4 Defense Equipment Stocks to Watch as Air Traffic Gradually Improves

A gradual recovery in global air travel over the past few months has been renewing hopes for stocks in the Aerospace-Defense Equipment industry, especially those which have been suffering due to the pandemic’s impact on commercial aerospace. Also, mergers and acquisitions have started taking place, which boosts revenue generation prospects.

Moreover, the ongoing hostility between Israel and Iran along with inherent security issues prevalent worldwide is expected to boost investment activity within the industry. Some important players in this industry include CAE Inc. (CAE), Transdigm Group (TDG), Bae Systems Plc (BAESY) and Triumph Group (TGI).

About the Industry

The Zacks Aerospace-Defense Equipment industry comprises firms that manufacture a wide variety of vital components for the aerospace-defense space, ranging from aerostructures, space shuttles, propulsion systems, aircraft engines, defense electronics, missile and radar systems to flight test equipment, structural adhesives, instrumentation and control systems, communication products and many more. A few of these companies also offer integrated simulation and training services to the U.S. defense force.

While the majority of revenues is generated from production of the aforementioned accompaniments, the industry players also generate revenues by providing notable aftermarket support and services like maintenance, repair and overhaul activities to aerospace and defense players.

3 Trends Shaping the Future of the Aerospace-Defense Equipment Industry

New M&As Instill Hopes: Rising competition has historically prompted industry majors to expand their product lines through small and medium-sized mergers and acquisitions (M&As) besides some big mergers witnessed in the industry. Notably, in January 2021, TransDigm Group finalized the purchase of Cobham Aero Connectivity for approximately $965 million in cash. It’s true that the economic crisis owing to the novel coronavirus outbreak caused an initial cash crunch in the industry leading to some notable deal cancellations like that of Hexcel Corporation (HXL) and Woodward. Nevertheless, the recent uptick in air travel is expected to bring in some notable consolidations like the one we witnessed in April 2020, following which Raytheon Technologies (RTX) was formed. Such consolidations by leading industry players should improve economies of scale for the aerospace-defense equipment industry as a whole.

Improved Traffic Boosts Prospects: The year 2020 can be deemed as the worst year in history for global air travel, with revenue passenger kilometers plunging 65.9% from 2019. However, optimism surrounding the arrival and initial distribution of vaccine has instilled confidence among travelers over the past couple of months. Resultantly, a gradual recovery has been observed in global air traffic. Looking ahead, the International Air Transport Association (IATA) recently revealed its forecast for 2021, which indicates 50.4% improvement on 2020 demand that would bring the industry to 50.6% of 2019 levels. This surely offers notable growth prospect for stocks in the aerospace-defense equipment industry, which have been recording dismal operational performance over the recent past, courtesy of the pandemic.

Socio-Political Uncertainty to Aid: Widespread geo-political as well as socio-economic tensions have been a growth driver for the aerospace and defense equipment industry for decades. In the recent times, escalating international terrorist attacks along with civil wars like the ones in the Middle East have been adding more impetus to this space. One of the most influential factors dominating geopolitics in the Middle East is the cold war between Israel and Iran. Both countries are set to host elections in 2021 and most analysts project that they will elect more hard-line leaderships that might lead to further confrontations. Though the pandemic had dealt a significant blow to its growth trajectory, the recent geopolitical tensions worldwide are expected to be beneficial for this industry.

Zacks Industry Rank Reflects Encouraging Outlook

The Zacks Aerospace-Defense Equipment industry is housed within the broader Zacks Aerospace sector. It currently carries a Zacks Industry Rank #115, which places it in the top 45% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

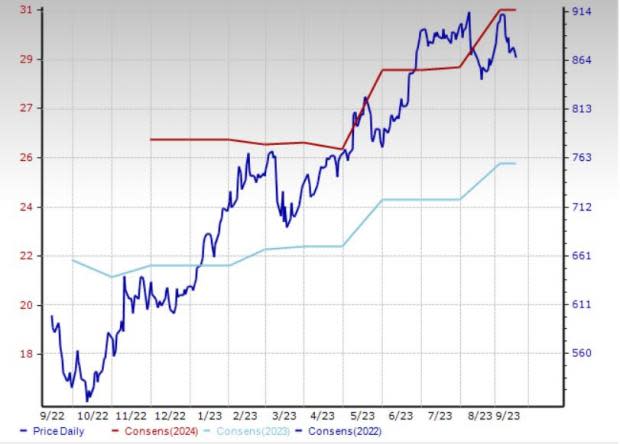

The industry’s position in the top 50% of the Zacks-ranked industries can be attributed to a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts have gained confidence in this group’s earnings growth potential in recent times. Evidently, the industry’s earnings estimates for the current fiscal year have improved 2.3% since Dec 31.

Before we present a few aerospace-defense equipment stocks that you may want to add to your portfolio, let’s take a look at the industry’s recent stock market performance and valuation picture.

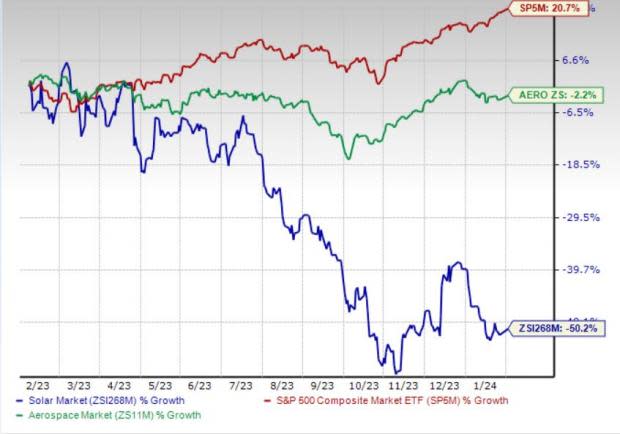

Industry Lags S&P 500 and Sector

The Aerospace-Defense Equipment industry has underperformed the Zacks S&P 500 composite as well as its own sector over the past year. The stocks in this industry have collectively plunged 31.6% compared with the Aerospace sector’s decline of 30.2%. The Zacks S&P 500 composite has moved up 20.3% in the same timeframe.

Industry’s Current Valuation

On the basis of trailing 12-month EV/Sales, which is used for valuing capital intensive stocks like aerospace-defense equipment, the industry is currently trading at 2.5X compared with the S&P 500’s 4.6X and the sector’s 2.5X.

Over the past five years, the industry has traded as high as 2.58X, as low as 1.10X, and at the median of 2.11X, as the charts show below.

EV-Sales Ratio (TTM)

4 Aerospace-Defense Equipment Stocks to Keep a Close Eye on

CAE Inc: Based in Montreal, Canada, CAE Inc is a global leader in offering training and operational support solutions for the civil aviation, defense and security, and healthcare markets. Following its acquisition of Merlot Aero Limited in December 2020, the company has expanded its expertise into digital flight crew management and made a step forward to achieving its goal of unifying the digital flight operations ecosystem.

The Zacks Consensus Estimate for fiscal 2021 earnings has moved up 60% in the past 90 days. The Zacks Consensus Estimate for fiscal 2022 earnings has moved up 11.9% in the past 90 days. The company currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Transdigm Group: Based in Cleveland, OH, Transdigm Group’s diversified portfolio of highly engineered proprietary aerospace components enjoy solid demand in the aircraft market. The company’s recently completed Cobham Aero acquisition is expected to enhance its business volumes. Its Esterline acquisition in 2019 expanded Trandigm’s market share significantly in the aerospace-defense equipment space, with significant aftermarket exposure.

The Zacks Consensus Estimate for fiscal 2021 earnings has moved up 4.7% in the past 60 days. The Zacks Consensus Estimate for fiscal 2022 earnings has improved 3.3% in the past 30 days. The company currently holds a Zacks Rank #2.

BAE Systems: U.K.-based BAE Systems is a well-known defense contractor that manufactures products ranging from warships, combat vehicles and aircraft to providing cyber security solutions. The company’s frequent contract wins from across the globe tend to fuel its overall operational performance. BAE Systems in collaboration with UAVTEK has developed a nano “Bug” drone, the first 30 units of which have been delivered to the British Army, which has put it through its paces as part of a trial. Such innovations are surely going to expand the company’s footprint in the Aerospace sector.

The Zacks Consensus Estimate for 2021 earnings has moved up 1.6% in the past 60 days. The Zacks Consensus Estimate for 2021 earnings has moved up 6.9% in the past 60 days The company currently has a Zacks Rank #3 (Hold).

Triumph Group.: Based in Berwyn, PA, Triumph Group is a well-known supplier of a wide range of aircraft parts including hydraulic, mechanical and electromechanical control systems, aircraft and engine accessories, structural components, auxiliary power units and avionics and aircraft instruments. For Boeing’s Apache helicopter, Triumph is improving its T700 electronic engine controls, enhancing safety and performance. The company expects to win a contract worth $200 million involving this upgrade. Such developments are expected to boost Triumph’s military backlog, thereby bolstering its revenue generation prospects.

The Zacks Consensus Estimate for fiscal 2022 earnings has moved up 37.5% in the past 60 days, while the stock’s long-term earnings growth rate is estimated at 2.6%. The company currently carries a Zacks Rank #2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Triumph Group, Inc. (TGI) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

CAE Inc (CAE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research