These 4 Measures Indicate That Perma-Pipe International Holdings (NASDAQ:PPIH) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Perma-Pipe International Holdings, Inc. (NASDAQ:PPIH) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Perma-Pipe International Holdings

How Much Debt Does Perma-Pipe International Holdings Carry?

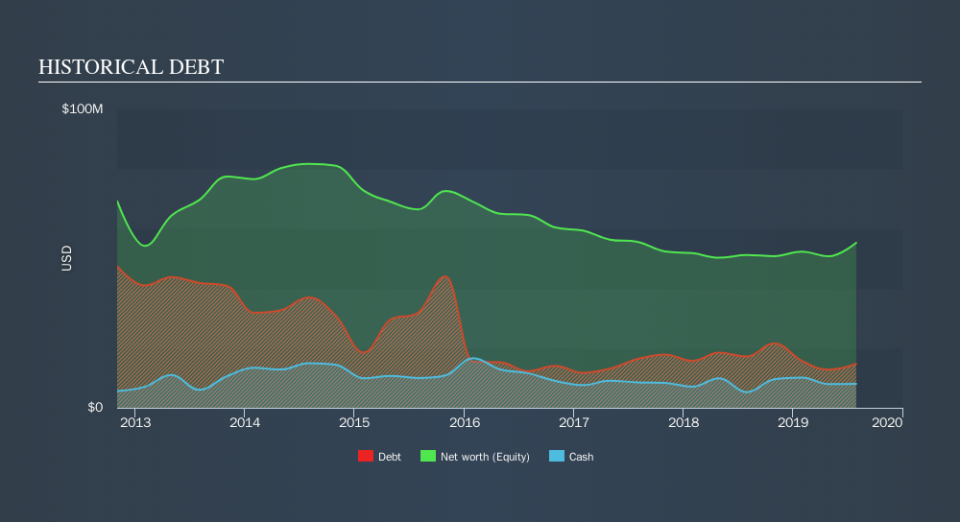

The image below, which you can click on for greater detail, shows that Perma-Pipe International Holdings had debt of US$14.7m at the end of July 2019, a reduction from US$17.2m over a year. However, it does have US$8.05m in cash offsetting this, leading to net debt of about US$6.66m.

How Strong Is Perma-Pipe International Holdings's Balance Sheet?

The latest balance sheet data shows that Perma-Pipe International Holdings had liabilities of US$35.6m due within a year, and liabilities of US$23.6m falling due after that. On the other hand, it had cash of US$8.05m and US$33.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$17.3m.

This deficit isn't so bad because Perma-Pipe International Holdings is worth US$70.0m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Perma-Pipe International Holdings's low debt to EBITDA ratio of 0.63 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.1 last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Although Perma-Pipe International Holdings made a loss at the EBIT level, last year, it was also good to see that it generated US$6.1m in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Perma-Pipe International Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Perma-Pipe International Holdings recorded free cash flow worth a fulsome 94% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Perma-Pipe International Holdings's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And its net debt to EBITDA is good too. All these things considered, it appears that Perma-Pipe International Holdings can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Perma-Pipe International Holdings insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.