These 4 Measures Indicate That Advanced Emissions Solutions (NASDAQ:ADES) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Advanced Emissions Solutions, Inc. (NASDAQ:ADES) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Advanced Emissions Solutions

How Much Debt Does Advanced Emissions Solutions Carry?

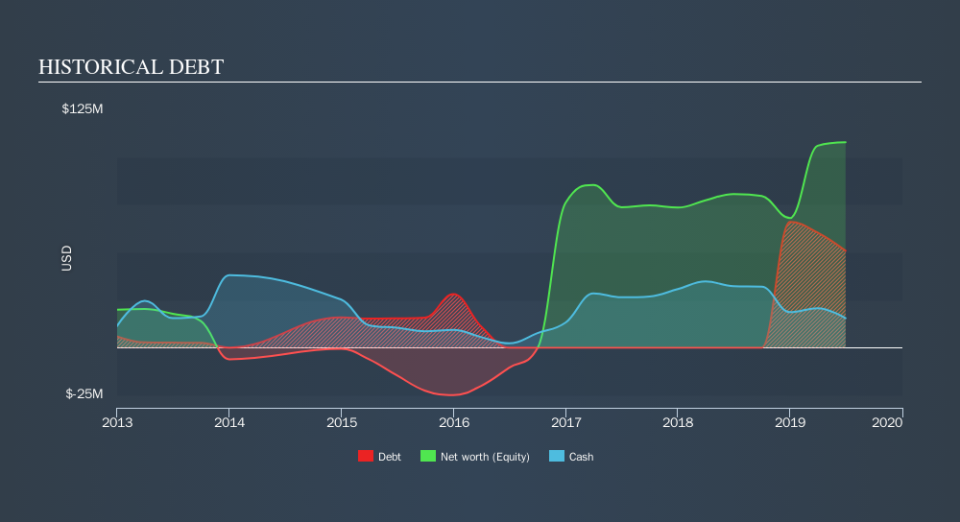

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Advanced Emissions Solutions had US$50.8m of debt, an increase on none, over one year. However, it also had US$15.4m in cash, and so its net debt is US$35.4m.

How Strong Is Advanced Emissions Solutions's Balance Sheet?

The latest balance sheet data shows that Advanced Emissions Solutions had liabilities of US$39.7m due within a year, and liabilities of US$39.7m falling due after that. Offsetting this, it had US$15.4m in cash and US$9.80m in receivables that were due within 12 months. So its liabilities total US$54.1m more than the combination of its cash and short-term receivables.

Advanced Emissions Solutions has a market capitalization of US$257.6m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Advanced Emissions Solutions shareholders face the double whammy of a high net debt to EBITDA ratio (6.7), and fairly weak interest coverage, since EBIT is just 0.35 times the interest expense. The debt burden here is substantial. However, the silver lining was that Advanced Emissions Solutions achieved a positive EBIT of US$1.9m in the last twelve months, an improvement on the prior year's loss. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Advanced Emissions Solutions's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Advanced Emissions Solutions actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We weren't impressed with Advanced Emissions Solutions's net debt to EBITDA, and its interest cover made us cautious. But its conversion of EBIT to free cash flow was significantly redeeming. Looking at all this data makes us feel a little cautious about Advanced Emissions Solutions's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Given Advanced Emissions Solutions has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.