5 Big Bank Stocks to Sell Now

U.S. equities are backpedaling a little on Tuesday morning ahead of Wednesday’s memorial closure in honor of President George H.W. Bush. Financials and technology stocks — an area of frequent momentum excitement — are lagging. As for bank stocks, the pullback is being driven by an ongoing flattening of the yield curve with the difference between the two-year and 10-year Treasury yield dropping to the lowest since 2007.

This, along with a steady rise in interest rates, threatens to not only slow loan demand but the profit margins banks enjoy on the loans they do originate. This is a double whammy.

As a result, a number of bank stocks in the sector look vulnerable. Here are five stocks to sell now.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

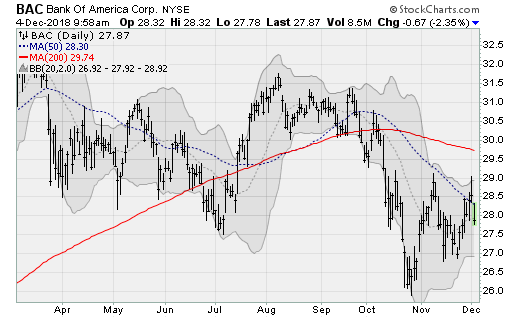

Bank of America (BAC)

Shares of Bank of America (NYSE:BAC) have dropped back below their 20-day and 50-day moving averages after hitting double-top resistance near the $29-a-share level. Watch for a retest of the late October low, which would be worth a decline of more than 7% from here. BAC stock has been in a downward trending sideways channel since the beginning of the year.

The company will next report results on Jan. 14 before the bell. Analysts are looking for earnings of 64 cents per share on revenues of $22.4 billion. When the company last reported on Oct. 15, earnings of 66 cents per share beat estimates by 4 cents on a 3.2% rise in revenues.

Citigroup (C)

Citigroup (NYSE:C) shares are reversing lower, threatening to break below the three-month support range established around the $63-$62 level. This marks a 15% decline from the high set in September and risks a violation of the lows set over the summer. A breakdown here would likely result in a fall all the way back to the lows seen in early 2017/late 2016 near $56, which would be worth a decline of more than 8% from here.

The company will next report results on Jan. 11 before the bell. Analysts are looking for earnings of $1.65 per share on revenue of $18 billion. When the company last reported on Oct. 12, earnings of $1.73 beat estimates by 7 cents on a 0.2% decline in revenues.

Goldman Sachs (GS)

Shares of Goldman Sachs (NYSE:GS) continue to trend lower, breaking to fresh lows not seen since late 2016 for a total decline of more than 30% from the high set back in March. A double-bottom was formed down near $133 in the early part of 2016, which is likely the next stop for GS stock — representing a further 30% drop from here.

The company will next report results on Jan. 15 before the bell. Analysts are looking for earnings of $6 per share on revenues of $8.2 billion. When the company last reported on Oct. 16, earnings of $6.28 per share beat estimates by 94 cents on a 3.8% rise in revenues.

Morgan Stanley (MS)

Morgan Stanley (NYSE:MS) stock is also under significant pressure, maintaining a downtrend that has kept prices largely contained below a falling 50-day moving average. Already down 24% from the peak set in March, a return to early 2017 support just below the $40-a-share level looks likely, which would be worth a loss of more than 10% from here.

The company will next report results Jan. 15 before the bell. Analysts are looking for earnings of $1 per share on revenues of $9.6 billion. When the company last reported on Oct. 16, earnings of $1.17 per share beat estimates by 16 cents on a 7.3% rise in revenues.

Wells Fargo (WFC)

Wells Fargo (NYSE:WFC) stock is falling back below its 200-day moving average and returning to a sideways trading range that has been in place since late September. Already down more than 10% from its August high, watch for a violation of the 200-week moving average, which has been in play on multiple bounces since late 2016. A violation would trace to a downside target near $45 for WFC stock — worth a further 15% decline from here.

The company will next report results on Jan. 11 before the bell. Analysts are looking for earnings of $1.19 per share on revenues of $21.3 billion. When the company last reported on Oct. 12, earnings of $1.13 missed estimates by 4 cents on a 0.4% rise in revenues.

As of this writing, William Roth did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 5 Big Bank Stocks to Sell Now appeared first on InvestorPlace.