5 Auto Stocks Poised to Deliver Q4 Earnings Beat

The Auto sector has started this earnings season on a somewhat mixed note. Before delving into the factors that are likely to have shaped the quarterly results this time around, let’s take a look at the S&P auto sector components that have unveiled fourth-quarter results so far.

Picture So Far

Till now, only two of the S&P 500 auto companies — namely PACCAR Inc. PCAR and Tesla TSLA — have reported fourth-quarter results. While both the firms missed earnings estimates, they did manage to beat the top-line mark. Encouragingly, EV king Tesla’s profit and sales recorded impressive year-on-year gains, whereas the trucking giant PACCAR’s earnings and revenues dipped from fourth-quarter 2019. Notably, PACCAR posted earnings of $1.17 per share and revenues of $5.57 billion. Tesla — which hit a milestone by entering the prestige S&P 500 club on Dec 21, 2020 — reported earnings of 80 cents a share and revenues of $10.7 billion.

Upbeat Expectations

Overall earnings for the sector are projected to witness year-over-year growth of 76.9% on 3.8% higher revenues, per the latest Earnings Trends. Notably, 7 of the 16 Zacks sectors are expected to experience earnings growth in Q4 and the Auto Sector is likely to witness the highest growth. The projections for the to-be-reported quarter indicate an improvement from 47.9% earnings growth on 0.4% increase in revenues witnessed in the third quarter.

Factors Setting the Tone for the Sector’s Results

The auto market — badly hit by coronavirus-led sluggish demand during the first half of 2020 — started to rebound in the third quarter, with the recovery picking up pace in fourth-quarter 2020. Sales of vehicles during the fourth quarter improved sequentially amid pent-up demand, easier credit conditions and preference for personal mobility.

While fourth-quarter delivery numbers of most auto biggies witnessed a rise from the third quarter, sales of certain auto biggies like General Motors and Volkswagen also climbed year over year. Rising vehicle demand is likely to have aided the companies’ results this earnings season. In fact, total new vehicle sales in the United States grew year over year in the last month of the year, as consumers’ confidence was boosted amid vaccine optimism.

Rising e-commerce initiations and cost-cut initiatives undertaken by the companies are also expected to have positively impacted earnings and sales of auto firms. Ship-to-home next day, curb-side pick-up option, as well as buying online & pick-up in stores options picked up pace, thereby helping dealers to generate sales amid tough times. Improving vehicle demand is anticipated to have benefited not just the auto giants but also the equipment suppliers to the auto industry.

The Winning Strategy

The encouraging scenario and projections suggest that there are a number of companies that are likely to trump fourth-quarter estimates. However, with a wide range of auto firms thronging the investment space, it is by no means an easy task for investors to arrive at stocks that have the potential to deliver better-than-expected earnings.

While it is impossible to be sure about such outperformers, our proprietary methodology — Earnings ESP — makes it relatively simple. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP is our proprietary methodology for identifying stocks that have high chances of surprising with their next earnings announcement. It shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. You can further narrow down the list of choices by looking at stocks that have a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). Our research shows that for stocks with the combination of a favorable rank and positive ESP, the chance of delivering an earnings beat is as high as 70%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our Choices

We have identified five auto stocks that are poised to trump fourth-quarter earnings estimates.

Ford F: The U.S. auto giant, with an Earnings ESP of +12.88% and a Zacks Rank #1, is scheduled to release quarterly earnings on Feb 4. The Zacks Consensus Estimate for loss has been narrowed by 2 cents per share over the past 30 days. Coming to earnings surprise history, Ford surpassed estimates in two of the trailing four quarters and missed on the other two occasions, with an average surprise of 27.01%. Focus on SUVs and trucks, along with capital discipline and operational efficiency is expected to aid the company’s results.

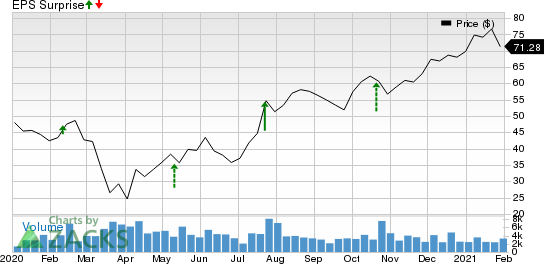

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Lear Corporation LEA: Auto equipment provider Lear, having an Earnings ESP of +3.88% and a Zacks Rank #3, is scheduled to release quarterly earnings on Feb 4. The Zacks Consensus Estimate for earnings has increased by 31 cents per share over the past 30 days. Coming to earnings surprise history, it surpassed estimates in each of the trailing four quarters, with the average being 35%. The Xevo buyout, operational efficiency, and revenue growth in both Seating and E-Systems segments are likely to drive Lear’s fourth-quarter 2020 results.

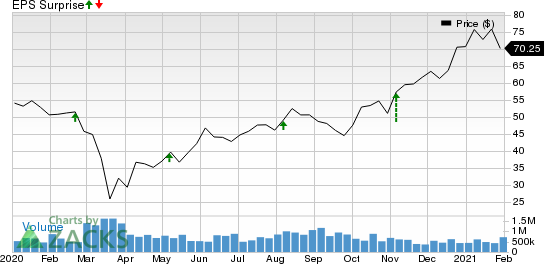

Lear Corporation Price and EPS Surprise

Lear Corporation price-eps-surprise | Lear Corporation Quote

AutoNation AN: This largest automotive retailer in the United States, with an Earnings ESP of +1.91% and a Zacks Rank #3, is scheduled to release quarterly earnings on Feb 16. The Zacks Consensus Estimate for earnings has moved north by 2 cents per share over the past 60 days. Coming to earnings surprise history, AutoNation surpassed estimates in each of the trailing four quarters, with the average being 95.4%. The company’s enhanced digital solutions and omni-channel marketing strategy, as well as increased focus on cost-containment efforts are expected to boost the upcoming results.

AutoNation, Inc. Price and EPS Surprise

AutoNation, Inc. price-eps-surprise | AutoNation, Inc. Quote

Allison Transmission ALSN: Auto equipment manufacturer Allison, with an Earnings ESP of +7.44% and a Zacks Rank #3, is scheduled to release quarterly earnings on Feb 17. The Zacks Consensus Estimate for earnings has moved north by 2 cents per share over the past 30 days. Coming to earnings surprise history, it surpassed estimates in each of the trailing four quarters, with the average surprise being 24.7%. Allison's upcoming quarterly release is anticipated to reflect the synergies from strategic buyouts of Walker Die, C&R Tool & Engineering, Vantage Power and AxleTech’s EV systems division.

Allison Transmission Holdings, Inc. Price and EPS Surprise

Allison Transmission Holdings, Inc. price-eps-surprise | Allison Transmission Holdings, Inc. Quote

Magna International MGA: Automotive equipment supplier Magna, with an Earnings ESP of +5.42% and a Zacks Rank #1, is scheduled to release quarterly earnings on Feb 19. The Zacks Consensus Estimate for earnings has moved north by 8 cents per share over the past 30 days. Coming to earnings surprise history, the company surpassed estimates in each of the trailing four quarters, with the average surprise being 20.8%. Its strategic collaborations and expansion of business through joint ventures and hub openings are expected to positively reflect on the firm’s fourth-quarter 2020 results.

Magna International Inc. Price and EPS Surprise

Magna International Inc. price-eps-surprise | Magna International Inc. Quote

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

To read this article on Zacks.com click here.