5 Guru Stocks Boosting Book Value

According to the GuruFocus All-in-One Screener, a Premium feature, as of Jan. 30, the following companies have grown their book value per share over the past decade.

Book value per share is calculated as total equity minus preferred stock, divided by shares outstanding. Theoretically, it is what shareholders will receive if a company is liquidated. Total equity is a balance sheet item and is equal to total assets minus total liabilities. Since the book value per share may not reflect the company's true value, some investors check the tangible book value to confirm their investment ideas.

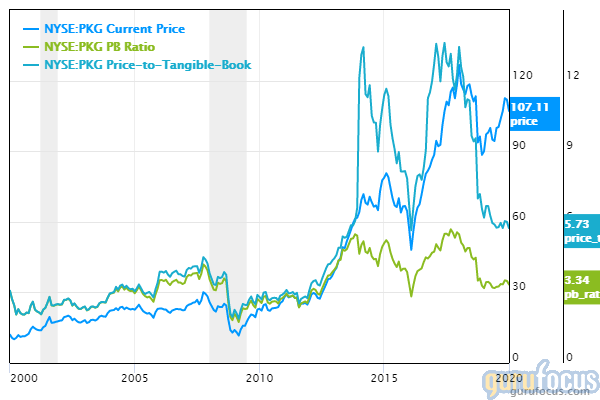

Packaging Corp. of America

The book value per share of Packaging Corp. of America (NYSE:PKG) has grown 14.30% over the past 10 years. The price-book ratio is 3.06 and the price-tangible book value is 5.59.

The American containerboard and corrugated packaging manufacturer has a market cap of $9.88 billion and an enterprise value of $11.89 billion.

According to the discounted cash flow calculator, the stock is undervalued and is trading with a 43% margin of safety at $98. The share price has been as high as $114.78 and as low as $87.85 in the last 52 weeks. As of Thursday, the stock was trading 9.04% below its 52-week high and 18.84% above its 52-week low. The price-earnings ratio is 12.95.

With 0.19% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.11% and Joel Greenblatt (Trades, Portfolio) with 0.09%.

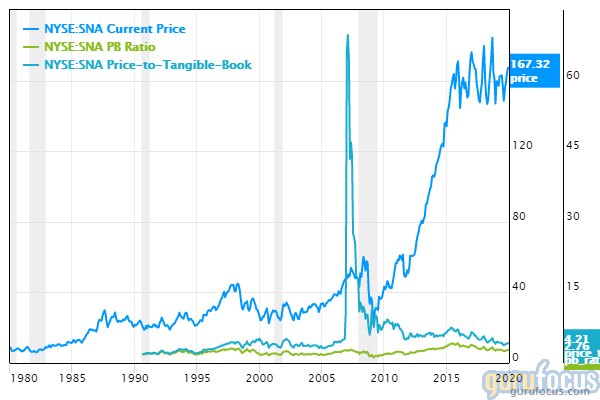

Snap-on

Snap-on Inc.'s (NYSE:SNA) book value per share has grown 10.90% over the past decade. The price-book ratio is 2.74 and the price-tangible book value is 4.19.

The company, which operates in the industrial products sector, has a market cap of $9.04 billion and an enterprise value of $10.11 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 36.05% margin of safety at $163. The share price has been as high as $174 and as low as $143.12 in the last 52 weeks. As of Thursday, the stock was trading 5.29% below its 52-week high and 15.15% above its 52-week low. The price-earnings ratio is 13.26.

With 1.68% of outstanding shares, John Rogers (Trades, Portfolio) is the company's largest guru shareholder, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.98%, Richard Pzena (Trades, Portfolio) with 0.45% and Mairs and Power (Trades, Portfolio) with 0.13%.

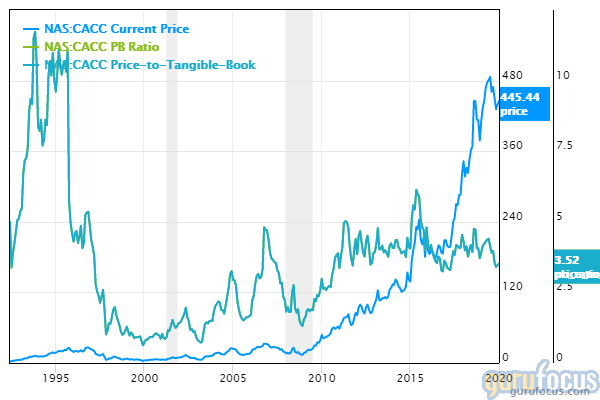

Credit Acceptance

Credit Acceptance Corp.'s (NASDAQ:CACC) book value per share has grown 23.50% over the past decade. The price-book ratio and the price-tangible book value are both 3.61.

The automobile loans provider has a market cap of $8.60 billion and an enterprise value of $12.75 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 52.50% margin of safety at $460. The share price has been as high as $509.99 and as low as $385.36 in the last 52 weeks. As of Thursday, the stock was trading 10.25% below its 52-week high and 18.78% above its 52-week low. The price-earnings ratio is 13.52.

Ruane Cunniff (Trades, Portfolio) is the company's largest guru shareholder with 5.74% of outstanding shares, followed by Simons' firm with 0.29%, Jeremy Grantham (Trades, Portfolio) with 0.23% and Lee Ainslie (Trades, Portfolio) with 0.05%.

Signature Bank

The book value per share of Signature Bank (NASDAQ:SBNY) has grown 17.60% over the past 10 years. The price-book ratio and the price to tangible book value are both 1.63.

The bank has a market cap of $7.90 billion and an enterprise value of $4.86 million.

According to the DCF calculator, the stock is undervalued and is trading with a 53.50% margin of safety at $146.26. The share price has been as high as $148.64 and as low as $111.91 in the last 52 weeks. As of Thursday, the stock was trading 1.60% below its 52-week high and 30.69% above its 52-week low. The price-earnings ratio is 12.92.

With 1.52% of outstanding shares, First Pacific Advisors (Trades, Portfolio) is the company's largest guru shareholder, followed by Steven Romick (Trades, Portfolio) with 1.36%, Simons' firm with 0.43% and Prem Watsa (Trades, Portfolio) with 0.05%.

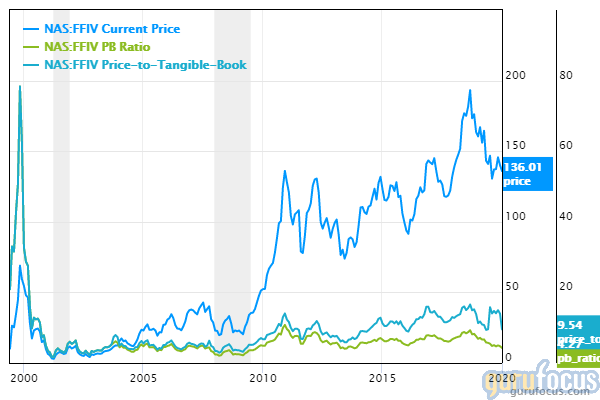

F5 Networks

F5 Networks Inc.'s (NASDAQ:FFIV) book value per share has grown 8.10% over the past decade. The price-book ratio is 3.97 and the price-tangible book value is 8.87.

The software company has a market cap of $7.66 billion and an enterprise value of $6.84 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 22% margin of safety at $124. The share price has been as high as $173.44 and as low as $121.36 in the last 52 weeks. As of Thursday, the stock was trading 26.78% below its 52-week high and 4.65% above its 52-week low. The price-earnings ratio is 18.95.

Simons' firm is the company's largest guru shareholder with 3.82% of outstanding shares, followed by Pioneer Investments with 0.12%, Greenblatt with 0.12% and Ray Dalio (Trades, Portfolio) with 0.09%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Energy Stocks Gurus Are Buying

Parnassus Endeavor Fund Exits Biogen, Trims Regeneron

6 Stocks Boosting Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.