4 Promising Chinese Stocks to Buy for 2023

A stringent zero-COVID policy has taken its toll on China’s economy this year. Rigid government-mandated lockdowns, which triggered nationwide protests, have taken a bite out of the world’s second-biggest economy, hurting a host of industries in that country, and dragging down stocks of several Chinese companies.

China, a major source of demand for a vast spectrum of products, has emerged as a global growth engine over the past few decades. As such, the sputtering engine of the Chinese economy has weighed on the world economy this year.

However, the loosening of nationwide COVID curbs and a surfeit of government stimulus measures to boost the economy are likely to improve business and consumer sentiments and expected to serve as a catalyst for growth moving into 2023. This calls for placing bets on some attractive China stocks like Pinduoduo Inc. PDD, China Automotive Systems, Inc. CAAS, TAL Education Group TAL and Tencent Music Entertainment Group TME for next year.

China’s Economy Weighed Down by COVID Controls

The draconian COVID-control measures, weakening external demand, the slump in the property market and the global economic slowdown partly driven by the ongoing Russia-Ukraine conflict interest rate hikes to control inflation are weighing heavily on China’s economy. The pandemic-led lockdowns have resulted in reduced consumer spending and a disruption in the supply chain.

Notably, China’s economy grew 8.1% in 2021, the fastest pace in a decade, per the country’s National Bureau of Statistics (“NBS”). This growth, which was partly driven by the strength in export, trumped the China government’s target of 6% for the year. Beijing has set a growth target of roughly 5.5% for 2022, indicating a sharp slowdown from last year’s growth. The International Monetary Fund has pegged China’s GDP growth for 2022 at 3.2%, factoring in the impact of the lockdowns and the challenges in the real estate sector.

China’s GDP growth slumped to 0.4% in second-quarter 2022 from a 4.8% expansion in the first quarter, pummeled by reduced industrial activities and lower consumer spending due to nationwide lockdowns to curb coronavirus cases as the country battled its worst COVID-19 outbreak since the start of the pandemic. On a positive note, the economy rebounded in the third quarter with a 3.9% growth, thanks to strong industrial production and growth in export.

The country’s manufacturing sector is bearing the brunt of the COVID-19 lockdowns. The manufacturing sector has taken a beating due to the virus resurgence, which has hit demand for manufactured goods and supply chains. Manufacturing is also being hurt by semiconductor shortages and power outages.

China’s manufacturing activities dropped to the lowest level in seven months in November 2022. The official manufacturing purchasing managers’ index came in at 48.0 in November, declining from 49.2 in the previous month, per NBS. A reading below 50 indicates a contraction in activity.

China has also seen a slowdown across construction and the property sectors this year. The country’s real estate sector has also taken a hard hit from repeated lockdowns. Investment in the sector has slowed to its lowest level in roughly three decades. Government’s credit-tightening measures weighed on the property market. Property investment shrank 9.8% year over year in the first 11 months of 2022 amid subdued demand, per NBS.

Meanwhile, China’s automobile sales dropped year over year in November as pandemic restrictions weighed on consumer sentiment and suppressed demand. Total vehicle sales dropped 7.9% year over year for the month, per the China Association of Automobile Manufacturers. The world’s largest automobile market is about to end the year on a downbeat note.

Retail sales also fell sharply in November as a spike in coronavirus cases led to stricter control on mobility and hurt consumer confidence. According to NBS, China’s retail sales tumbled 5.9% for the month, worsening from a 0.5% decline a month ago. Industrial output growth also slowed considerably to 2.2% in November from a 5% rise in October.

China’s export juggernaut has also slowed in the wake of the COVID-led supply disruptions and weak external demand. The country’s export sagged for the fourth straight month in November, tumbling 8.7% year over year, per customs data. The downturn is expected to continue over the near term due to weak overseas demand amid the global economic slowdown largely driven by high inflation.

Easing of COVID Curbs, Stimulus Measures Bode Well

Beijing’s efforts to beef up infrastructure investment to prop up its faltering economy and stabilize the real estate market offer a glimmer of hope moving into 2023. Government stimulus measures are expected to cushion the country’s manufacturing sector. The Chinese authorities have also taken a host of measures to counter the economic headwinds, including interest rate cuts and tax rebates.

A host of measures, including loan program for debt-laden property developers and financial support to ensure residential project completion, have also been announced to rescue the beleaguered property sector, which accounts for roughly a quarter of the country’s economy.

Moreover, China’s government recently announced new measures to ease pandemic restrictions amid protests across major cities, marking a fundamental shift away from its zero-COVID approach. The moves include allowing people with mild or no symptoms to quarantine at home and the removal of COVID test requirement for domestic travel. All these actions bode well for the Chinese economy moving into the New Year.

4 Chinese Stocks Worth A Bet

The widespread coronavirus-led restrictions have largely contributed to the slowdown in the Chinese economy this year. However, government actions to perk up the economy and the easing of pandemic control measures are likely to boost China’s prospects. We have highlighted a few China stocks that hold promise for investors in 2023.

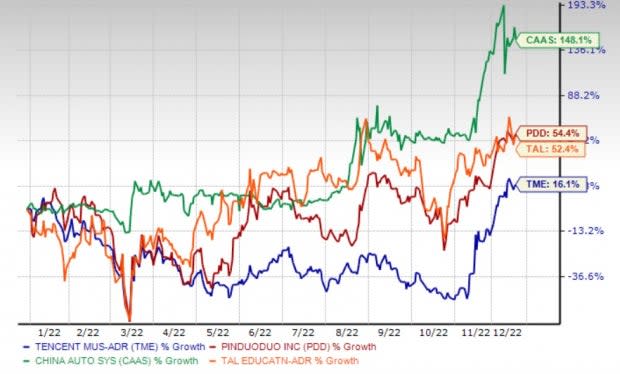

With the help of the Zacks Stocks Screener, we have picked four Chinese stocks that have gained more than 15% so far in 2022, and have the potential to run higher based on their strong fundamentals. Also, these stocks currently carry a Zacks Rank #1 (Strong Buy) or 2 (Buy). Our research shows that stocks with a Zacks Rank #1 or 2 offer the best investment options.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Our Picks

Pinduoduo: Shanghai-based Pinduoduo, which operates an e-commerce platform, sports a Zacks Rank #1. It remains committed to beefing up investment in R&D to create value through innovations. Higher revenues from online marketing services and transaction services are also driving its top line.

Pinduoduo has an expected earnings growth of 3.8% for the next year. Over the last 60 days, the Zacks Consensus Estimate for 2023 has increased 3.6%. PDD’s earnings beat the Zacks Consensus Estimate in each of the last four quarters at an average of 174.3%. We note that the stock has rallied 54.4% so far this year.

China Automotive Systems: This leading supplier of power steering components and systems carries Zacks Rank #1. It is seeing strong sales in China on the back of higher customer demand for its products. Strong sales of hydraulic products are driving its top line. CAAS is expected to benefit from a recovery in China’s automotive market in 2023.

The Zacks Consensus Estimate for China Automotive Systems’ earnings for 2023 has increased 36.7% over the last 60 days. Its earnings beat the Zacks Consensus Estimate in three of the last four quarters. CAAS has a trailing four-quarter earnings surprise of roughly 321.7%, on average. The stock has rallied 148.1% year to date.

TAL Education: This smart learning solutions provider currently carries a Zacks Rank #2. TAL Education is expected to benefit from its investment in learning services, learning content solutions and learning technology solutions. TAL is also focused on product development, optimizing its product and services and exploring new opportunities in overseas markets.

TAL Education has expected year-over-year earnings growth of 85.9% for fiscal 2023. Over the last 60 days, the Zacks Consensus Estimate for fiscal 2023 has increased 27.6%. The stock has gained 52.4% year to date.

Tencent Music Entertainment: Shenzhen-based Tencent Music Entertainment, which operates online music entertainment platforms in China, has seen its shares gain 16.1% this year. TME is witnessing strong growth in music subscription revenues, supported by higher revenues from sales of digital albums and advertising services. Gains in subscriptions are driving revenues from online music services. Improved operating efficiency and effective cost optimization are also driving its profitability.

Tencent Music Entertainment, carrying a Zacks Rank #2, has an expected earnings growth of 18.6% for 2023. Over 60 days, the Zacks Consensus Estimate for 2023 has increased 24.4%. The company’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. TME has a trailing four-quarter earnings surprise of roughly 8.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TAL Education Group (TAL) : Free Stock Analysis Report

China Automotive Systems, Inc. (CAAS) : Free Stock Analysis Report

Pinduoduo Inc. Sponsored ADR (PDD) : Free Stock Analysis Report

Tencent Music Entertainment Group Sponsored ADR (TME) : Free Stock Analysis Report