3D Systems (DDD) to Buy Oqton in Cash-and-Stock Deal Worth $180M

3D Systems DDD recently signed an agreement to acquire Oqton, a leading software company that creates new breed of intelligent, cloud-based Manufacturing Operating System (MOS) platform, in a cash-and-stock deal worth $180 million. The company expects to complete the transaction in the fourth quarter of 2021.

The acquisition is aimed to accelerate the adoption of additive manufacturing technologies and thereby, strengthen the manufacturing competitiveness by improving efficiencies while reducing costs.

Additive manufacturing is a process of joining materials to make objects from 3D model data. The main functions of additive fabrication are designing/modeling, prototyping and direct part production. The use of additive manufacturing facilitates quick design change, which helps save cost and time.

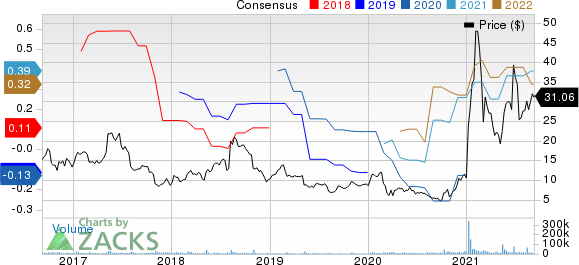

3D Systems Corporation Price and Consensus

3D Systems Corporation price-consensus-chart | 3D Systems Corporation Quote

Oqton helps organizations improve production efficiencies, while reducing costs through deploying its unique cloud-based, artificial intelligence (AI)-enabled MOS that accelerates the automation of digital manufacturing. Its solution banks on artificial intelligence (AI), machine learning and Industrial Internet of Things (IIOT) technologies that help organizations automate their digital manufacturing workflows.

Per the terms of the deal, the company will operate Oqton as a separate independent organization to ensure the data security and confidentiality of its customers. The company intends to offer its most advanced software platforms — 3D Sprint, 3DXpert, Geomagic portfolio, and Additive Works’ Amphyon — as optional add-ons to the Oqton MOS platform.

With this acquisition, 3D Systems intends to tap the growing opportunities in the smart manufacturing solution space. The company estimates that the spending on smart manufacturing is likely to reach $6.5 billion by 2025 from $1.5 billion today.

3D Systems anticipates that the combination will accelerate the adoption of additive manufacturing in the existing production environments. Moreover, it projects run rate revenues from the Oqton software to exceed $100 million by 2025.

The 3D printing technology has the potential to revolutionize manufacturing and improve the commercial space. Various companies, ranging from hospital managers to car manufacturers, are now opting for varied 3D solutions to address simple make-to-stock orders as well as complex, engineer-to-order production strategies.

Consequently, the company has been expanding its operational processes to meet the rising demand across diverse sectors. For instance, sectors like automotive, consumer products, government and defense, industrial/business machines, education research, and others (arts and architecture) are likely to spur further demand for 3D printing products. Apart from these, the aerospace and the trillion-dollar oil & gas industries are showing a penchant for 3D printing too, which will aid the company’s growth in the days to come.

Moreover, 3D Systems has been making acquisitions to diversify its offerings, add synergistic technology and expand the company’s domain expertise in operating markets. The company has already secured an important place in sectors like manufacturing, medical and aerospace, while also pursuing unconventional sectors like food and fashion. 3D Systems expects its portfolio of innovative products to drive more than 30% organic growth over the next couple of years, thereby boosting its margins and earnings.

With the booming 3D printing industry, the company’s focus on this market presents a favorable long-term opportunity. As a matter of fact, the majority of 3D Systems’ customers are shifting from prototyping to end-use production, using 3D printing technology, and the company believes it is well positioned to aid them in their transformation. It anticipates that robust demand for production printers, materials and software will continue being a key catalyst in the days to come, driving growth.

Zacks Rank & Stocks to Consider

3D Systems currently carries a Zacks Rank #3 (Hold).

Some other top-ranked stocks in the broader technology sector include Microsoft MSFT, Cadence Design Systems CDNS, and NVIDIA NVDA, all carrying a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth rate for Microsoft, Cadence Design, and NVIDIA is currently pegged at 11.1%, 11.7%, and 17.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

3D Systems Corporation (DDD) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research