's Lou Whiteman noted, 2017 was a pretty good year for Alcoa. However, the market wasn't blind to the story and drove the shares up an investor-pleasing 90% by year end. Alcoa looks a little expensive today, but you should keep it on your watchlist for further consideration. Alcoa's largely commodity business is tied to the ups and downs of aluminum prices, a key benefit in 2017 as the metal rallied late in the year. That said, being tied to commodity prices also means that a downturn in aluminum prices, and the commodities used to make it, could quickly put Alcoa in the bargain bin, even though long-term trends suggest aluminum demand will continue to increase over time.

If you want to avoid the commodity side of the business as much as possible, you should take a look at companies like Arconic and Kaiser. This pair of stocks take aluminum and transform it into the parts that actually get used in cars and planes, among other things. This is a value-added business that can get away with charging higher prices -- which translates into wider margins and often repeat business (airplane and car makers don't like to change suppliers; it can be expensive and time-consuming). Note, however, that when aluminum prices go up, this pair will actually face higher costs, so their results will sometimes be suffering at the very point that you'd expect Alcoa to be benefiting.

Arconic's third quarter 2017 revenue breakdown by industry. Image source: Arconic.

Arconic's first year as a stand-alone company was solid, but mixed with a lot of drama. For example, its GAAP earnings roughly doubled year over year through the first nine months of 2017. However, the CEO of the company, the man who orchestrated the Arconic/Alcoa breakup, stepped down in April because of "bad judgement" related to a fight with dissident shareholders. The stock was up around 47% for the year. However, its specialty parts business should benefit from the demand trends in the auto and aerospace markets over time. Arconic is worth a deep dive, though you might want to wait for a price pullback before stepping in here, as well.

Kaiser Aluminum was the laggard here, up "only" 37.5%. Through the first nine months of 2017, Kaiser's revenues and GAAP earnings were both higher, advancing 2% and 10%, respectively. However, underneath those numbers was an interesting dichotomy. The company's value-added sales into the auto sector increased 4%, but sales into the aerospace arena declined 8%. This is a clear indication that, despite the long-term structural demand for aluminum and aluminum parts, it's not going to be a straight line. Still, Kaiser's specialty parts focus is worth researching if you're interested in aluminum's increasing role in the world. But, as with Alcoa and Arconic, you might want to wait for a price pullback before you pull the trigger.

Bright future, but no rush

When you step back to look at the aluminum market, there are numerous applications that should provide robust long-term demand. However, that demand is going to take time to develop. So, there's not likely to be a change in the results at aluminum makers like Alcoa and specialty parts companies like Arconic and Kaiser, which means the solid runs this trio had in 2017 shouldn't lead you to rush into the stocks. But that doesn't mean you shouldn't be considering them now, while you wait for better prices. There's plenty of opportunity in the industry if you take your time to invest wisely.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.