3M (MMM) '22 Earnings to Grow on Robust Sales Amid Supply Woes

3M Company MMM, at its Virtual Strategic Update and 2022 Outlook Meeting yesterday, provided its projections for 2022. It also talked about its growth opportunities and investment plans.

Notably, shares of 3M lost1% yesterday, ending the trading session at $158.01.

Inside the Headlines

As communicated, the company is poised to benefit from its healthy businesses, innovation and digital capabilities, and manufacturing footprint. Growth opportunities within electronic materials, home improvement, manufacturing, healthcare IT, automotive/mobility, and wound care markets are advantageous.

Robust cash flow and healthy balance sheet too add vigor. Due importance is given to acquisitions, divestitures, organic growth opportunities, and rewards to shareholders via dividends and share buybacks. However, supply-chain restrictions, logistics and raw material issues, and semiconductor shortages are headwinds for the near term.

For 2022, the company anticipates year-over-year organic sales growth of 2-5%. Total revenues are predicted to increase 1-4%. For the Consumer segment, the company predicts low-to mid-single-digit growth in organic sales. Organic growth is expected to be in the mid-single digits for Healthcare, in the flat to low-single digits for Safety & Industrial, and in the low- to high-single digits for Transportation & Electronics.

Earnings are predicted to be $10.15-$10.65 per share for the year, suggesting a rise from $10.12 recorded in 2021. Declining pandemic-induced demand for respirators is predicted to lower organic growth by 2%, margin by 70 basis points and earnings by 45 cents. Forex woes are predicted to adversely impact sales by 1%. Logistics/raw material-related cost headwinds are predicted to be $350-$450 million. The tax rate is expected to be 18.5-19.5%.

Net cash flow from operating activities is predicted to be $7.3-$7.9 billion in 2022. Capital spending is expected to be $1.7-$2 billion and free cash flow is likely to be $5.3-$6.2 billion. Free cash flow conversion in the year is anticipated to be 90-100%.

For the first quarter of 2022, the company expects stability in volumes of elective procedures in the Healthcare segment. A decline in global auto builds and the persistence of supply-chain restrictions might be concerning. A fall in the pandemic-related demand for respirators is likely to hurt revenues by $100-$150 million. Cost headwinds related to logistics/raw material are anticipated to hurt by $200-$250 million. Effective pricing will be a relief. The tax rate in the quarter is expected to be 18.5-19.5%, suggesting a rise from 16.4% reported in the year-ago quarter.

In addition to the above-mentioned projections, the company reiterated its plans to spend $1 billion in a 20-year timeframe on its environmental goals. Water reduction, the installation of state-of-the-art purification technology, carbon reduction and lower dependence on fossil-based plastic are 3M’s main environmental targets. In 2022, the company plans to work on a 10% water reduction.

Zacks Rank, Price Performance and Earnings Estimates

With a market capitalization of $91.1 billion, 3M currently carries a Zacks Rank #3 (Hold). Solid product offerings, strengthening end markets, and portfolio-reshaping actions will be beneficial for 3M. Supply-chain restrictions and cost inflation are headwinds.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past three months, 3M’s shares have lost 13.8% compared with the industry’s decline of 11.6%.

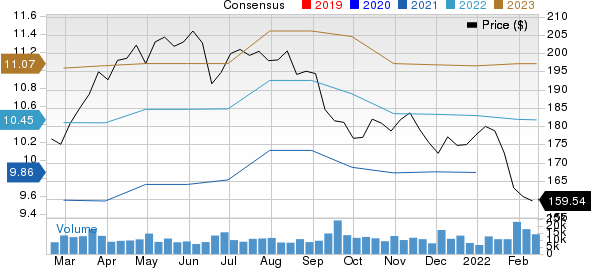

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for MMM’s earnings per share is pegged at $10.45 for 2022 and $11.07 for 2023, reflecting a decline of 0.5% and growth of 0.2% from the respective 60-day-ago figures. The consensus estimate for first-quarter 2022 earnings of $2.44 has decreased 1.6% over the past 60 days.

3M Company Price and Consensus

3M Company price-consensus-chart | 3M Company Quote

Upcoming Releases

Below we discussed three companies from the same industry that are likely to report their results soon.

Icahn Enterprises L.P. IEP is likely to report its fourth-quarter 2021 results on Feb 25.

The Zacks Consensus Estimate for Icahn’s earnings is pegged at 13 cents per share for the fourth quarter of 2021. In the last reported quarter, Icahn reported weaker-than-expected results, with an earnings surprise of -600.00%.

LSB Industries, Inc. LXU is likely to report results for fourth-quarter 2021 on Feb 23.

In the past 60 days, the Zacks Consensus Estimate for LSB Industries’ earnings has been unchanged at 37 cents per share. The company’s results were better-than-expected in the last quarter, withan earnings beat of 125.00%.

Federal Signal Corporation FSS will likely release its fourth-quarter 2021 results on Feb 24.

In the past 60 days, the Zacks Consensus Estimate for Federal Signal’s earnings has decreased 2.6% to 38 cents per share. In the last reported quarter, the company’s earnings surpassed estimates by 4.35%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

3M Company (MMM) : Free Stock Analysis Report

Icahn Enterprises L.P. (IEP) : Free Stock Analysis Report

Lsb Industries Inc. (LXU) : Free Stock Analysis Report

Federal Signal Corporation (FSS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research