4 Real Estate Companies to Consider on Rising Existing Home Sales

- By Sydnee Gatewood

Total home sales in 2020 reached their highest level since 2006, driven by Covid-19 pandemic-related demand.

The National Association of Realtors reported on Friday that closed sales of existing homes increased 0.7% month-to-month in December to a seasonally adjusted annualized rate of 6.76 million units. Sales were up 22% from December 2019.

While demand is strong, there is a shortage of homes available, pushing up prices. At the end of December, just 1.07 million homes were on the market, which represents a 23% decrease from a year ago.

As a result of these developments, investors may be interested in finding opportunities among companies in real estate sector.

Using the GuruFocus Fair Value Line, a new unique method of estimating the intrinsic value of a stock, investors can find potential value opportunities. Based on the popular Peter Lynch value line, which compares a stock's current price to how much its earnings per share would be worth if it traded at a price-earnings ratio of 15, the GF Value Line takes more than price into account when determining value. It also considers a company's historical price-earnings, price-book, price-sales and price-to-free cash flow ratios, an adjustment factor based on past returns and growth as well as future estimates of the business' performance.

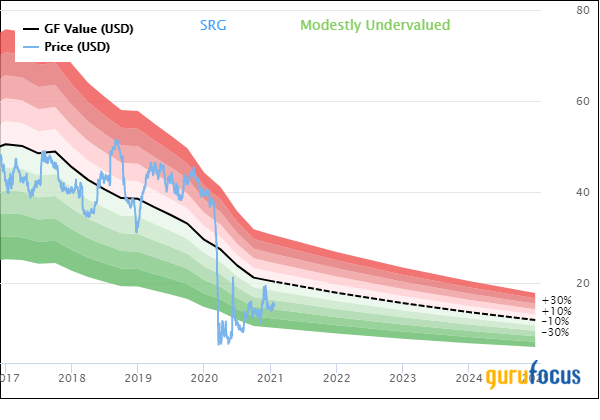

Using the GF Value Line for Seritage Growth Properties (NYSE:SRG) as an example, we can see that the stock is considered to be modestly undervalued. The share price is represented by the blue line, while the solid black line shows the past intrinsic values calculated by the GF Value Line. The dotted portion of the black line illustrates the estimates of future intrinsic value. The red and green bands delineate overvaluation and undervaluation, respectively, with the darker shades indicating more severe deviations from the intrinsic valuation.

As of Jan. 22, the GuruFocus All-in-One Screener, a Premium feature, found real estate companies that were modestly undervalued, had a price-to-GF Value ratio between 0.4 and 0.8, a 10-year revenue per share growth rate of at least 6% and a predictability rank of at least one out of five stars were Apollo Commercial Real Estate Finance Inc. (NYSE:ARI), CorEnergy Infrastructure Trust Inc. (NYSE:CORR), New England Realty Associates LP (NEN) and Starwood Property Trust Inc. (NYSE:STWD).

Apollo Commercial Real Estate Finance

Apollo Commercial Real Estate (NYSE:ARI) has a $1.63 billion market cap; its shares were trading around $11.62 on Friday with a price-earnings ratio of 50.52, a price-book ratio of 0.72 and a price-sales ratio of 6.71.

The New York-based real estate investment trust primarily originates and invests in senior mortgages, mezzanine loans and other commercial real estate-related debt investments collateralized by properties throughout the U.S. and Europe.

Based on a GF Value of $14.99 and a price-to-GF Value ratio of 0.77, the stock appears to be modestly undervalued.

The GuruFocus valuation rank of 7 out of 10 also points to undervaluation.

GuruFocus rated Apollo Commercial Real Estate's financial strength 2 out of 10 as a result of issuing approximately $3 billion in new long-term debt over the past three years, though it is still at a manageable level. The company has also recorded a decline in revenue per share over the past five years.

The company's profitability fared better, scoring a 4 out of 10 rating despite having margins and returns that underperform over half of its competitors. Apollo Commercial also has a moderate Piotroski F-Score of 5, which suggests business conditions are stable, as well as a one-star predictability rank. According to GuruFocus, companies with this rank return, on average, 1.1% annually over a 10-year period.

Of the gurus invested in Apollo Commercial, Jim Simons (Trades, Portfolio)' Renaissance Technologies has the largest stake with 0.27% of outstanding shares. Hotchkis & Wiley and Paul Tudor Jones (Trades, Portfolio) also own the stock.

CorEnergy Infrastructure Trust

CorEnergy Infrastructure Trust (NYSE:CORR) has a market cap of $104.84 million; its shares were trading around $7.75 on Friday with a price-book ratio of 3.51 and a price-sales ratio of 3.83.

Headquartered in Kansas City, Missouri, the energy infrastructure-focused REIT owns assets leased to oil and gas operators.

With a GF Value of $9.87and a price-to-GF Value ratio of 0.78, the stock appears to be modestly undervalued.

The GuruFocus valuation rank of 9 out of 10 also leans toward undervaluation.

CorEnergy's financial strength was rated 3 out of 10 by GuruFocus. While the cash-to-debt ratio of 0.91 is outperforming versus its industry, the Altman Z-Score of -3.72 warns the company could be in danger of going bankrupt if it does not improve its liquidity position.

The company's profitability scored a 7 out of 10 rating, driven by an expanding operating margin. Its returns, however, are negative and underperforming a majority of industry peers. CorEnergy is also supported by a moderate Piotroski F-Score of 4, but the one-star predictability rank is on watch as a result of revenue per share declining over the past three years.

Simons' firm has a 5.55% stake in CorEnergy Infrastructure.

New England Realty Associates

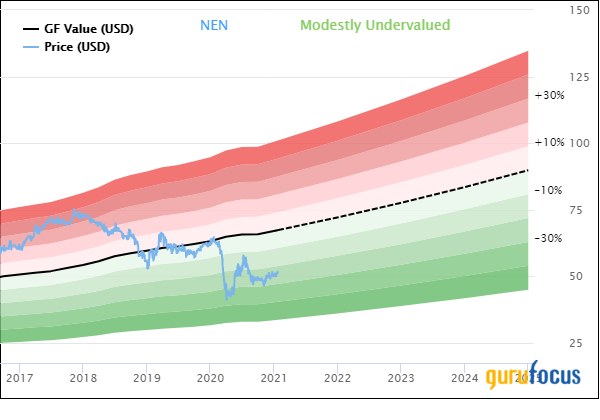

New England Realty Associates (NEN) has a $184.46 million market cap; its shares were trading around $50.50 on Friday with a price-earnings ratio of 43.46 and a price-sales ratio of 2.98.

The Allston, Massachusetts-based real estate company owns and operates apartment buildings, condominiums and commercial properties.

Trading with a GF Value of $67.29 and a price-to-GF Value ratio of 0.75, the stock appears to be modestly undervalued currently.

The GuruFocus valuation rank of 8 out of 10 also supports undervaluation.

Weighed down by weak interest coverage, GuruFocus rated New England Realty's financial strength 2 out of 10. The low Altman Z-Score of 0.75 also warns that the company could be at risk of bankruptcy, especially since assets are building up at a faster rate than revenue is growing.

The company's profitability fared much better with a 7 out of 10 rating. In addition to an expanding operating margin, New England Realty is supported by returns that outperform around half of its competitors as well as a high Piotroski F-Score that indicates business conditions are healthy. Boosted by consistent earnings and revenue growth, it also has a 2.5-star predictability rank. GuruFocus says companies with this rank return an average of 7.3% annually.

No gurus currently own the stock.

Starwood Property Trust

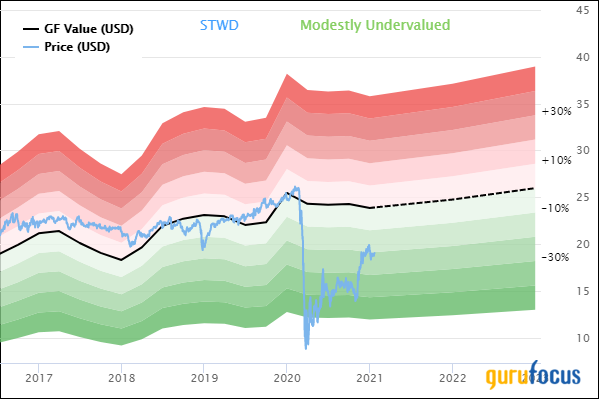

Starwood Property Trust (NYSE:STWD) has a market cap of $5.49 billion; its shares were trading around $19.26 on Friday with a price-earnings ratio of 14.07, a price-book ratio of 1.21 and a price-sales ratio of 6.06.

Headquartered in Greenwich, Connecticut, the REIT manages commercial mortgage loans and commercial mortgage-backed securities.

With a GF Value of $23.91 and a price-to-GF Value ratio of 0.81, the stock appears to be modestly undervalued.

GuruFocus' valuation rank of 8 out of 10 also points to undervaluation.

Starwood's financial strength was rated 2 out of 10 by GuruFocus as a result of issuing approximately $4.8 billion in new long-term debt over the past several years.

The REIT's profitability scored a 4 out of 10 rating. While its margins and returns outperform over half of industry peers, Starwood also has a low Piotroski F-Score of 3, indicating business conditions are in poor shape, as well as a one-star predictability rank.

Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder with 0.04% of outstanding shares. Joel Greenblatt (Trades, Portfolio) also owns the stock.

Disclosure: No positions.

Read more here:

Steven Romick Plugs Into First Energy, Covers Short Positions in 4th Quarter

Netflix Shares Soar on Strong Subscriber Growth

Charles Schwab Shares Rise on Strong 4th-Quarter Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.