4 Value Picks From the Top-Ranked Life Insurance Industry

The Zacks Life Insurance industry is housed within the top 21% of the 255 Zacks industries. The industry players are poised to benefit from product redesigning and repricing along with increased automation. It currently carries a Zack Industry Rank #54. The industry’s earnings estimates for the current year have been revised 16.2% upward in a year’s time.

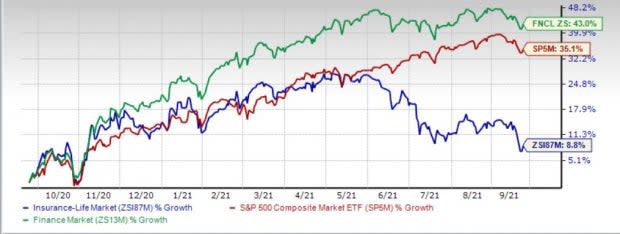

The industry that suffered last year due to the pandemic has been gaining pace. The industry has gained 8.8% year to date compared with the Finance sector’s increase of 43.2% and the Zacks S&P 500 composite’s 35.1% rally.

Image Source: Zacks Investment Research

Increased vaccinations, improving employment and an encouraging economic growth outlook instill confidence in the industry. Economic growth as reflected by GDP increased at an annualized rate of 6.5% for the second quarter.

Life insurers are sensitive to interest rates. They invest the premium earned to meet the contractually guaranteed obligations of policyholders. A low rate weighs on income from investment. Thus, insurers are directing their funds into alternative investments like private equity, hedge funds and real estate to navigate the challenges. The rate is expected to remain low until 2023, as indicated in the latest FOMC meeting.

The industry players are also refraining from selling long-duration term life insurance. The players are opportunistically moving away from guaranteed savings products toward protection products of unit-linked savings products.

The increased adoption of technologies like blockchain, artificial intelligence, advanced analytics, telematics, cloud computing, and robotic process automation aid in seamless underwriting and claims processing, in turn improving operational efficiency.

Per a report by IBISWorld, the $886.7-billion U.S. Life Insurance & Annuities Market represents 4.2% growth in 2021. The players are well poised to capitalize on the opportunity, banking on their core strengths. Sales should benefit from increasing demand for protection products.

The industry is currently undervalued compared with the Zacks S&P 500 composite as well as the Zacks Finance sector. The price-to-book (P/B) ratio, the best multiple for valuing insurers because of their unpredictable financial results, is 1.2, lower than the Zacks S&P 500 composite’s 6.9 and the sector’s 3.3. Such a market positioning hints at more room for upside in the coming quarters.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Value Picks

Given the industry prospects, let’s look at a few stocks that are currently undervalued and have the potential of generating better returns. Our proprietary Value Score makes the daunting task easier.

The Value Score helps find attractive value stocks. These value stocks have a long history of showing superior returns. Back-tested results have shown that stocks with a solid Value Score and favorable Zacks Rank generate better returns.

With the help of the Zacks Stock Screener, we have selected five life insurance stocks with a favorable Value Score of A or B. Each of these stocks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

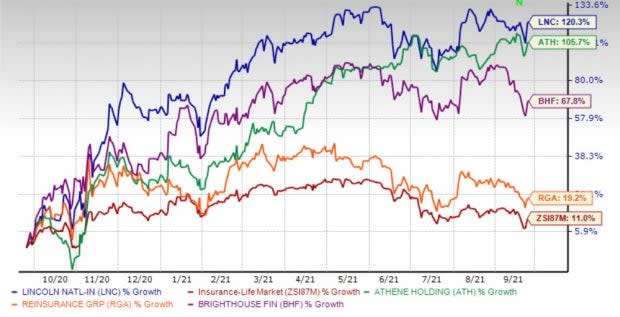

These stocks have also witnessed positive estimate revisions in the past 60 days, reflecting analysts’ confidence in the companies’ operational efficiency. Shares of each of these life insurers have outperformed the industry in a year’s time and are cheaper than the industry average.

Image Source: Zacks Investment Research

Based in Philadelphia, PA, Lincoln National Corporation LNC is a diversified life insurance and investment management company. This diversified life insurance and investment management company is poised to grow on the back of strong performance of the Life Insurance segment. The company has been making changes in its sales mix to emphasize on sales, without a long-term guarantee to improve profitability. Improved economic backdrop and an expanding set of retirement solutions products should drive the Retirement business. The company is prudently managing costs to preserve margins.

Shares of the company have gained 120.3% over a year. The stock is currently trading at a 0.6 price to book multiple.

Bermuda-based Athene Holding ATH is a provider of insurance and reinsurance retirement products across the United States and Bermuda, and is poised for long-term growth driven by continued focus on organic channels along with a strong relationship with Apollo. The portfolio of capital-efficient products and the addition of reinsurance partners are likely to offer improved retirement solutions. The company expects healthy organic growth to continue in 2021. It also estimates total organic inflows to likely meet or exceed $30 billion in 2021.

Strategic buyouts and block reinsurance transactions with several companies should fuel inorganic growth.

Shares of the company have gained 105.7% over a year. The stock is currently trading at a 0.61 price to book multiple.

Chesterfield, MO-based Reinsurance Group of America RGA is a global provider of traditional life and health reinsurance as well as financial solutions, and is poised to benefit from the changing life reinsurance pricing environment, expanding business in the pension risk transfer market along with disciplined capital management.

Significant value embedded in the in-force business is estimated to generate predictable long-term earnings. Reinsurance Group expects longevity insurance to see long-term growth in the Canadian market as it is projected to see steady demand.

Shares of the company have gained 19.2% over a year. The stock is currently trading at a 0.56 price to book multiple.

Charlotte, NC-based Brighthouse Financial BHF boasts one of the largest providers of annuity and life insurance products in the United States, and is poised to grow on a compelling suite of life and annuity products, individual insurance, and focus on transitioning the business mix to less capital-intensive products.

The company remains focused on ramping up new sales of life insurance products and expanding the distribution network, aiming to become a premier player in the industry. It targets total annual annuity sales of more than $8.5 billion and $250 million of total life sales in 2021. Though the company’s Fixed Rate Annuity sales are anticipated to be lower, it projects growth in Shield and Variable Annuities in 2021.

Given solid execution of strategies to drive profitability, enhanced financial strength and flexibility, the company targets to pay back $1.5 billion of capital to shareholders by 2021-end.

Shares of the company have gained 67.8% over a year. The stock is currently trading at a 0.23 price to book multiple.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Athene Holding Ltd. (ATH) : Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research