4 Stocks to Buy Ahead of Earnings Releases Next Week

We are in the last leg of the third-quarter 2022 earnings season. So far, corporate America has shown mixed results. Although the earnings growth rate has declined systematically, margin pressures are less than expected. This earning season is of immense importance as U.S. corporates are facing severe challenges from record-high inflation, an extremely hawkish Fed and threats of a recession.

We have identified four stocks with a favorable Zacks Rank that are set to beat earnings estimates next week. Investment in these stocks should be fruitful as an earnings beat is expected to drive stock prices going forward. These companies are — Tencent Music Entertainment Group TME, Helmerich & Payne Inc. HP, Ross Stores Inc. ROST and StoneCo Ltd. STNE.

Q3 Earnings Results So Far

Our estimates for third-quarter earnings of the market’s benchmark, the S&P 500 Index, have shown a gradual decline in the past three and a half months. As of Nov 9, 453 companies on the S&P 500 Index have reported results.

Total earnings of these companies are up 2.6% from the same period last year on 12.4% higher revenues, with 69.3% beating EPS estimates and 68% beating revenue estimates. Our current estimate has projected that total earnings of the S&P 500 Index are expected to be up 1.5% year over year on 11.4% higher revenues.

Our Top Picks

We have chosen four companies that will report third-quarter earnings results next week. Each of these stocks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings releases. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

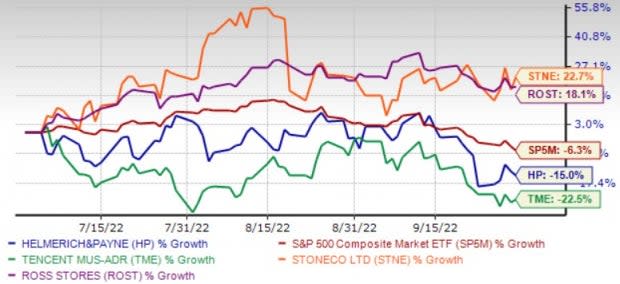

The chart below shows the price performance of our four picks in he past quarter.

Image Source: Zacks Investment Research

Tencent Music operates online music entertainment platforms to provide music streaming, online karaoke, and live streaming services in the People's Republic of China. TME offers QQ Music, Kugou Music, and Kuwo Music, which enable users to discover and listen to music in personalized ways. It also offers WeSing, which enables users to sing and interact with friends, share their singing performances and discovering songs that others have sung.

TME has an Earnings ESP of +4.76%. It has an expected earnings growth rate of 5.1% for next year. The Zacks Consensus Estimate for next-year earnings has improved 2.5% over the last 30 days.

Tencent Music recorded earnings surprises in the last four reported quarters, with an average beat of 13.4%. TME is set to release earnings results on Nov 15, before the opening bell.

StoneCo provides financial technology solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil. STNE distributes its solutions, principally through proprietary Stone Hubs, which offer hyper-local sales and services; and technology and solutions to digital merchants through sales and technical personnel and software vendors, as well as sells solutions to brick-and-mortar and digital merchants through sales team.

STNE has an Earnings ESP of +45.45%. It has an expected earnings growth rate of 66.7% for the current year. STNE is set to release earnings results on Nov 17, after the closing bell.

Ross Stores is gaining from robust customer demand, accelerated vaccination rates, government stimulus payments and easing of COVID-19 restrictions. ROST’s sales benefited from broad-based growth across certain merchandise categories and regions, as well as robust comparable store sales.

The children and men's categories performed well in the holiday selling period, and the Midwest and Southeast regions were the outperforming regions for Ross Stores. Sales trends were also robust at the dd's DISCOUNTS business.

ROST has an Earnings ESP of +3.13%. The Zacks Consensus Estimate for next-year earnings has improved 0.3% over the last 30 days. Ross Stores recorded earnings surprises in three out of the last four reported quarters, with an average beat of 14.1%. ROST is set to release earnings results on Nov 17, after the closing bell.

Helmerich & Payne is engaged in the contract drilling of oil and gas wells in the United States and internationally. HP’s technologically-advanced FlexRigs are much in demand and the company has already upgraded most of its drilling feet with the latest technology.

Customer acceptance of Helmerich & Payne's digitization efforts has led to cost reduction, improvement in efficiency and higher profits. HP’s low debt levels, both on an absolute and relative basis, are also impressive.

HP has an Earnings ESP of +14.32%. The Zacks Consensus Estimate for current-year earnings improved 7.5% over the last 30 days. Helmerich & Payne recorded earnings surprises in three out of the last four reported quarters, with an average beat of 118.2%. HP is set to release earnings results on Nov 16, after the closing bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helmerich & Payne, Inc. (HP) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

StoneCo Ltd. (STNE) : Free Stock Analysis Report

Tencent Music Entertainment Group Sponsored ADR (TME) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research