4 Stocks to Buy From the Thriving Security and Safety Services Industry

The Zacks Security and Safety Services industry stands to benefit from the growing demand for Internet security products and services. The ever-increasing need to ensure safe infrastructure in smart cities augurs well for the industry. New product launches, enhanced digitalization and technological developments should foster the industry’s growth in the near term despite supply chain constraints, cost inflation and foreign currency headwinds.

Amid this buoyant backdrop, companies like Axon Enterprise, Inc. AXON, MSA Safety Incorporporated MSA, Brady Corporation BRC and Intellicheck, Inc. IDN are poised to benefit.

About the Industry

The Zacks Security and Safety Services industry comprises companies that provide sophisticated and interactive security solutions and related services, which are meant to be used for residential, commercial and institutional purposes. A few industry players develop electrical weapons for personal defense as well as military, federal, law enforcement and private security. Some of them provide solutions for the recovery of stolen vehicles, wireless communication devices, equipment for the safety of facility infrastructure and employees, and products for detecting hazards. A few companies provide a variety of services to automobile owners and insurance companies. The industry serves customers belonging to various end markets, including manufacturing, electronics, hospitality, education, construction, telecommunications, aerospace and medical.

3 Trends Shaping the Future of the Security and Safety Services Industry

Increased Demand for Security and Safety Services: With instances of hacking on the rise, the industry is seeing growing demand for Internet security products and services like firewalls and unified threat management. Demand for safety and security products has also been boosted by security breaches in healthcare institutions and other organizations during the pandemic. Increasing efforts directed toward ensuring safe infrastructure in smart cities bodes well for the industry.

Product Launches and Digitalization: These companies constantly focus on upgrading and developing new products to keep up with the changing market sentiment toward electronic security products and solutions. This is expected to bolster their top line. Enhanced digitalization and technological developments are other tailwinds likely to benefit industry participants.

Supply Chain Woes: Supply chain disruptions, including shortage of electronic chips and other parts, and labor scarcity are hurting the companies’ operations. Cost inflation associated with labor, raw material and freight might impede the bottom line of industry participants. Given the substantial international exposure of these companies, they are exposed to foreign currency headwinds as well.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Security and Safety Services industry, housed within the broader Industrial Products sector, currently carries a Zacks Industry Rank #101. This rank places it in the top 40% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than two to one.

Given the bullish near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it is worth taking a look at the industry’s shareholder returns and its current valuation first.

Industry Lags Both Sector & S&P 500

The Zacks Security and Safety Services industry has underperformed both the broader Industrial Products sector and the Zacks S&P 500 composite index over the past year.

Over this period, the industry has declined 27.2%, compared with the broader sector and the S&P 500 Index’s 18.7% and 7.6% decrease, respectively.

One-Year Price Performance

Industry's Current Valuation

On the basis of forward P/E (F12M), which is a commonly used multiple for valuing security and safety services stocks, the industry is currently trading at 19X compared with the S&P 500’s 17.97. It is also above the sector’s P/E (F12M) ratio of 15.47X.

Over the past five years, the industry has traded as high as 24.87X, as low as 11.18X and at the median of 17.29X, as the chart below shows:

Price-to-Earnings Ratio

Price-to-Earnings Ratio

3 Security and Safety Services Stocks to Buy

Below we discuss four stocks from the industry that have solid growth opportunities. Each of the stocks mentioned carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

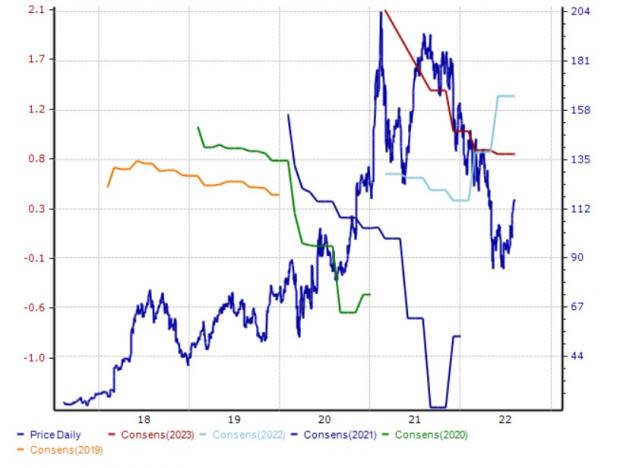

Axon: Headquartered in Scottsdale, AZ, Axon engages in the development, manufacture and sale of electrical weapons for law enforcement, federal, military, private security and personal defense markets. Higher cloud revenues owing to strong user growth for Evidence.com platform are supporting AXON’s growth. Higher Fleet 3 shipments and body camera unit growth bodes well for the company. AXON’s efforts to increase manufacturing output should support its margin performance.

The Zacks Consensus Estimate for Axon’s current-year earnings has remained steady over the past 60 days. Its shares have gained nearly 30% in the past three months.

Price and Consensus: AXON

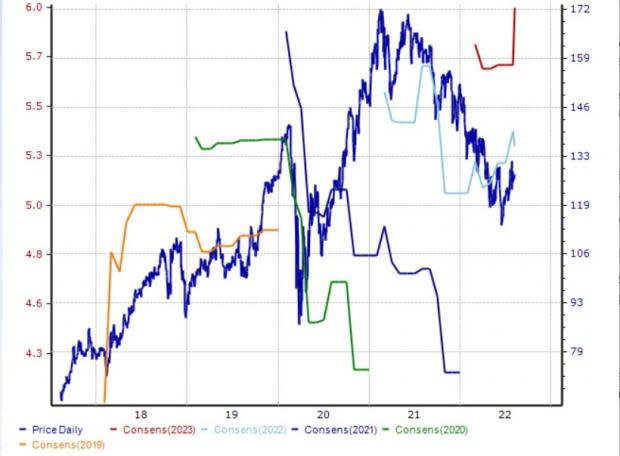

MSA Safety: MSA Safety develops, manufactures and supplies safety products that protect people and facility infrastructures. Robust demand across diversified end markets and strong order activity are key catalysts to the company’s growth. Higher volumes, price realization and acquisitions are driving the company’s top line.

The Zacks Consensus Estimate for MSA Safety’s current-year earnings has been revised upward by 1.5% in the past 60 days. MSA has gained around 7% in the past three months.

Price and Consensus: MSA

Brady: Headquartered in Milwaukee, WI, Brady provides solutions that help in protecting places, people and products. Its offerings, including safety devices, signs, high-performance labels and software, are used in medical, construction, manufacturing, electronics and other end-markets. Enhanced product offerings, acquisitions and cost-cutting measures are driving the company’s growth. Pricing actions are aiding BRC’s margin performance.

The Zacks Consensus Estimate for Brady’s current-year earnings has been revised upward by 3.3% in the past 60 days. The stock has gained 4.5% in the past three months.

Price and Consensus: BRC

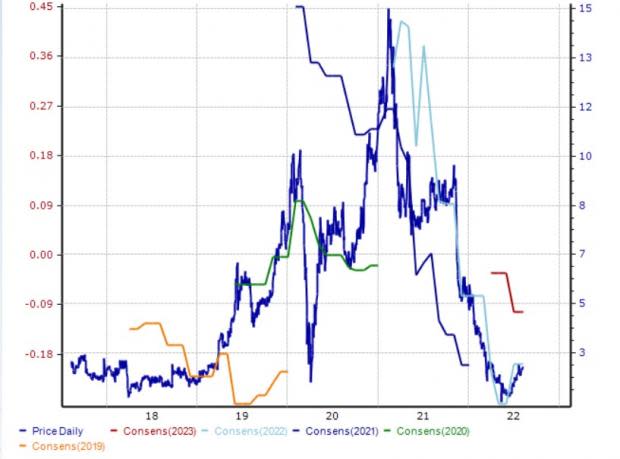

Intellicheck: Intellicheck is a technology company, providing on-demand digital and physical identity validation solutions. Investments in technology and operations are helping the company serve its clients well. Continued expansion in core markets should fuel IDN’s growth.

The Zacks Consensus Estimate for Intellicheck’s current-year earnings has been revised upward by 9.5% in the past 60 days. IDN’s shares have gained 25.5% in the past three months.

Price and Consensus: IDN

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

MSA Safety Incorporporated (MSA) : Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN) : Free Stock Analysis Report

To read this article on Zacks.com click here.