5 Dividend-Paying Multiline Insurers That Ensure Stable Income

With the major indices — S&P 500, the Dow Jones Industrial Average and the Nasdaq Composite — losing steam, investors are looking for returns on their investment in the form of dividends. The hawkish move of the Fed to cut down inflation (having increased interest rate fives time already in 2022), concerns over the Russia-Ukraine conflict and a strong dollar are causing the weakness in the stock market.

The Zacks Multiline Insurance industry’s performance too has been affected. The industry has lost 13.7% year to date. Amid this, players like MetLife Inc. MET, Prudential Financial Inc. PRU, The Hartford Financial Services Group, Inc. HIG, Old Republic International Corporation ORI and Radian Group Inc. RDN, who have an impressive dividend history, offer a breather.

By virtue of the nature of their business, multiline insurers stand to benefit from a diversified portfolio that in turn lowers concentration risk. Increased awareness driving higher demand for protection products should benefit sales and premiums of life insurance operations. Continued improvement in pricing should support the premium growth of non-life insurance operations. Also, an increase in the exposure of intangibles and increase in cyber threats offers room for growth for non-life insurers. Per Deloitte Insights, The Swiss Re Institute estimates an increase in demand for insurance coverage across the globe, that in turn will drive a 3.9% rise in premiums in 2022. Per Deloitte Insights, life insurance premium is estimated to increase 4% while non-life insurance premium is expected to increase 3.7% in 2022.

The Fed’s hawkish move is a boon for the insurance industry as insurers are direct beneficiaries of an improving rate environment. Insurers invest a portion of their premium income. Therefore, higher the rates. better the investment results. Also, investment income is an important component of insurers’ top line.

Players are investing heavily in technology to improve scale and efficiencies. While a solid policyholders’ surplus helps the industry absorb losses, a sturdy capital level aids insurers in pursuing strategic mergers and acquisitions, investing in growth initiatives, engaging in share buybacks, and increasing dividends or paying out special dividends.

Dividend Stocks for Your Portfolio

In this volatile market, stocks that give regular dividends offer an attractive investment opportunity. Regular dividend hikes reflect confidence in operational strength, which, in turn, fuel earnings power.

With the help of the Zacks Stock Screener, we have selected three multiline insurers that have a Zacks Rank #1 (Strong Buy) or #2 (Buy) or #3 (Hold), a dividend yield of more than 2% as well as a five-year historical dividend growth rate of more than 2%. These stocks have a payout ratio of less than 60, reflecting enough room for future dividend increases. You can see the complete list of today’s Zacks #1 Rank stocks here.

Radian Group, with a market capitalization of $3.1 billion, is a credit enhancement company, which supports homebuyers, mortgage lenders, loan servicers and investors with a suite of private mortgage insurance and related risk-management products and services.

RDN witnessed a four-year CAGR of 199.1%. Riding on continued financial strength and flexibility, Radian declared a 43% increase in quarterly dividend in the first quarter of 2022, which translated into the highest dividend yield in the private MI industry. Its current dividend yield of 3.7% betters the industry average of 2.5%. The insurer’s payout ratio is 19, with a five-year dividend growth rate of 245.8%. (Check Radian Group’s dividend history here)

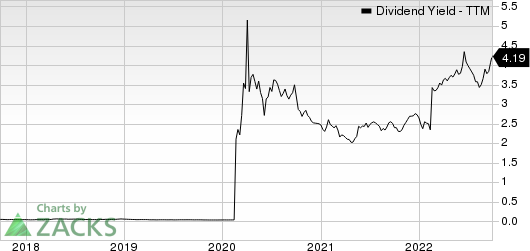

Radian Group Inc. Dividend Yield (TTM)

Radian Group Inc. dividend-yield-ttm | Radian Group Inc. Quote

Radian’s mortgage insurance portfolio is expected to create a strong foundation for future earnings. RDN remains focused on improving its mortgage insurance portfolio, the main catalyst of long-term earnings growth. For 2022, Radian estimates total mortgage originations to be nearly $3 trillion, reflecting an 8% increase in purchase originations and a 58% decrease in refinance activity. Also, given the strong credit characteristics of the new loans insured, we expect the company to see fewer claims than before. Radian Group maintains a solid balance sheet with sufficient liquidity and strong cash flows. A strong capital position helps this Zacks Rank #1 insurer deploy capital via share repurchases and dividend hikes that enhance shareholders value.

Old Republic International, with a market capitalization of $6.4 billion, engages in the insurance underwriting and related services business primarily in the United States and Canada.

ORI has an impressive dividend history, banking on a solid capital position. The third-largest title insurer in the country increased dividends for 41 straight years and paid out dividends for the last 81 years, besides paying special dividends occasionally. Its dividend yield of 4.5% betters the industry average of 2.5%. Old Republic is one of the 111 companies with at least 25 consecutive years of annual dividend growth. The insurer’s payout ratio is 31, with a five-year dividend growth rate of 4.1%. (Check Old Republic International’s dividend history here)

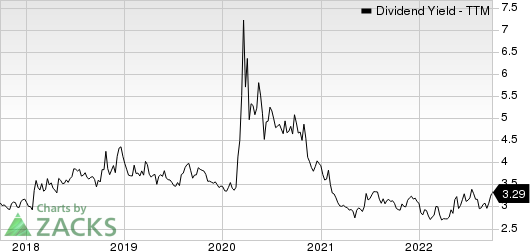

Old Republic International Corporation Dividend Yield (TTM)

Old Republic International Corporation dividend-yield-ttm | Old Republic International Corporation Quote

ORI’s solid market presence, niche focus, low property catastrophe exposure in its General Insurance segment and robust capital position auger well for growth. This Zacks Rank #2 insurer continues to strengthen its balance sheet by improving its cash balance while lowering its leverage ratio.

MetLife, with a market capitalization of $48.5 billion, is an insurance-based global financial services company providing protection and investment products to a range of individual and institutional customers.

Since 2011, the company has been successfully raising its quarterly dividend at a CAGR of 9.5%. Its current dividend of $2.00 yields 3.3%. The insurer’s payout ratio is 23, with a five-year dividend growth rate of 4.6%. (Check MetLife’s dividend history here).

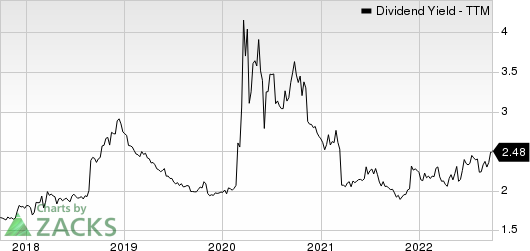

MetLife, Inc. Dividend Yield (TTM)

MetLife, Inc. dividend-yield-ttm | MetLife, Inc. Quote

This Zacks Rank #3 insurer’s focus on streamlining its business, numerous acquisitions and partnerships, and balance sheet will drive long-term growth. MET has undertaken strategies to control cost and increase efficiency and remains optimistic about achieving a direct expense ratio below the target set for 2022. A strong balance sheet, coupled with sound free cash flows, supports its shareholder value-boosting effort.

Prudential, with a market capitalization of $32.4 billion, is a financial services leader that offers an array of financial products and services, including life insurance, annuities, retirement-related services, mutual funds, investment management and real estate services.

PRU has been increasing its dividend for the past 14 years. Its dividend yield of 5% compares favorably with the industry’s figure of 2.5%. The insurer’s payout ratio is 40, with a five-year dividend growth rate of 9.5%. (Check Prudential’s dividend history here).

Prudential Financial, Inc. Dividend Yield (TTM)

Prudential Financial, Inc. dividend-yield-ttm | Prudential Financial, Inc. Quote

PRU is on track to reprice as well as move toward lower risk and less capital-intensive products. As it transforms to become a higher growth, less market-sensitive business, it expects to double its growth businesses to more than 30% of earnings and the individual annuities business to 10% or less of earnings. PRU remains focused on investing in businesses to expand its addressable market and to continue to improve expense and capital efficiency. This Zacks Rank #3 insurer envisions about 65% free cash flow ratio of earnings and about two times its dividend.

The Hartford Financial, with a market capitalization of $20 billion, is one of the major multi-line insurance and investment companies in the country, providing investment products, group life and group disability insurance, property and casualty insurance and mutual funds in the United States.

HIG increased its dividend at a five-year CAGR of 8.7%. Its dividend of $1.54 yields 2.5%. The insurer’s payout ratio is 22, with a five-year dividend growth rate of 10.2%. (Check Hartford Financial’s dividend history here).

The Hartford Financial Services Group, Inc. Dividend Yield (TTM)

The Hartford Financial Services Group, Inc. dividend-yield-ttm | The Hartford Financial Services Group, Inc. Quote

Hartford Financial has been vending non-core businesses to concentrate on its U.S. operations and enhance its operating leverage. HIG expects its Hartford Next initiative to bring cumulative savings of $540 million in 2022 and $625 million in 2023. This Zacks Rank #3 insurer is gaining from lower COVID-related losses, an improved Commercial Lines loss ratio and a rise in earned premiums.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research