These 4 Measures Indicate That Ramelius Resources (ASX:RMS) Is Using Debt Safely

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Ramelius Resources Limited (ASX:RMS) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Ramelius Resources

How Much Debt Does Ramelius Resources Carry?

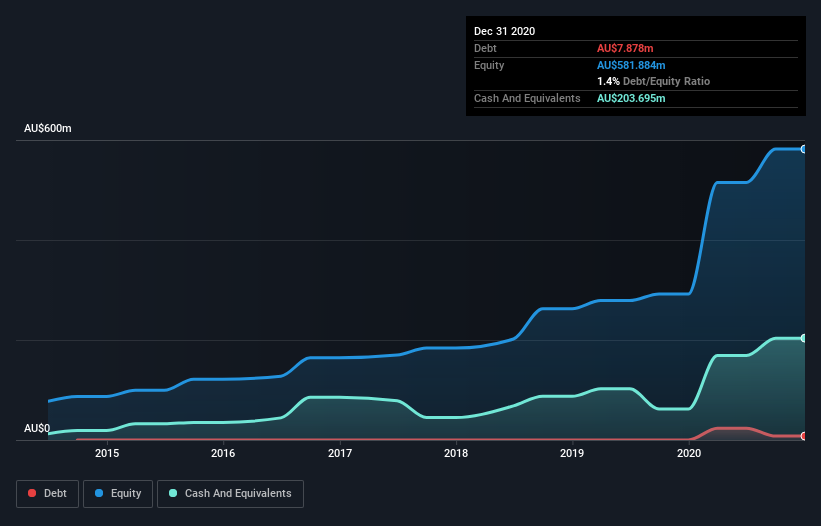

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Ramelius Resources had AU$7.88m of debt, an increase on none, over one year. But it also has AU$203.7m in cash to offset that, meaning it has AU$195.8m net cash.

How Strong Is Ramelius Resources' Balance Sheet?

We can see from the most recent balance sheet that Ramelius Resources had liabilities of AU$150.3m falling due within a year, and liabilities of AU$81.4m due beyond that. On the other hand, it had cash of AU$203.7m and AU$11.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$16.5m.

This state of affairs indicates that Ramelius Resources' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the AU$1.58b company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, Ramelius Resources also has more cash than debt, so we're pretty confident it can manage its debt safely.

Better yet, Ramelius Resources grew its EBIT by 345% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Ramelius Resources's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Ramelius Resources may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Ramelius Resources recorded free cash flow worth a fulsome 82% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Ramelius Resources has AU$195.8m in net cash. And it impressed us with free cash flow of AU$193m, being 82% of its EBIT. So is Ramelius Resources's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Ramelius Resources you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.