4 Top Stock Trades for Friday: MS, SHOP, RAD, SNAP

It was a back and forth session on Thursday, with little progress made in either direction. With that in mind, here’s a look at a few top stock trades for Friday.

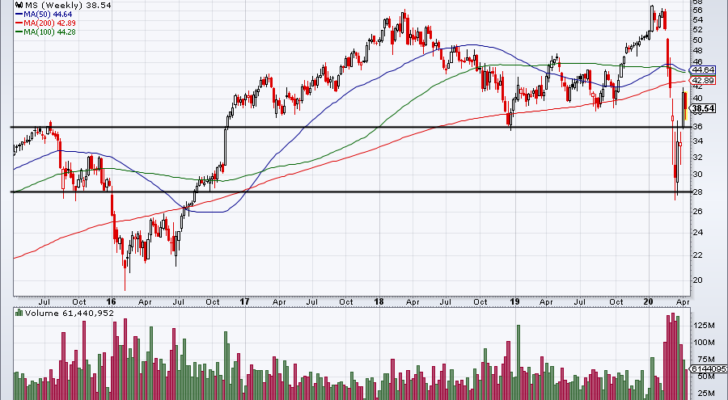

Top Stock Trades for Tomorrow No. 1: Morgan Stanley (MS)

Source: Chart courtesy of StockCharts.com

Like most of the bank stocks, Morgan Stanley (NYSE:MS) is struggling to rally after reporting earnings. Shares slipped about 3% on Thursday after the company’s quarterly results.

The decline is sending shares of Morgan Stanley below $40, although it’s rebounding off the session lows. From here, the bank is sort of sitting in no man’s land on the weekly chart.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

If the current low holds and shares continue to push higher, I want to see MS clear last week’s high near $42. Up near $43 is the 200-week moving average, while the 50-week and 100-week moving averages are near $44.50. These are reasonable upside targets if Morgan Stanley can clear last week’s high.

On the downside, though, I would like to see $36 hold as support. Below that puts $32 back in play, followed by a possible retest of the lows near $28.

Top Stock Trades for Tomorrow No. 2: Shopify (SHOP)

Source: Chart courtesy of StockCharts.com

Earlier this month, Shopify (NYSE:SHOP) stock was struggling to hold the $350 level. Now after clearing $500 resistance, it’s flirting with a move to $550. This stock is a big mover and not afraid to show it.

From here, let’s see if Shopify can get up to $550. If it can, it puts a move up to the prior high near $590 in the cards.

On a pullback, however, we want to see $500 hold as support. That’s asking for a lot should the market start to correct, though. So below that mark, look to see if the $450 level can buoy Shopify on a pullback. That level has been significant in the past, while the 50-day moving average is just below at $446.

Below $446, and investors may want to let Shopify reset before attempting a long position in the name.

Top Stock Trades for Tomorrow No. 3: Rite Aid (RAD)

Source: Chart courtesy of StockCharts.com

Rite Aid (NYSE:RAD) shares are under pressure after reporting earnings, falling more than 20%. The silver lining here is that support is coming into play right where it needs to.

It’s hard to like most retail stocks right now, short of e-commerce players and high-quality big-box retailers. Being considered a low-quality retail stock by most investors makes it hard to be a big believer in RAD stock.

That said, the 200-day moving average continues to act as support, as does the $10 level. On a dip, buyers can try to scoop up a few shares, provided RAD stays above these key levels. Below and I have no interest in owning this name.

On the upside, though, let’s see if RAD can rally back to the 100-day moving average near $13. Above that puts the 50-day moving average and downtrend resistance (blue line) in play near $14.50.

Top Stock Trades for Tomorrow No. 4: Snap (SNAP)

Source: Chart courtesy of StockCharts.com

Snap (NYSE:SNAP) made a pretty ugly move to the downside on Thursday. Shares failed at the 50-day moving average and $14 level.

It would be bullish to see Snap reclaim these levels, putting $15-plus in play. However, that seems unlikely at the moment. That’s as the stock breaks below its rising wedge (blue lines).

When a stock has a narrowing range to the upside and breaks trend support, it’s usually a bearish technical development. From here, we need to see where Snap ultimately finds its footing. Is it at $11? How about $12? Let’s wait for the stock to reset first, then go from there. Below both marks puts $10 back in play.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, he did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 4 Top Stock Trades for Friday: MS, SHOP, RAD, SNAP appeared first on InvestorPlace.