4 Outperforming Real Estate Companies With High Financial Strength

In light of the Federal Reserve's decision to cut the overnight lending rate, four real estate companies with solid financial strength and have outperformed the Standard & Poor's 500 Index over the past six months are CoStar Group Inc. (NASDAQ:CSGP), Income Opportunity Realty Investors Inc. (IOR), Public Storage (NYSE:PSA) and PS Business Parks Inc. (NYSE:PSB).

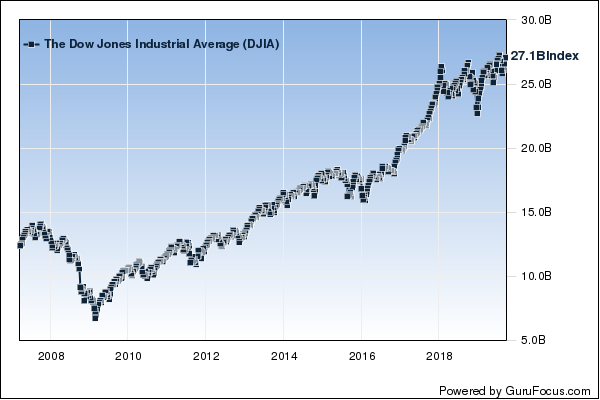

Dow takes small gain despite tumbling on Fed's comments regarding future rate cuts

On Wednesday, the Dow Jones Industrial Average closed at 27,147.86, up 37.06 from Tuesday's close of 27,110.80. Despite this, the Dow traded at an intraday low of 26,920.68 around 1:40 p.m., down approximately 190 points from the previous close on the Fed's comments regarding future rate cuts.

The Fed announced it will take down the benchmark overnight lending rate to a target range of 1.75% to 2%. Wednesday's rate cut occurred approximately two months after the prior rate cut, which was the first in 11 years.

Despite the Fed's decision, the Federal Open Market Committee offered conflicting views regarding future rate cuts: While seven Fed members wanted additional rate cuts, several others wanted the Fed to keep the target rate between 2% and 2.25%, the target range following the July rate cut.

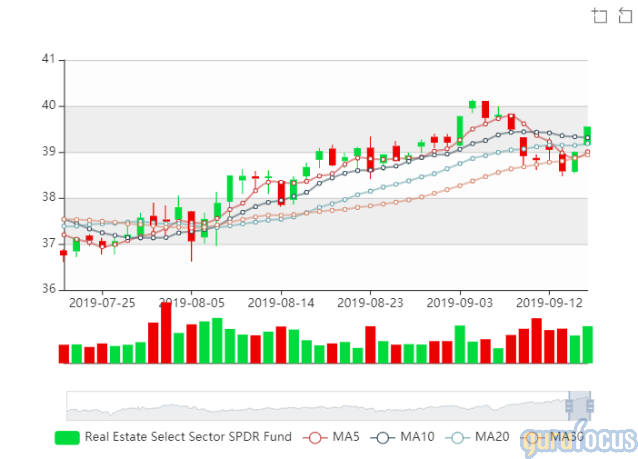

Real estate ETF nears 52-week high

CNBC said on Sept. 3 that in light of lowering interest rates, investors flocked to real estate and utility stocks, two sectors that offer "high dividends and steady cash flow." The Real Estate Select Sector SPDR exchange-traded fund (ARCA:XLRE) traded at $39.29, close to a 52-week high of $40.10.

According to the All-in-One Screener's backtesting feature, real estate companies that have a financial strength rank greater than 7 with a positive six-month performance relative to S&P total returns returned 25.23% year to date, outperforming the benchmark's return of 20.41%.

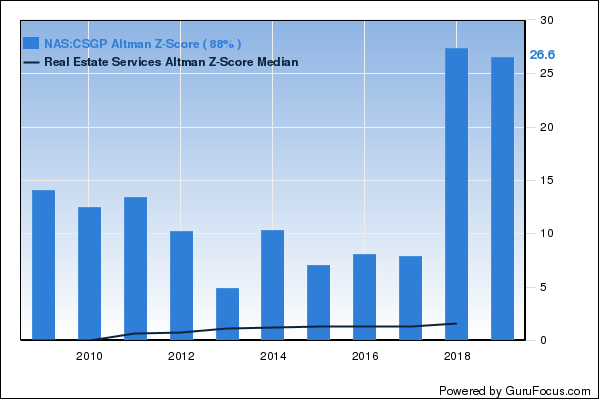

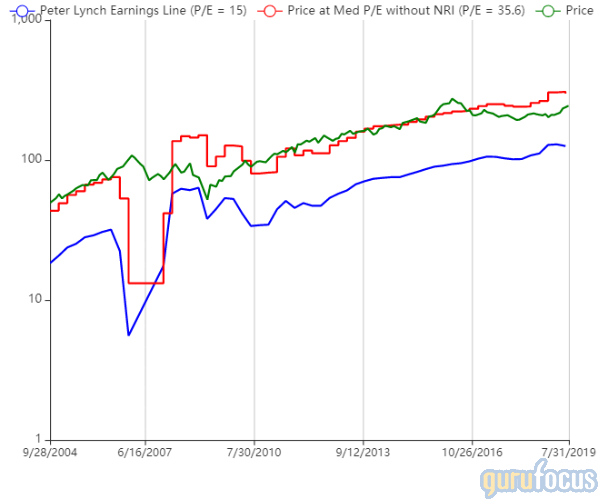

CoStar Group

CoStar Group has outperformed the S&P 500 by 22.21% over the past six months, the highest-return stock among those on the Screener list.

The Northwest, Washington-based company's platform contains in-depth analytical data on approximately 4.5 million properties related to various subsectors, including office, retail, multifamily, health care and industrial. GuruFocus ranks the company's financial strength 9 out of 10 on several positive indicators, which include a strong Altman Z-score of 31.41 and debt ratios that outperform over 94% of global competitors.

CoStar's profitability ranks 8 out of 10 on the heels of operating margins near a 10-year high of 26.65% despite outperforming just 55.20% of global real estate services companies. Gurus riding CoStar's strong financial strength and profitability include Pioneer Investments (Trades, Portfolio) and Ron Baron (Trades, Portfolio)'s Baron Funds.

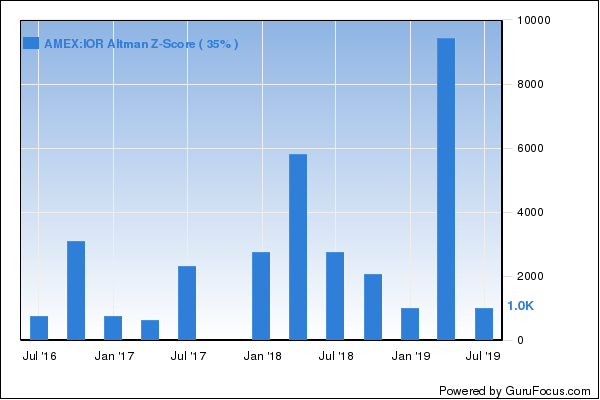

Income Opportunity Realty Investors

Dallas-based Income Opportunity Realty Investors has outperformed the S&P 500 benchmark by 16.35% over the past six months according to the Screener list.

Income Opportunity Realty finances real estate and real estate-related activities through investments in mortgage loans. GuruFocus ranks the company's financial strength 8.2 out of 10 on several positive indicators, which include no long-term debt and robust Altman Z-scores.

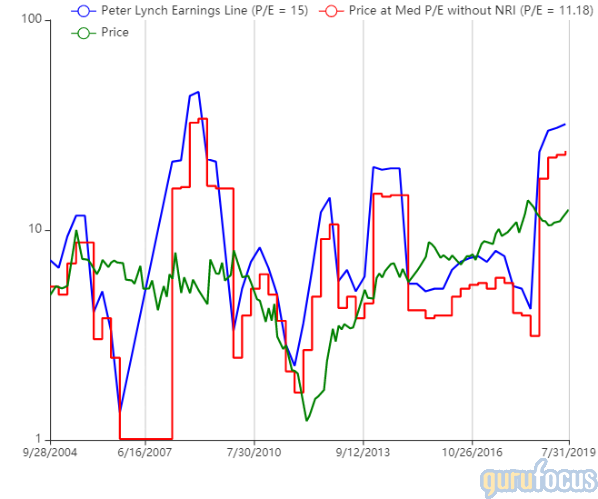

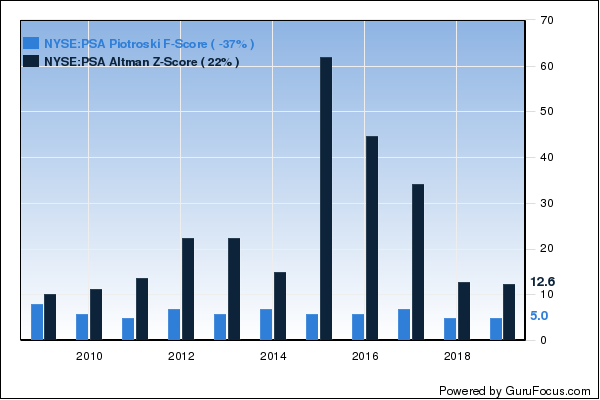

Public Storage

According to the Screener results data, Public Storage outperformed the S&P 500 benchmark by 11.90% over the past six months.

The Glendale, California-based company operates over 23,000 self-storage facilities in 38 states, with over 150 million net square feet of rentable space. GuruFocus ranks Public Storage's financial strength and profitability 7 out of 10 on several positive indicators, which include interest coverage and debt ratios that outperform over 94% of global competitors. Additionally, Public Storage has a business predictability rank of 4.5 stars and a return on assets that outperforms 97.26% of global competitors despite a weak Piotroski F-score of 4.

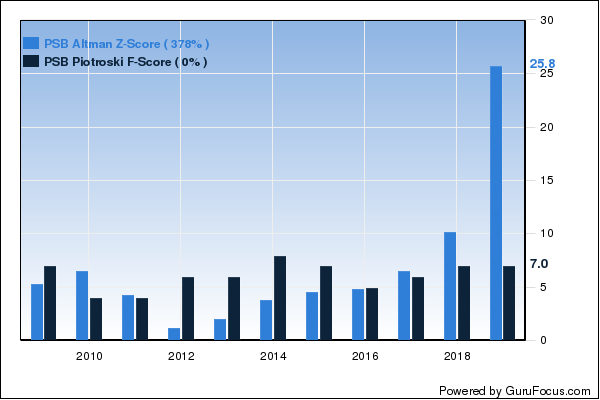

PS Business Parks

The Screener results show that PS Business Parks has outperformed the S&P 500 by 13.12% over the past six months.

The Glendale, California-based REIT owns and operates multitenant commercial warehouse, office, industrial park and flex properties in the U.S. GuruFocus ranks the REIT's financial strength 10 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 7, a robust Altman Z-score of 36.59 and interest coverage ratios that outperform 96.21% of global competitors.

Disclosure: No positions.

Read more here:

FedEx Tumbles on Weak Fiscal 2020 Earnings Guidance

5 Residential Construction Companies Gurus Agree on

5 Good Stocks to Consider Ahead of Fall 2019

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.