5 Companies With Positive Earnings Growth Estimates

According to the GuruFocus All-in-One Screener, while most of the following companies are trading at a discount, all have positive three- to five-year future earnings estimates.

Shares of Computer Task Group Inc. (NASDAQ:CTG) are trading around $4.90 per share.

The company, which provides information technology services, has a GuruFocus profitability and growth rating of 5 out of 10. Analysts project a three-year to five-year earnings growth rate of 15%. The return on equity of -3.92% and return on assets of -1.88% are underperforming 64% of companies Application Software industry.

With 6.91% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder, followed by Chuck Royce (Trades, Portfolio) with 0.61%.

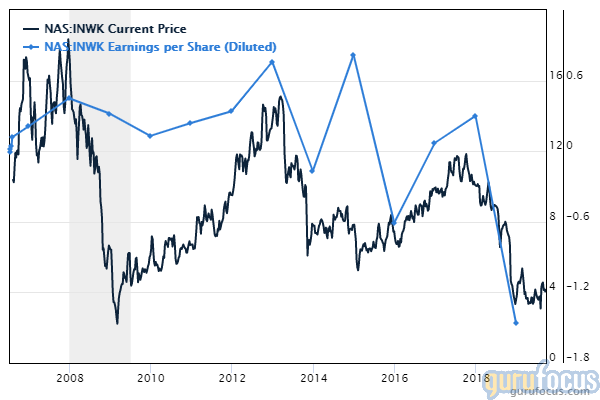

InnerWorkings Inc. (NASDAQ:INWK) is trading around $4.50 per share.

The marketing solutions provider has a GuruFocus profitability and growth rating of 4 out of 10. Analysts project a three-year to five-year earnings growth rate of 20%. The return on equity of -38.23% and return on assets of -12.31% are underperforming 85% of companies in the Advertising and Marketing Services industry.

Hotchkis & Wiley is the company's largest guru shareholder with 1.84% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 0.55% and Simons' firm with 0.08%.

Lumber Liquidators Holdings Inc. (NYSE:LL) is trading around $9.90 per share.

The hardwood flooring retailer has a GuruFocus profitability and growth rating of 5 out of 10. Analysts project a three-year to five-year earnings growth rate of 30%. The return on equity of -35.31% and return on assets of -11.69% are underperforming 89% of the companies in the Retail - Apparel and Specialty industry.

With 2.65% of outstanding shares, Royce is the company's largest guru shareholder, followed by Simons' firm with 1.98%, Barrow, Hanley, Mewhinney & Strauss with 0.85% and Philippe Laffont (Trades, Portfolio) with 0.16%.

Anika Therapeutics Inc. (NASDAQ:ANIK) is trading around $54 per share.

The orthopedic medicines provider has a GuruFocus profitability and growth rating of 8 out of 10. Its earnings per share have fallen 2.60% over the last five years. Analysts project a three-year to five-year earnings growth rate of 10%. The return on equity of 11.38% and return on assets of 10.39% are outperforming 89% of companies in the Biotechnology industry.

With 3.22% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Ken Fisher (Trades, Portfolio) with 0.58%, Royce with 0.08%, Joel Greenblatt (Trades, Portfolio) with 0.07% and Paul Tudor Jones (Trades, Portfolio) with 0.05%.

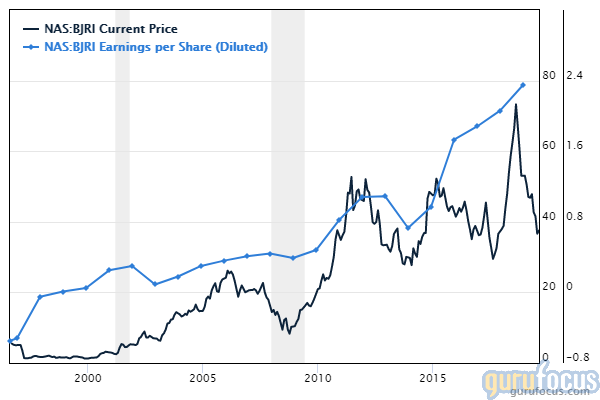

BJ's Restaurants Inc. (NASDAQ:BJRI) is trading around $39 per share.

The company, which operates casual dining restaurants, has a GuruFocus profitability and growth rating of 7 out of 10. Its earnings per share have grown 26.40% over the last five years. Analysts project a three-year to five-year earnings growth rate of 15%. The return on equity of 14.73% and return on assets of 5.57% are outperforming 67% of companies in the Restaurants industry.

With 2.93% of outstanding shares, Ron Baron (Trades, Portfolio) is the company's largest guru shareholder, followed by Greenblatt with 0.33% and John Hussman (Trades, Portfolio) with 0.24%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Insiders Are Buying vTv Therapeutics, Selling Facebook

6 Declining Stocks in Gurus' Portfolios

5 Companies Boosting Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.