5 ETF Stories You Might Have Missed

It's been a busy few weeks in ETF Land. But with all the focus on leveraged ETF closures, oil ETF shake-ups and the Fed's purchases of bond ETFs, there hasn't been much ink left on the page for coverage of less dramatic—though no less significant—ETF stories.

Below we take a look at a few of the developing, yet overlooked, ETF stories on our radar.

Leveraged Oil ETF Quietly Pulls A USO

The United States Oil Fund LP (USO) isn't the only oil futures ETF that has had to make emergency portfolio adjustments in the wake of plummeting crude prices.

The ProShares Ultra Bloomberg Crude Oil (UCO), a 2x leveraged ETF that tracks crude oil futures, has also amended its prospectus several times over the past two weeks, giving the fund not just the leeway to use instruments besides crude oil futures, but changing its roll date and shifting its holdings to contracts further out on the futures curve.

As of its most recent 8-K notice, UCO has moved one-third of its portfolio into December 2020 WTI crude oil futures, while the rest of its portfolio holds September 2020 contracts. The shift was done specifically to avoid exceeding NYMEX position and accountability limits, according to the notice (read: "Biggest Oil ETF Halts Creations").

Another similarity UCO shares with USO: Investors can't get enough of it. Despite falling 97% year to date (making it the worst-performing ETF we track), UCO has seen $2.9 billion in new net cash from investors, including $1.8 billion in the past 30 days alone.

One ESG ETF To Rule Them All?

Cratering oil prices were the signal many investors were waiting for to make the switch to ESG ETFs. Several ESG ETFs, particularly iShares funds, have seen strong inflows year to date, continuing a trend we first spotted last year (read: "Demand Hot For iShares ESG Funds").

However, no ESG ETF has seen stronger inflows year to date than the iShares ESG MSCI U.S.A. ETF (ESGU), which has pulled in $5.2 billion in new net cash—more than quadruple its total flows for all of 2019. Almost half of that $5.2 billion entered the fund in the last 30 days alone:

(For a larger view, click on the image above)

Source: ETF.com. Data as of May 7, 2020.

Investors aren't performance-chasing here, given that ESGU's returns are average among ESG ETFs. In the short term, ESGU's 16% rise over the past month has been far outstripped by those of renewable energy ETFs, like the First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) or the Invesco WilderHill Clean Energy ETF (PBW), which have risen 28% and 24%, respectively.

But the point of ESGU isn't to outperform. It's to provide marketlike exposure without the stocks that ESG investors find objectionable, like tobacco sales or landmine production. It also minimizes—but does not eliminate entirely—exposure to oil stocks, like Exxon Mobil Corp (XOM) or Chevron Corp (CVX).

(Use our stock finder tool to find an ETF’s allocation to a certain stock.)

What ESGU does, it does well, and in fact, the fund continues to exhibit modest outperformance over vanilla market-cap exposure. Whereas ESGU is down 10% year to date, the SPDR S&P 500 ETF Trust (SPY) is down 11%.

Invesco ETF Avoids $105M Rebalance Penalty

In a reminder that mutual funds and ETFs tracking the same index are not necessarily interchangeable, Invesco recently had to pay $105 million for missing a scheduled rebalance in two mutual funds tied to the S&P 500 Equal Weight Index.

However, the Invesco S&P 500 Equal Weight ETF (RSP), which also tracks that index, escaped unscathed, because it had been rebalanced on time.

The issue arose when S&P Dow Jones Indexes made the decision back in March to delay its regular index rebalances, pushing some rebalances to April and others to June. However, Invesco failed to notice the separated delay dates, and missed its scheduled rebalance for the Invesco Equally-Weighted S&P 500 Fund and the Invesco V.I. Equally-Weighted S&P 500 Fund, both mutual funds.

The error was corrected five days later, but it had already made an impact on performance. On May 6, Invesco made a $105 million contribution to the two mutual funds to compensate them for the market moves made in the five days in which they tracked an outdated benchmark.

JETS Smashes Thematic ETF Expectations

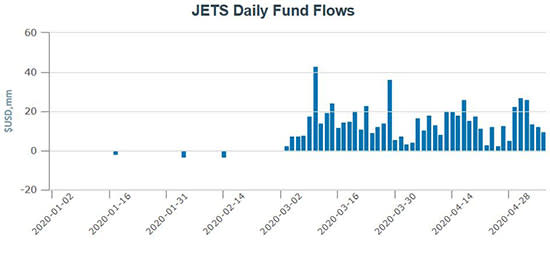

Apparently, oil isn't the only rebound investors are waiting for. Investors keep on plowing money into the US Global Jets ETF (JETS), the only ETF to track the global airline industry, which has seen $652 million in new net cash year to date:

(For a larger view, click on the image above)

Source: ETF.com. Data as of May 7, 2020.

That would be rare enough for a thematic ETF, but JETS has dropped 58% year to date, with no indication of a future turnaround evident anytime soon. Globally and here in the U.S., COVID-19-related lockdowns may be easing, but the number of passengers traveling right now is roughly 95% lower than last year, and many airline stocks remain at record lows.

Still, JETS' inflows have remained positive since early March, and not even the news that Warren Buffett was dumping airline stocks could dint JETS' momentum. While it has been speculated that retail investors are driving the bulk of these flows, individual trades remain anonymous, so there's no way to tell for sure.

Interestingly, the ETFMG Travel Tech ETF (AWAY), which also covers the travel industry, hasn't seen the same boost in flows from bargain hunters. Year to date, the fund has only brought in about $4 million in new net inflows (read: "Flows Into Airline ETFs Take Off").

Investors Shrug At Active 2.0 ETFs

At the end of March, the first two semitransparent active ETFs made their long-awaited debut: the American Century Focused Large Cap Value ETF (FLV) and the American Century Focused Dynamic Growth ETF (FDG). The lead-up to the funds' launches had been accompanied with a lot of FinTwit debate and existential analysis on the nature of ETFs, but in the end, FLV and FDG had a quieter debut than many might have expected.

Since inception, FLV has seen new net inflows of $8.9 million, bringing its total assets under management to $13.4 million. Meanwhile, FDG has brought in net flows of $5 million, bringing its assets to $10 million.

Normally, we wouldn't take much notice of ETFs that hadn't gained assets, but part of the argument in favor of this new breed of less transparent ETFs was that there was pent-up demand from investors hungry for proprietary strategies that they could not otherwise get in a transparent ETF wrapper. By using new ETF structures that would conceal daily portfolios, issuers could finally satisfy that all pent-up demand.

At the moment, that doesn't seem to be the case, as these funds haven't been breakout successes with investors—though it's possible that investors, like everybody else, have just been a bit distracted lately by, well, everything.

Contact Lara Crigger at lcrigger@etf.com

Recommended Stories