3 Top Dividend Stocks to Buy Right Now

Finding the best dividend stocks involves selecting companies that have the financial stability to continue paying dividends for years to come, a healthy yield, and a solid business that can weather the inevitable tides of the stock market.

To help you track down a few such companies, we asked a few Motley Fool contributors for some to dividend stocks you should consider adding to your portfolio right now. Here's why Procter & Gamble (NYSE: PG), Microsoft (NASDAQ: MSFT), and Verizon Communications (NYSE: VZ) made it on to their list.

Image source: Getty Images.

Adjusting to a changing market

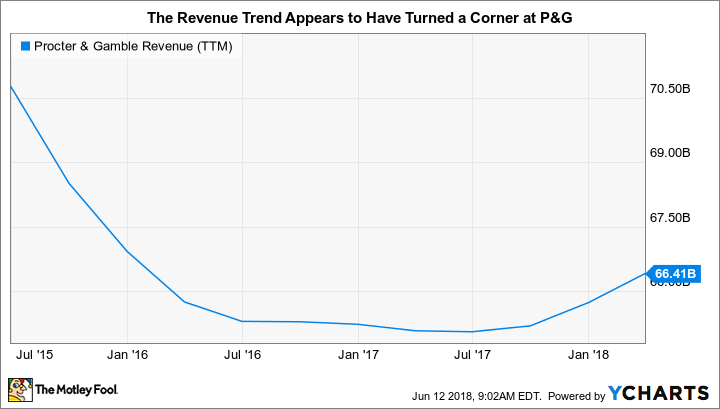

Reuben Gregg Brewer (The Procter & Gamble Company): Consumer tastes are changing, and that's having a negative impact on Procter & Gamble, whose stock is down around 15% so far this year. But the consumer products giant hasn't been sitting still; it's adjusting to better serve customers.

The biggest change was the decision to slim down, getting rid of smaller and unprofitable brands. That effort is complete, allowing P&G to focus on its largest and most important businesses, including iconic brands like Gillette, Bounty, and Pampers. Procter & Gamble's core strengths are in research & development, marketing, and distribution, so putting more of its money and time behind a smaller portfolio of brands makes complete sense.

It's also been augmenting its product lineup by introducing "natural" versions of its iconic brands to better align with current consumer demand. In addition, it has been more aggressively taking on internet-based competitors. These are all hard choices that require near-term sacrifices for a long-term benefit. Fiscal 2017 revenues, for example, fell about 0.5%.

Image source: PG Revenue (TTM) data by YCharts.

However, nine months into fiscal 2018, we're starting to see improved results as P&G's top line advanced 3% year over year. So, the combination of its efforts appear to be taking hold. That, however, is being obscured somewhat today by rising costs, notably for transportation. While investors are worrying about the current headwind (which will eventually get resolved by price increases), you can buy P&G with a yield of nearly 4% and pay more attention to the improving big picture.

A great software company

Ashraf Eassa (Microsoft): Software giant Microsoft isn't the highest-yielding stock on the market -- its dividend yield is just 1.7% as of writing -- but it's a phenomenal business that should continue to do well over the long term.

Microsoft's growth, despite the fact that it's already a huge business, continues to be impressive. Last quarter, the company reported that its revenue surged 16% to an eye-popping $26.8 billion, with operating income -- my favorite measure of a business's financial health -- growing 23% to $8.3 billion.

The company isn't a one-trick pony, either, with its growth being relatively broad-based. For example, last quarter, Microsoft's Productivity and Business Process segment enjoyed 17% revenue growth, its Intelligent Cloud business unit saw sales grow by 15%, and its More Personal Computing segment saw revenue rise by 11%.

Microsoft has a lot of great product franchises and business units that have delivered and could continue to deliver excellent, highly profitable growth. So, if you're looking for a solid business that, in addition to offering investors a real opportunity for significant share price appreciation, also pays a reasonable dividend, Microsoft is definitely worth a look.

A bet on emerging wireless tech

Chris Neiger (Verizon): Verizon hardly needs an introduction, but it's worth taking a second to consider the company's position in the mobile wireless market. Even with increased competition in the cellular space over the past few years from AT&T; and T-Mobile, Verizon still remains the biggest carrier in the U.S. by customers. Not only that, but Verizon is bent on leading the competition in the nascent 5G wireless market as well.

5G will allow for faster uploads and downloads across the mobile internet, enhance wireless connections for Internet of Things devices, and bring new business opportunities for telecoms like fixed wireless broadband. The push for 5G technology is growing across the globe, and in the U.S., Verizon is quickly becoming a leader.

The company launched 5G tests in five markets this year and aims to start commercial 5G services next year. If you think 5G is just another cell-phone company gimmick, consider that this new tech is expected to become a $251 billion market by 2025.

Not only does 5G offer new ways for the company to grow its wireless and home broadband businesses, it's also becoming clear that Verizon is looking to 5G to enhance its content business as well. You may recall that Verizon currently owns Yahoo!, AOL, and other content services, which are housed under its Oath subsidiary. Well, last month, Oath CEO Tim Armstrong (formerly the CEO of AOL) told CNBC in an interview: "That's why 5G is important. It's more speed, but it's also amazing amounts of compute power for us to do different types of content."

Investors will have to be patient in waiting for Verizon to launch its commercial 5G services next year, and understand that it could take a few more years before it spreads across the country. Nevertheless, it's clear that the nation's No. 1 wireless telecom is taking the right steps now to benefit from this new technology in the coming years.

With Verizon's dividend yield at about 4.7% right now and its shares trading at just 6.6 times the company's trailing earnings -- along with its growing 5G potential -- this dividend stock should easily earn a spot on nearly any income investor's short list.

More From The Motley Fool

Teresa Kersten is an employee of LinkedIn and is a member of The Motley Fool's board of directors. LinkedIn is owned by Microsoft. Ashraf Eassa has no position in any of the stocks mentioned. Chris Neiger has no position in any of the stocks mentioned. Reuben Gregg Brewer owns shares of Procter & Gamble. The Motley Fool owns shares of Verizon Communications. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.