5 Defensive Retail Companies Gurus Agree On

- By James Li

According to the Aggregated Portfolio, the five most broadly held stocks in the discount stores, grocery stores and pharmaceutical retailers industries are Walmart Inc. (WMT), Walgreens Boots Alliance Inc. (WBA), Costco Wholesale Corp. (COST), Target Corp. (TGT) and Dollar General Corp. (DG).

Warning! GuruFocus has detected 4 Warning Sign with WMT. Click here to check it out.

The intrinsic value of WMT

Buffett continued investing in stocks during the financial crisis

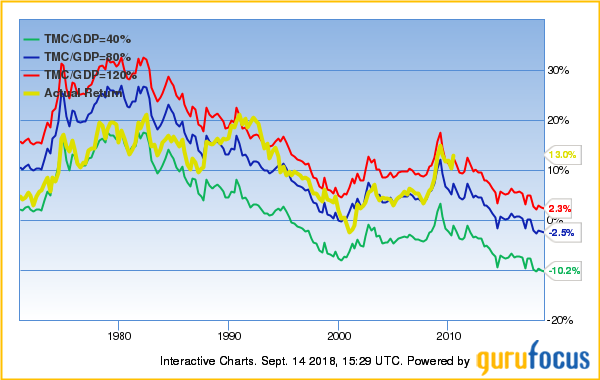

As the 2008 financial crisis nears its 10th anniversary, Berkshire Hathaway Inc. (BRK-A)(BRK-B) CEO Warren Buffett (Trades, Portfolio) said on a CNBC interview that another financial crisis will eventually occur. Buffett's favorite market indicator stands at 147.5%, approximately 1% below its all-time high. Based on current market valuations, the U.S. market is expected to return -2.5% per year over the next eight years.

CNBC columnist Ali Montag said Buffett was still buying stocks during the financial crisis, including investments in Goldman Sachs Group Inc. (GS) and General Electric Co. (GE). Two GuruFocus strategies that have outperformed the Standard & Poor's 500 index benchmark over the past 10 years include the most broadly held strategy and the undervalued predictable strategy.

The retail sector is not all cyclical

Legendary investor Peter Lynch warned about investing in cyclical companies, which can have volatile earnings based on changes in the business cycle. While apparel and specialty retail companies have high cyclicality, defensive retail companies like discount stores and pharmaceutical retailers are less sensitive to economic changes.

Walmart

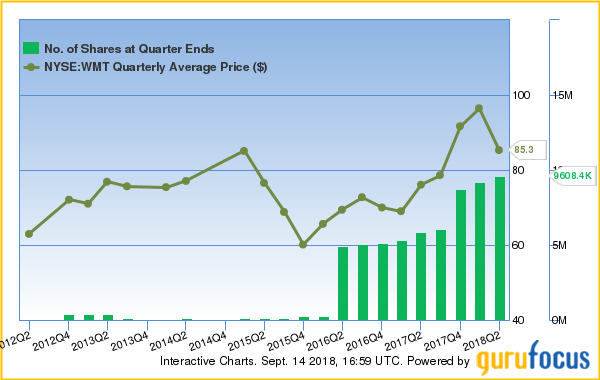

According to the aggregated portfolio, 21 gurus have holdings in Walmart. Gurus with large positions in Walmart include Bill Gates (Trades, Portfolio)' Bill & Melinda Gates Foundation Trust, Ken Fisher (Trades, Portfolio) and Richard Pzena (Trades, Portfolio).

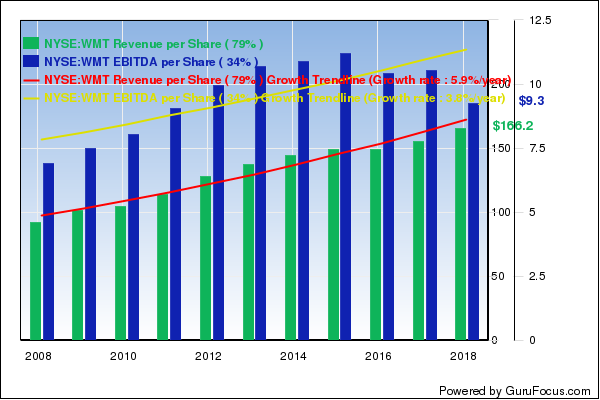

The Bentonville, Arkansas-based discount retailer mentioned in its Sept. 6 quarterly report that comparable sales for the three months ending July 31 increased 5.1% year over year on strong Walmart U.S. and Sam's Club sales growth. In the U.S., strong ticket and traffic growth contributed to a 4.7% year-over-year sales growth, outperforming the prior year by 3%.

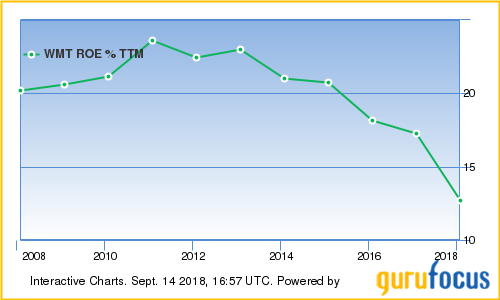

GuruFocus ranks Walmart's profitability 7 out of 10 on several factors, including a satisfactory Piotroski F-score of 6 and returns on equity that are outperforming two-thirds of global competitors.

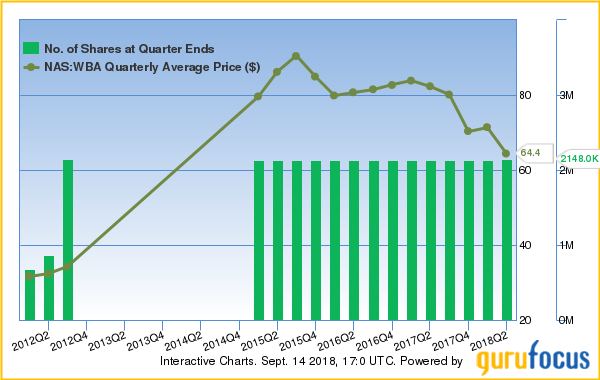

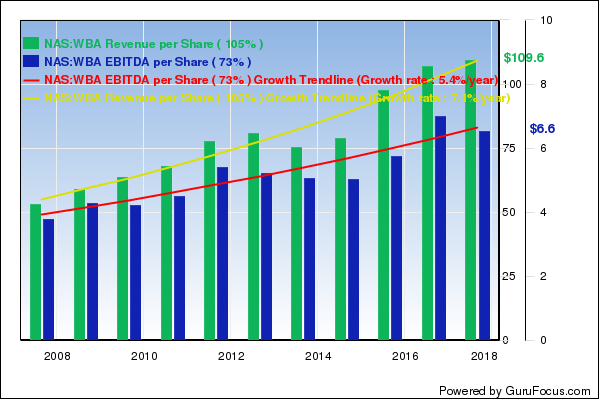

Walgreens

Seventeen gurus own shares of Walgreens according to the aggregated portfolio. Gurus with large ownership in Walgreens include the Vanguard Health Care Fund (Trades, Portfolio), Larry Robbins (Trades, Portfolio) and Tom Gayner (Trades, Portfolio).

GuruFocus ranks the Deerfield, Illinois-based pharmaceutical retailer's business predictability five stars as the company has consistent revenue and earnings growth over the past 10 years. Walgreens' three-year revenue growth rate of 11.50% outperforms 80% of global competitors.

Costco

Buffett and Spiros Segalas (Trades, Portfolio), two of the 17 gurus with positions in Costco, have the top two holdings: the former owns 4,333,633 shares while the latter owns 2,771,636 shares.

GuruFocus ranks the Issaquah, Washington-based wholesale retailer's profitability 7 out of 10 on several positive investing signs, including consistent revenue growth and margins that are increasing approximately 2.80% per year. Additionally, Costco's business predictability ranks four stars out of five.

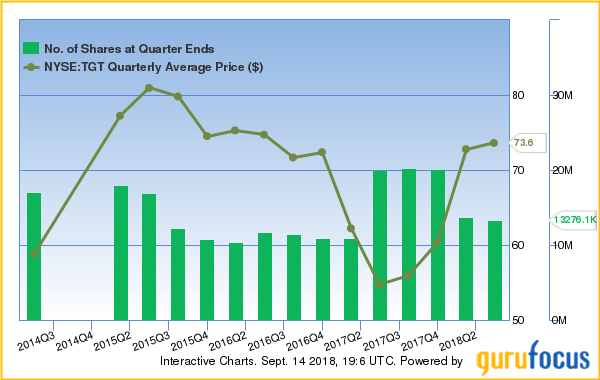

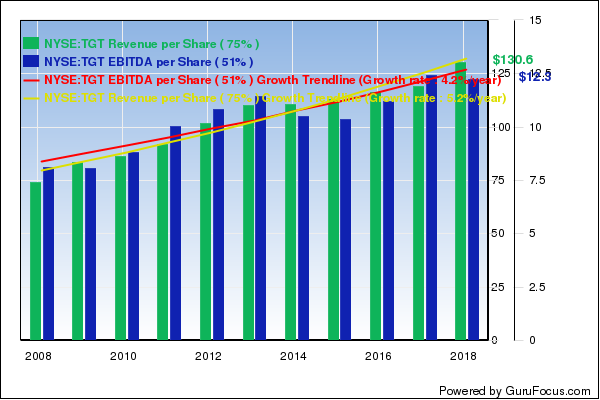

Target

With over 13 million shares, Dodge & Cox has the largest holding of Target, a discount retailer specializing in large-format stores. Fourteen other gurus own shares of Target according to the aggregated portfolio.

The Minneapolis-based company said on Aug. 22 that traffic growth for the quarter ending Aug. 4 contributed to 6.5% comparable sales growth, the company's best in 13 years according to CEO Brian Cornell. GuruFocus ranks Target's profitability 8 out of 10 on positive investing signs like consistent revenue growth and a strong Piotroski F-score of 7.

The company's business predictability ranks three stars out of five.

Dollar General

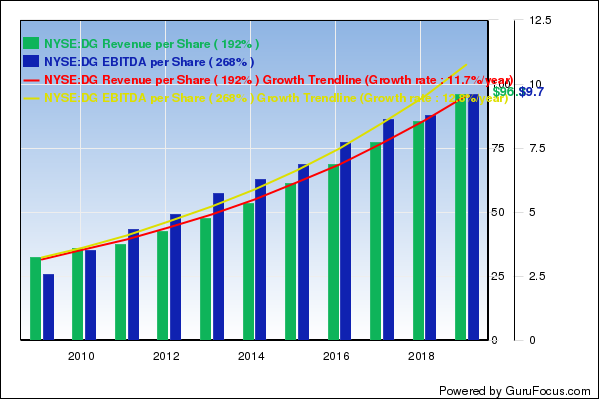

According to the aggregated portfolio, 14 gurus own shares of Dollar General. GuruFocus ranks the Goodlettsville, Tennessee-based retailer's profitability 9 out of 10 on several positive investing signs, including consistent revenue growth and a Piotroski F-score of a perfect 9. Dollar General's operating margin is still outperforming 87% of global competitors despite contracting approximately 3.1% per year. Additionally, the company's business predictability ranks four stars out of five.

Disclosure: The author owns shares of Costco.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with WMT. Click here to check it out.

The intrinsic value of WMT