4 Airline Stocks to Consider as Oil Prices Spike 15%

In light of crude oil future prices increasing over 15% during the "harvest moon" weekend, four airline stocks listed on the Peter Lynch Growth screen, a predefined screen within our All-in-One Screener, are Allegiant Travel Co. (NASDAQ:ALGT), Hawaiian Holdings Inc. (NASDAQ:HA), JetBlue Airways Corp. (NASDAQ:JBLU) and Southwest Airlines Co. (NYSE:LUV).

Oil prices soar on Saudi Arabian oil industry attack, sending airline stocks down

Saudi Aramco, the national oil company of Saudi Arabia, said on Saturday that the terrorist attacks at its plants in Abqaiq and Khurais sent crude oil production down 5.7 million barrels per day. As the supply of oil declines, the price of oil increases assuming constant demand. Brent crude oil futures prices reached an intraday high of $71.95, up 19.5% from the previous close, while West Texas Intermediate oil future prices reached an intraday high of $63.34, up 12.27% from the previous close.

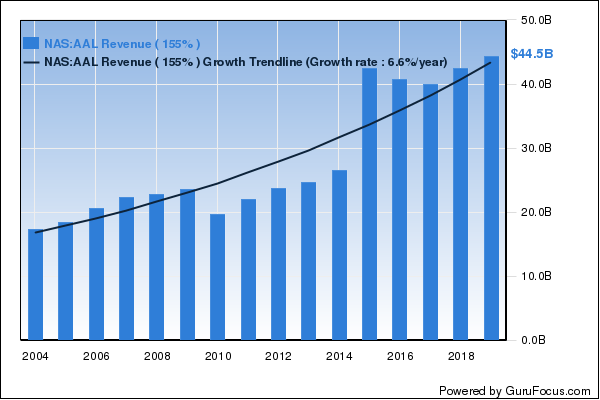

Saudi Aramco CEO Amin Nassar said in a company statement he was "grateful there were no injuries" and thanked the teams for bringing the situation under control. Despite this, shares of companies with high fuel costs, such as airlines and cruise operators, sunk Monday morning on the news. American Airlines Group Inc. (NASDAQ:AAL), Delta Air Lines Inc. (NYSE:DAL) and United Continental Holdings (NASDAQ:UAL), major airline holdings of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B), declined over 1.5% from their previous close.

Peter Lynch seeks undervalued stocks based on price-earnings

Legendary investor Peter Lynch seeks undervalued stocks based on the price-earnings ratio. The author of "One Up on Wall Street" said one way to determine if a stock is undervalued is by comparing the price line to the earnings line. Lynch defined an undervalued stock as one where the share price is below 15 times earnings per share.

GuruFocus' Peter Lynch Growth screen identifies noncyclical companies that not only are undervalued based on Lynch's criterion, but also have strong growth potential based on several metrics, which include good business predictability and revenue growth.

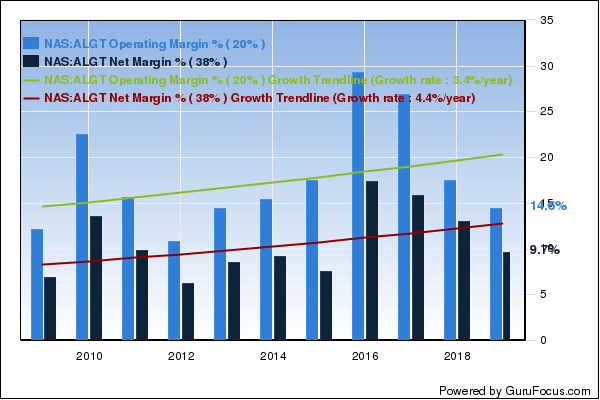

Allegiant

Las Vegas-based Allegiant offers air travel from small-to-medium cities to world-class vacation destinations using a non-stop, low-fare network. GuruFocus ranks the airline's profitability 8 out of 10 on several positive indicators, which include a return on equity that outperforms 83.33% of global competitors and operating margins outperforming 95.16% of global airlines despite contracting approximately 1.2% per year over the past five years.

Allegiant has a five-star business predictability rank on the heels of strong and consistent revenue and earnings growth over the past 10 years. Gurus riding the airline's strong profitability include Diamond Hill Capital (Trades, Portfolio) and First Public Advisors.

Hawaiian

Hawaiian Holdings provides transportation between the Hawaiian Islands, the U.S. and the South Pacific through its subsidiary Hawaiian Airlines. GuruFocus ranks the Honolulu-based airline's profitability 7 out of 10: The company has a poor Piotroski F-score of 4 while profit margins and returns are outperforming approximately 70% of global competitors.

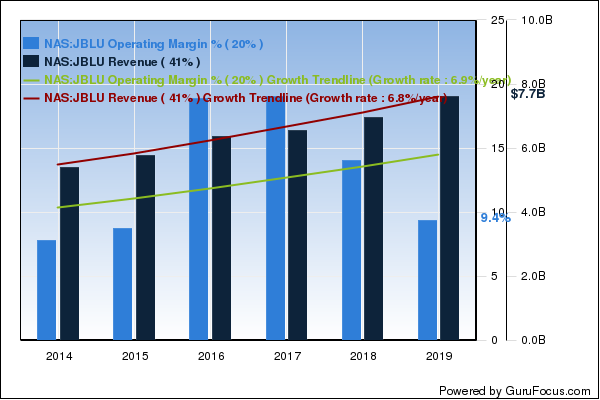

JetBlue

Long Island City, New York-based JetBlue provides air travel between the U.S., Latin America, Puerto Rico and the Caribbean. GuruFocus ranks the airline's profitability 7 out of 10: Operating margins are increasing approximately 6.90% per year over the past five years despite outperforming just 51.61% of global competitors. Additionally, JetBlue's business predictability ranks 3.5 stars out of five on consistent revenue growth over the past 10 years.

Gurus with large holdings in JetBlue include PRIMECAP Management (Trades, Portfolio) and Donald Smith (Trades, Portfolio).

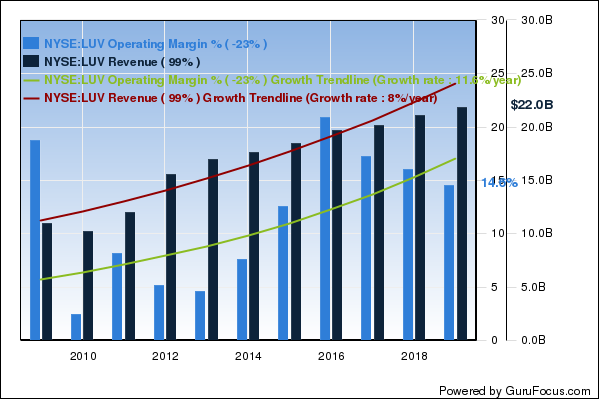

Southwest

A major domestic carrier, Dallas-based Southwest operates over 700 aircraft manufactured by Boeing Co. (NYSE:BA). GuruFocus ranks Southwest's financial strength 6.6 out of 10 and profitability 7 out of 10 on several positive indicators, which include robust interest coverage, a five-star business predictability rank and operating margins that are outperforming 87.10% of global airline competitors. Despite this, Southwest's Piotroski F-score ranks a poor 4 out of 9.

Buffett's conglomerate and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates both own shares of Southwest. Other gurus riding the carrier's strong profitability include Tom Gayner (Trades, Portfolio) and the T Rowe Price Equity Income Fund (Trades, Portfolio).

Disclosure: Long Allegiant and Southwest.

Read more here:

5 Greenblatt Magic Formula Stocks in Basic Materials

Carl Icahn's Top 6 Holdings

6 Undervalued-Predictable Chinese Companies

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.