4 Stocks John Paulson and Paul Tudor Jones Agree On

- By Sydnee Gatewood

Investors John Paulson (Trades, Portfolio), who heads up Paulson & Co., and Paul Tudor Jones (Trades, Portfolio), leader of Tudor Investment Corp., may have slightly different approaches to value investing, but both have a few holdings in common.

Warning! GuruFocus has detected 7 Warning Signs with SHPG. Click here to check it out.

The intrinsic value of SHPG

As of the second quarter, Paulson and Jones have positions in Shire PLC (SHPG), Allergan PLC (AGN), NXP Semiconductors NV (NXPI) and Altaba Inc. (AABA).

Shire

Paulson reduced his Shire stake by 5.08% in the second quarter, while Jones established a 90,800-share position.

The Irish biotechnology company, which focuses on neuroscience, rare diseases, gastrointestinal, internal and regenerative medicine, has a $46.1 billion market cap; its shares were trading around $178.70 on Friday with a price-earnings ratio of 11.53, a price-book ratio of 1.50 and a price-sales ratio of 3.59.

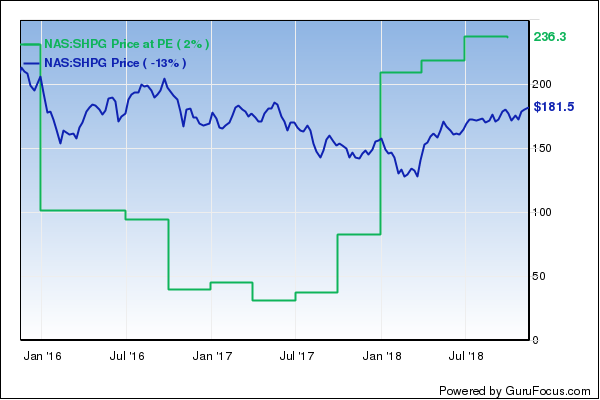

The Peter Lynch chart below shows the stock is trading below its fair value, suggesting it is undervalued.

GuruFocus rated Shire's financial strength 5 out of 10. While the company has sufficient interest coverage, its Altman Z-Score of 1.63 indicates it is at risk of going bankrupt. The company's profitability and growth fared much better, scoring an 8 out of 10 rating. Although the operating margin is in decline, it still outperforms 91% of competitors. The company also has a moderate Piotroski F-Score of 6, which means business conditions are stable, and a business predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically see their stock prices gain an average of 1.1% per year.

GuruFocus estimates Paulson has lost 2% on his investment since the third quarter of 2012. Jones has gained approximately 11%.

Of the gurus invested in Shire, Larry Robbins (Trades, Portfolio) has the largest stake with 1.9% of outstanding shares. Other guru shareholders include Chris Davis (Trades, Portfolio), Lee Ainslie (Trades, Portfolio), Richard Snow (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Leon Cooperman (Trades, Portfolio) and Seth Klarman (Trades, Portfolio).

Allergan

Paulson did not make any changes to his Allergan position in the second quarter. Jones opened a 24,550-share holding.

The pharmaceutical company, which is also headquartered in Ireand, has a market cap of $65.38 billion; its shares were trading around $192.49 on Friday with a forward price-earnings ratio of 11.56, a price-book ratio of 0.92 and a price-sales ratio of 3.99.

According to the median price-sales chart, the stock is trading above its historical average.

Weighed down by inadequate interest coverage, Allergan's financial strength was rated 5 out of 10 by GuruFocus. In addition, the Altman Z-Score of 1.12 indicates the company is in danger of bankruptcy. The company's profitability and growth scored a 6 out of 10 rating. In addition to having margins and returns that underperform industry peers, the low Piotroski F-Score of 3 implies business conditions are poor.

According to GuruFocus, Paulson has gained an estimated 8% on his investment since the first quarter of 2014. Jones has gained approximately 20%.

With 4.09% of outstanding shares, the Vanguard Health Care Fund (Trades, Portfolio) is the company's largest guru shareholder. Klarman, David Tepper (Trades, Portfolio), Mason Hawkins (Trades, Portfolio)' Southeastern Asset Management, Robbins, Jim Simons (Trades, Portfolio)' Renaissance Technologies, Wallace Weitz (Trades, Portfolio), David Carlson (Trades, Portfolio) and many other gurus also have positions in the stock.

NXP Semiconductors

Paulson expanded his stake in NXP Semiconductors by 64.69% in the second quarter, whereas Jones trimmed his position by 29.85%.

The Dutch semiconductor manufacturer has a $32.35 billion market cap; its shares were trading around $94.01 on Friday with a price-earnings ratio of 33.41, a price-book ratio of 2.34 and a price-sales ratio of 3.45.

Based on the Peter Lynch chart, the stock appears to be overpriced.

GuruFocus rated NXP's financial strength 6 out of 10. The company is weakened by poor interest coverage and the Altman Z-Score of 2.74 indicates it is under some fiscal pressure. The company's profitability and growth scored an 8 out of 10 rating, boosted by a high Piotroski F-Score of 7 and an operating margin that outperforms 51% of competitors. GuruFocus also warns the company has seen a slowdown in revenue per share growth over the last 12 months.

According to GuruFocus, Paulson has lost an estimated 7% on his investment since the fourth quarter of 2016, while Jones has lost approximately 4% since the fourth quarter of 2015.

Paul Singer (Trades, Portfolio) has the largest holding of NXP among the gurus with 5.01% of outstanding shares. Daniel Loeb (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), George Soros (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Grantham and many other gurus are also shareholders.

Altaba

Paulson boosted his Altaba position by 6.64% in the second quarter. In contrast, Jones reduced his holding by 96.37%.

The New York-based investment management company, which was created when Verizon (VZ) acquired Yahoo's internet business in June 2017, has a market cap of $41.91 billion; it shares were trading around $69.18 on Friday with a price-earnings ratio of 23.81, a price-book ratio of 0.88 and a price-sales ratio of 67.99.

The Peter Lynch chart shows the stock is trading above its fair value.

Altaba's financial strength and profitability and growth were both rated 4 out of 10 by GuruFocus. While the company has a strong debt-to-equity ratio, its margins and returns underperform a majority of competitors. The company also has a one-star business predictability rank as the company has seen a decline in revenue per share over the last three years.

GuruFocus data shows Paulson has gained an estimated 28% on his investment since the second quarter of 2017. Jones has gained approximately 40% over that same period.

Other guru shareholders include Singer, First Pacific Advisors (Trades, Portfolio), Tepper, PRIMECAP Management (Trades, Portfolio), Steven Romick (Trades, Portfolio), Ruane Cunniff (Trades, Portfolio), David Avrams, Howard Marks (Trades, Portfolio)' Oaktree Capital and Soros.

Portfolio composition

Paulson's $4.89 billion portfolio, which is composed of 54 stocks, is largely invested in the health care sector. With the long-term goal of capital preservation, above-average returns and low correlation to the market, the New York-based investment management firm specializes in event-driven arbitrage strategies, including merger arbitrage, bankruptcy reorganizations and distressed credit, among others.

Jones' 1,015-stock portfolio is heavily invested in the technology and consumer cyclical sectors. The Stamford, Connecticut-based firm utilizes discretionary macro trading as well as model-driven and systematic approaches to generate consistent returns.

Disclosure: No positions.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 7 Warning Signs with SHPG. Click here to check it out.

The intrinsic value of SHPG