5 Best Int'l Value Picks Right Now

Foreign equities are delivering strong returns this year, particularly Asian markets—and specifically China. But there haven’t been a lot of headlines talking about the region, and many China ETFs have actually faced net outflows this year despite their performance. Meb Faber, head of ETF Issuer Cambria Funds and a known quant focused on value plays, offers his take on the case for Asia, and for all-things-but-the-U.S. when it comes to equity investing.

ETF.com: Some of the best-performing ETFs this year offer exposure to Asia. Are fundamentals generally strong, or is this a value play along with other emerging markets?

Meb Faber: It's both. In the summer of 2016, and early 2016, depending on the country, a lot of the foreign markets started to bottom. You started to see a lot of the outperformance relative to U.S. stocks.

In 2016, you saw the Brazils and the Russias of the world really have monster years. This year it's been various countries, but you have certainly even a lot of Europe doing well, and a lot of Asia.

U.S. stocks were the best-performing market from 2009 to 2016. Since then you've seen a rotation happen, and a lot of the cheap stuff, including emerging markets and some developed markets, like the former PIGS [Portugal, Ireland, Greece, Spain] do well.

The theme we've been talking about for four years now is that the U.S. is getting more expensive by the day, and a lot of these foreign markets could still do double-digit returns. But I don't know if there's anything unique about Asia, for example. It's just that a lot of the foreign markets are catching momentum.

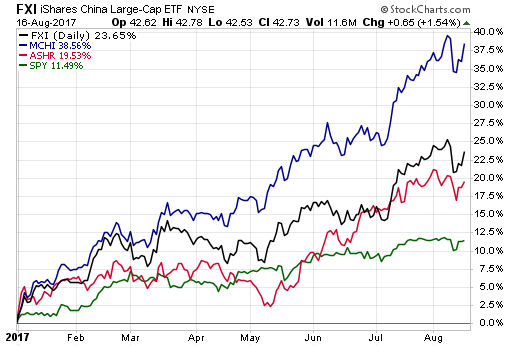

ETF.com: Specifically on China, the performance of China ETFs such as the iShares China Large-Cap ETF (FXI), iShares MSCI China ETF (MCHI) and Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (ASHR) is solid this year. But many of them have faced asset outflows. Why?

Chart courtesy of StockCharts.com

Faber: China, for whatever reason, attracts boom/bust extremes in flows, valuation and sentiment. People have a very love/hate relationship with Chinese equities.

Lots of investors like to gamble on Chinese equities. In 2007, Chinese stocks traded at long-term P/E ratio of in the 60s. In 2009, it got down to 14. Into 2013, it got to 12. In 2015, we pointed out that China was the cheapest it'd been in a decade.

So in just a few years, you see the extremes in valuation that coincide with sentiment. We owned Chinese stocks in our global value fund until the spring, and we've sold out of all of it as they have appreciated.

But it's been a strong series of returns for most foreign markets in 2016 and 2017.

ETF.com: Is the China value play over, then?

Faber: No. If you look at the spectrum of 45 countries we look at, there's a lot in the bucket of reasonable-priced to cheap. But our global value ETF [Cambria Global Value ETF (GVAL)] is only choosing the cheapest 25%.

So some of the countries will grow out of it if they have good enough performance, like China did. But we still think China is a far better choice than the U.S., which is at a valuation long-term P/E ratio of above 30 now.

ETF.com: What pockets of value or opportunities are investors overlooking right now?

Faber: We've been singing the same tune for a long time. In general, investors here have way too much U.S. equity exposure.

The starting point for most people is 50% U.S., 50% foreign in a global market allocation. But almost every U.S. investor has about 70% in U.S. And it happens everywhere. Italians put the most in the Italian market, etc.

But it's a horrible idea, particularly now when the U.S. is one of the most expensive countries in the world, at a P/E of around 30, versus the rest of the world being much cheaper.

Our first recommendation is, at a minimum, diversify to where you have at least half your equity exposure in foreign. And then if you want to be more value-centric, tilt it even more toward value.

ETF.com: What's the best value in the world today from a country perspective?

Faber: The cheapest five—and some of these get small, so it's a little easier to say that it's cheap because there's only 10 stocks in the whole index versus 2,000 in Japan, for example—but they are the Czech Republic, Russia, Portugal, Brazil and Italy.

This cheap bucket has a CAPE ratio of around 10, a valuation that's one-third the valuation of the U.S. That compares to the median across all 45 countries of around 17. Foreign developed is around 20; foreign emerging around 15; and the U.S. is at 30.

ETF.com: If you go this extreme value route and concentrate on the five cheapest markets, is there a time horizon you need to work with to let this value play materialize?

Faber: It's the same as the business cycle. With value, we always say five, 10 years. Have a long-term perspective.

That said, I would much rather have my money in a basket of cheap equities than expensive ones. The expensive ones historically have shown they have a much higher probability of a big, fat drawdown in their future. That just happens to be the U.S. right now, but historically it's been other countries. And for the devalued stocks, you can’t rebalance frequently, because it doesn't give it time to recover.

ETF.com: Developed ex-U.S. ETFs have been hugely popular this year. Has that run its course?

Faber: In the deep value, we like Portugal, Italy, Austria, Norway, Spain, Greece—depending on which index provider and their category for developed or emerging—but we own a lot of Europe. We also own Poland-Turkey- kind-of-Europe periphery, but no Japan.

ETF.com: You did a poll recently on Twitter asking whether people owned U.S. equities, how much, and whether they’d continue to own it if valuations hit a 10-year CAPE of 100. A lot of the answers were yes to all of these things. What’s your takeaway?

Faber: The responses were a surprise to me. I think it's crazy bones. If you reframed the question and applied it to your house or the lemonade stand down the corner and said, ‘This lemonade stand makes $1,000 a year in earnings, what would you pay for it?’ I don't think anyone in their right mind would pay $100,000 for that.

People just have a different mindset when it comes to public market equities. And part of that is a very U.S.-centric focus. If you were to ask somebody in Greece or Brazil or Russia or even Japan the same question, they'd say, “You're bananas, no way.” People seem to forget the lessons of history.

ETF.com: U.S. valuations may be high, but the stock market keeps going higher. We're eight years into this, and it keeps going. I could see an investor agreeing that it’s crazy, but why bail out? Is there a clear sign of when it's time to bail?

Faber: Valuation is the yellow warning light, and historically we've been a trend-following shop. When the trend rolls over, it's historically been a really wonderful timing signal. You could call it the 200-day moving average, you could call it the 10-month moving average, all sorts of different stuff.

But if you were to put equity returns into four buckets historically across uptrend/downtrend, cheap/expensive, the best-returning bucket is cheap/uptrend. But the second-best is expensive/uptrend, which is where we are now. (The worst is obviously expensive/downtrend.)

The real danger comes when the trend starts to peter out and roll over. To me, that's really like the full signal to really put on some defensive positions or hedging. But again, look, at a valuation of 30, it's not as bad as it was in the '90s bubble when we were around 45. It's not as bad as China was in the 2000s.

We’re not in a bubble. There are a lot worse examples. Still, you don't have to play. You can wait for a better entry.

ETF.com: If someone today wants to trim some of their U.S. exposure, or protect themselves, what do you suggest?

Faber: There are a lot of things you can do. Selling would be one. But if you're not going to do that, then certainly adding hedges or asymmetric exposures would probably be the best way to hedge a traditional portfolio. If you're going to do U.S., you may want to think about a risk-managed approach.

Contact Cinthia Murphy at cmurphy@etf.com

Recommended Stories