5 Health Care Stocks Gurus Are Buying

According to the GuruFocus All-In-One Screener as of Friday, the following health care stocks are popular among gurus.

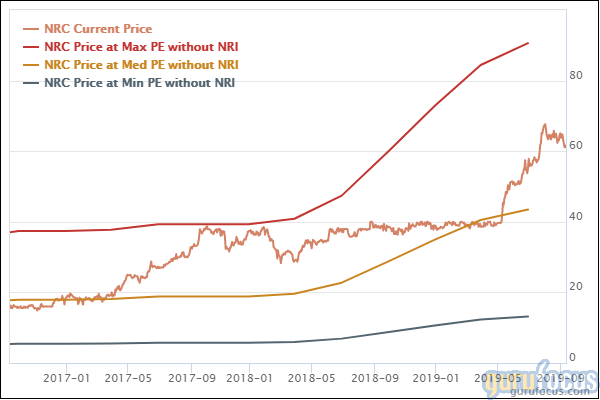

National Research Corp. (NASDAQ:NRC) is held by three gurus

The company, which operates in the medical diagnostics and research industry, has a market cap of $1.54 billion. Its revenue of $123.55 million has fallen 6.80% over a 10-year period.

The stock is trading with a price-book ratio of 48.16. The share price of $61.73 is 10.35% below the 52-week high and 73.50% above the 52-week low. Over the last 10 years, it has returned 208.65%.

The company's largest gur shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 2.07% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.87% and Paul Tudor Jones (Trades, Portfolio) with 0.02%.

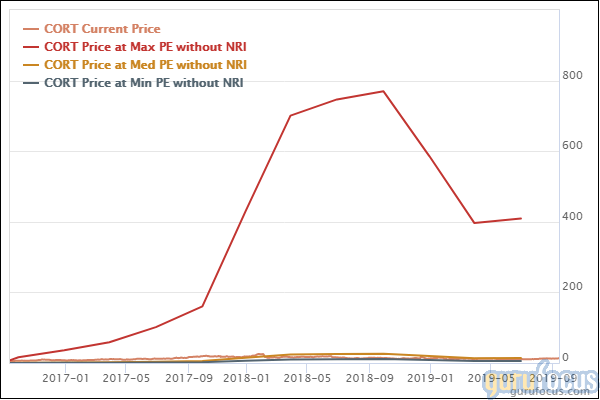

Corcept Therapeutics Inc. (NASDAQ:CORT) is held by four gurus

The company, which provides drugs for the treatment of severe metabolic, psychiatric and oncologic disorders, has a market cap of $1.52 billion. Its revenue of $268.36 million has grown 76.50% over the last five years.

The stock is trading with a price-earnings ratio of 20.85. The share price of $13.40 is 31.37% below the 52-week high and 46.28% above the 52-week low. Over the past decade, it has returned 855%.

Simons' firm is the company's largest guru shareholder with 4.92% of outstanding shares, followed by Jones with 0.22% and Joel Greenblatt (Trades, Portfolio) with 0.07%.

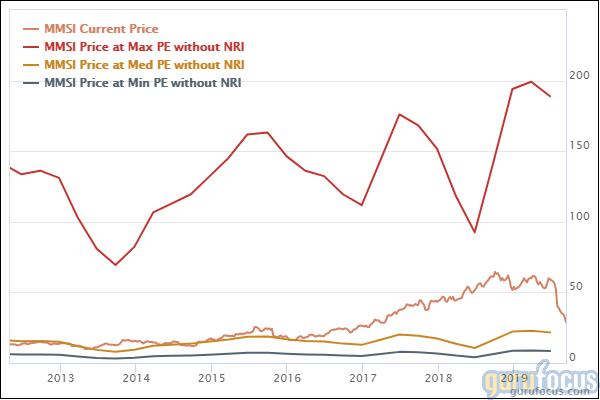

Merit Medical Systems Inc. (NASDAQ:MMSI) is held by four gurus

The company, which provides products for use in interventional cardiology, radiology and endoscopy procedures, has a $1.49 billion market cap. Its revenue of $948.79 million has grown 8.50% over the past decade.

The stock is trading with a price-book ratio of 1.53. The price of $27.08 is 59.18% below the 52-week high and 5.49% above the 52-week low. Over the last 10 years, it has gained 82.23%.

The company's largest guru shareholder is Ken Fisher (Trades, Portfolio) with 0.60% of outstanding shares, followed by Royce with 0.46%, Steven Cohen (Trades, Portfolio) with 0.23% and Pioneer Investments (Trades, Portfolio) with 0.14%.

Supernus Pharmaceuticals Inc. (NASDAQ:SUPN) is held by six gurus

The company, which provides products for the treatment of central nervous system diseases, has a market cap of $1.46 billion. Its revenue of $409.1 million has grown 50.60% over the past decade.

The stock is trading with a price-book ratio of 2.81. The share price of $27.89 is 45.72% below the 52-week high and 10.15% above the 52-week low. Over the past 10 years, it has returned 419.37%.

With 1.15% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Robert Bruce (Trades, Portfolio) with 0.28%, Greenblatt with 0.19%, Jones with 0.09% and John Hussman (Trades, Portfolio) with 0.05%.

Atrion Corp. (NASDAQ:ATRI) is held by four gurus

The manufacturer of products for medical applications has a $1.46 billion market cap. Its revenue of $155.92 million has grown 6% over the last 10 years.

The share price of $785.47 is 17.15% below the 52-week high and 25.88% above the 52-week low. Over the past decade, it has returned 473.75%.

The company's largest guru shareholder is Simons' firm with 3.29% of outstanding shares, followed by Royce with 1.94%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Largest Insider Trades of the Week

6 Stocks With Low Price-Sales Ratios

5 Companies Growing Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.