4 Stocks in Spotlight With AI Making Inroads in MedTech

Artificial Intelligence (AI)-driven technologies are playing a vital role in combatting the pandemic. Though AI in healthcare is not a new notion, it gained prominence amid several intensified COVID-19 phases when remote monitoring and treatment were the need of the hour.

AI-driven solutions are rapidly being used to detect & diagnose the virus through personalized information and learning. In fact, with the help of AI and robotics, healthcare providers can save more lives and cure diseases that are currently undiagnosable or incurable. For instance, this combination can provide surgeons meaningful insights into real-time blood flow, like enabling them to avoid tissue damage during surgeries.

While we discuss AI in healthcare, here are four companies, Medtronic plc MDT, Stryker Corporation SYK, Allscripts Healthcare Solutions, Inc. MDRX and Syneos Health, Inc. SYNH, that we think will gain enormously from the advancements in the space.

AI: A New-Generation Trend of MedTech

Within MedTech, AI-driven technologies are utilized to research the connection between treatment techniques and patient outcomes. The application of AI here includes robot-assisted surgery, virtual nursing assistants, dosage error reduction and connected machines, among others.

Per a report of Markets and Markets, the AI in healthcare market is projected to rise from $6.9 billion in 2021 to $67.4 billion by 2027, at a CAGR of 46.2%.

The influx of large and complex healthcare datasets, growing need to reduce treatment costs, improving computing power and declining hardware cost, rising number of partnerships and collaborations among different domains in the healthcare sector are the major factors driving the market.

While the COVID-19 outbreak had a positive influence on the AI market, according to the majority of market watchers, the acceptance trend of digital health will continue beyond the pandemic considering the advanced clinical outcomes and reduced costs of this mechanism.

Further, an article from the Brookings Institution suggests that “whoever leads in artificial intelligence in 2030 will rule the world until 2100.” This statement emphasizes the importance of AI in the future. It, therefore, goes without saying that stocks with a focus on AI-driven technologies will remain in trend in the days ahead.

Let’s talk about the four healthcare stocks that stand to benefit from the rising adoption of AI and robotics in the healthcare industry.

Stocks in Focus

Medtronic – The company is focusing on integrating AI into its existing surgery sectors, including advanced image processing, robotics, and navigation as well as increasing recruitment for remote patient monitoring. In February 2022, Medtronic announced that it will provide underserved communities with AI-assisted colonoscopy technology through the Health Equity Assistance Program for colon cancer screening with support from Amazon Web Services (AWS). In January 2022, Medtronic announced that the first clinical procedure in Europe was performed with the Hugo robotic-assisted surgery (RAS) system. The Hugo RAS system is Medtronic's solution to historical cost and utilization barriers that have kept surgical robotics out of reach for many hospitals. It is a modular, multi-quadrant platform designed for a broad range of soft-tissue procedures.

Image Source: Zacks Investment Research

Medtronic currently carries a Zacks Rank #3 (Hold). In 2023, MDT’s earnings are expected to grow 3.2%. Over the past year, Medtronic has lost 7.2% compared with the industry’s 12.6% fall.

Stryker – The company has significant exposure to robotics, AI for health care and medical mechatronics, which lent the company a competitive edge in the MedTech space. Stryker’s portfolio includes products like Hip, Knee and Mako Robotic-Arm Assisted Surgeries. The company offers Mako, a robotic-arm assisted surgery platform which is the first and only robotic technology that can be used for total knee, hip and partial knee replacement procedures. In 2021, the company’s Mako install base saw growth of 27% and currently has an installed base that is moving toward 1500 Mako robots. This reflects the strong demand for Stryker’s differentiated Mako robotic technology.

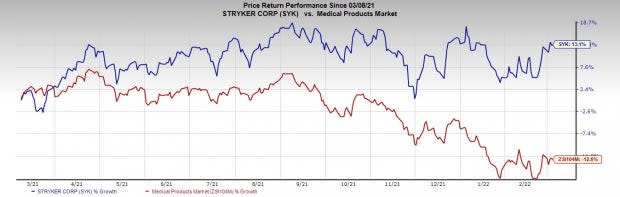

Image Source: Zacks Investment Research

Stryker currently carries a Zacks Rank #3. In 2023, SYK’s earnings are expected to grow 11.9%. Over the past year, Stryker has gained 13.1% against the industry’s 12.6% drop.

Allscripts Healthcare Solutions – The company’s portfolio has hit various innovation milestones over the past few months. In October 2021, the company announced the launch of Guided Scheduling, the latest addition to its automation features in Allscripts Practice Management. Allscripts’ Guided Scheduling is an AI scheduling application that utilizes real-time provider, practice and industry data to improve patient care and increase healthcare operational efficiencies. In the same month, Veradigm -- a business unit of Allscripts Healthcare Solutions, entered into an agreement with CareMetx to integrate its solutions and services directly into the Veradigm AccelRx specialty medication platform. The new partnership simplifies and accelerates the specialty approval medication process.

Image Source: Zacks Investment Research

Allscripts currently carries a Zacks Rank #1 (Strong Buy). In 2023, MDRX earnings are expected to grow 9.4%. Over the past year, Allscripts has gained 41.1% against the industry’s 46.7% fall. You can see the complete list of today’s Zacks #1 Rank stocks here.

Syneos Health – In October 2021, the company acquired RxDataScience – a healthcare-focused data analytics, data management and AI company. The acquisition brings AI and data engineering expertise, enterprise analytics and technology-enabled solutions to Syneos Health’s portfolio. Combining the company’s end-to-end services and deep behavioral and therapeutic expertise with RxDataScience’s AI and data-science capabilities will generate customer strategies to boost product development. In September, SYNH acquired StudyKIK, which expands Syneos Health’s ability to accelerate site start-up as well as patient enrolment engagement through their global network of patient communities and advanced technology platform, thereby enhancing patient retention and access.

Image Source: Zacks Investment Research

Syneos Health currently carries a Zacks Rank #3. In 2023, SYNH’s earnings are expected to grow 12.9%. Over the past year, Syneos Health has gained 12.1% against the industry’s 46.7% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

Syneos Health, Inc. (SYNH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research