4 Retail Home Furnishing Stocks to Watch in a Challenging Industry

Soft demand conditions, given the housing market slowdown, continued investments in e-commerce, supply-chain bottlenecks and higher raw material costs in the home furnishing market are overriding efficient cost management and persistent focus on product innovation. While efforts are being made to redesign the supply-chain network and rationalize product offerings, investments in merchandising of brands and digital marketing may hurt somewhat. However, Zacks Retail-Home Furnishings industry players, such as Williams-Sonoma, Inc. WSM, Fortune Brands Innovations, Inc. FBIN, Tempur Sealy International, Inc. TPX and Ethan Allen Interiors Inc. (ETD), are looking to overcome the challenges.

Industry Description

The Zacks Retail-Home Furnishings industry comprises retailers offering home furnishing products under various categories. The merchandise assortment includes furniture, garden accessories, framed art, lighting, mirrors, candles, tableware, lamps, picture frames, bathware, accent rugs, artificial floral products, and child and teen furnishing. The industry players also develop, manufacture, market and distribute bedding products. The companies provide home and security products for residential home repair, remodeling, new construction, and security applications. They are involved in manufacturing, assembling, and selling faucets, accessories, kitchen sinks, and waste disposal.

3 Trends Shaping the Future of the Retail-Home Furnishings Industry

Soft Demand: The industry has been suffering from an uncertain macro environment, continued softeness in business trends as a result of the ongoing weakness in the housing market and the Federal Reserve’s series of interest rate hikes. Higher mortgage rates are taking a toll on the housing sector and hence on the furnishing market.

Supply-Chain Issues, Inflation, Stiff Competition & Labor Expenses: Industry players have been grappling with supply-chain bottlenecks. Due to supply issues across the world, these companies have been witnessing some inventory delays, product shortages and manufacturing delays. Accelerating raw material and freight costs (including e-commerce shipping) as well as higher employment-related expenses have been putting pressure on the companies’ margins.

Meanwhile, the home furnishings industry is highly competitive, with interior design trade and specialty stores, antique dealers, national and regional home furnishing retailers as well as department stores giving a hard time. Online retailers focused on home furnishing also pose a threat. Competitive product pricing has been eating into margins. Even though sales-building initiatives of the industry participants have been reaping positive results, these involve high costs.

Strong Digital Platform, Product Reinvention & Marketing Moves: Optimization of the supply chain and improvement in e-commerce channels are expected to drive the top line. In fact, e-commerce rescued the retail sector amid pandemic-induced uncertainties. This digital platform will continue to play a major role as people find it more comfortable and safer to shop online. Product innovation plays a key role in market share gain in this industry. Companies aim to come up with products and collaborate with celebrated brands as well as designers to maintain exclusivity. Also, customer experience is being enhanced by innovative marketing techniques, with an emphasis on digital marketing, better merchandising, store remodeling and loyalty programs.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Retail-Home Furnishings industry is a seven-stock group within the broader Zacks Retail-Wholesale sector. The industry currently carries a Zacks Industry Rank #197, which places it in the bottom 22% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a dull earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s bottom-line growth potential. Since December 2022, the industry’s earnings estimates for 2023 and 2024 have been revised 2.7% and 8.9% downward, respectively.

Despite the industry’s dim near-term view, we will present a few stocks that one may consider adding to the portfolio. Before that, it’s worth taking a look at the industry’s shareholder returns and current valuation.

Industry Outperforms Sector, Lags S&P 500

The Zacks Retail-Home Furnishings industry has outperformed the broader Zacks Retail-Wholesale sector but lagged the Zacks S&P 500 composite over the past year.

The industry has lost 5.5% compared with the S&P 500’s 5.3% decline. The broader sector has declined 9.7% over this period.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings ratio, which is commonly used for valuing retail home furnishing stocks, the industry is currently trading at 11.01 compared with the S&P 500’s 18.2 and the sector’s 21.9.

Over the last five years, the industry has traded as high as 19.43X and as low as 7.09X, with the median being 14.05X, as the chart below shows.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

4 Retail-Home Furnishings Stocks to Watch

We have highlighted four stocks that currently carry a Zacks Rank #3 (Hold) and have been capitalizing on fundamental strengths. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ethan Allen Interiors Inc.: This Danbury, CT-based company engages in interior design, and manufacture and retail of home furnishings. Its wide array of offerings, a strong network of retail design centers and focus on interior design services as well as technological enhancement have been benefiting the company. It remains well-positioned for fiscal 2023 with its product offerings and the advantage of vertical integration, including its North American manufacturing, interior design-focused retail network, a strong logistics network and a healthy balance sheet to maximize opportunities during the year.

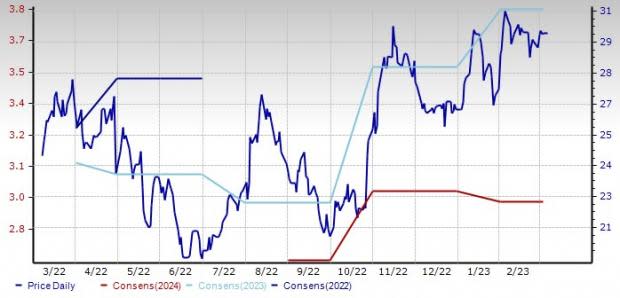

ETD’s shares have gained 20.7% over the past year, outperforming the industry. Earnings estimates for fiscal 2023 have increased 7.1% to $3.79 per share over the past 60 days. This depicts analysts’ optimism over the company’s growth prospects.

Price and Consensus: ETD

Tempur Sealy International: Headquartered in Lexington, KY, this company is involved in the development, manufacturing and marketing of bedding products. Strong industry demand, its worldwide leadership position in the industry and the omni-channel distribution strategy’s success have been boosting Tempur’s presence. Despite challenging macro conditions, the company has been investing in industry-leading product innovation and advertising spend, expanding manufacturing capacity, driving omni-channel expansion worldwide, and working on a balanced capital allocation strategy. For 2023, the company’s brand, products, and omnichannel initiatives will likely drive growth.

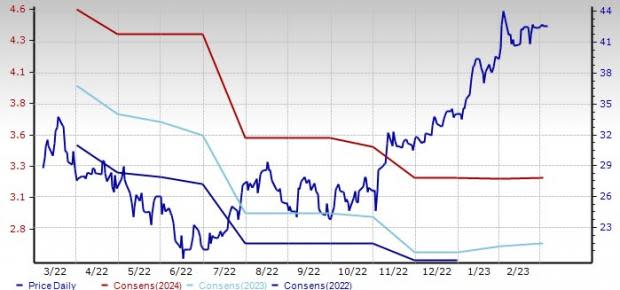

The TPX stock has gained 47.2% over the past year, outperforming the industry. Earnings estimates for 2023 have increased to $2.70 per share from $2.63 over the past 60 days. The company carries a Zacks Rank #3 and has an expected earnings growth rate of 3.9% for 2023.

Price and Consensus: TPX

Fortune Brands Innovations: Based in Deerfield, IL, this company provides home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally. In the ongoing challenging economic conditions, the company has been focusing on an alteration in cost structure, proficient production planning, protecting margins and improving cash generation in 2023. The company has rebranded its entire company, with a business focused on driving accelerated growth in categories through brand and innovation. It has reorganized the company from a decentralized structure with separate businesses to an aligned operating model that prioritizes activities that are key to brand, innovation and channel. These transformative changes will enable the company to drive growth in the future.

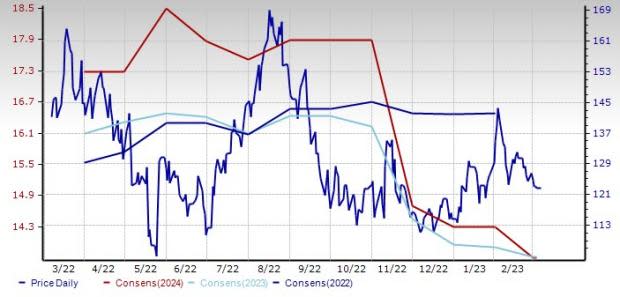

Although the FBIN stock has declined 22.7% over the past year, it carries an impressive VGM Score of B. This helps to identify stocks with the most attractive value, growth and momentum. This company surpassed earnings estimates in all of the trailing four quarters, the average being 6.2%.

Price and Consensus: FBIN

Williams-Sonoma: This is a San Francisco, CA-based multi-channel specialty retailer. The company has been benefiting from its focus on digital initiatives, higher e-commerce penetration and product introductions. In addition to the continued enhancement of the e-commerce channel, optimization of the supply chain and disciplined cost control are expected to drive growth.

Although the WSM stock has declined 13.1% over the past year, it carries an impressive VGM Score of B. This home furnishing provider surpassed earnings estimates in three of the trailing four quarters, the average being 9.6%.

Price and Consensus: WSM

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams-Sonoma, Inc. (WSM) : Free Stock Analysis Report

Tempur Sealy International, Inc. (TPX) : Free Stock Analysis Report

Ethan Allen Interiors Inc. (ETD) : Free Stock Analysis Report

Fortune Brands Innovations, Inc. (FBIN) : Free Stock Analysis Report