5 Machinery Stocks Set to Surpass Q1 Earnings Estimates

Machinery stocks are expected to see lackluster first-quarter 2019 results on account of both macro and micro levels issues that have fogged up near-term prospects of the industry. Notably,machinery stocks are broadly grouped under Zacks Industrial Products sector.

Among the leading industry players in the machinery space, New Britain based, Stanley Black & Decker Inc. SWK charted year-over-year growth in both earnings and sales in the first quarter. On the other hand, Illinois Tool Works Inc. ITW recorded decline in both top line and bottom line.

Overall, earnings are predicted to grow 0.4% in the first quarter compared with 7.4% growth recorded in fourth quarter of 2018. First-quarter revenues are likely to decline 0.8% for the Industrial Products sector, against 2.3% growth recorded in the previous quarter.

Factors to Impact Q1 Results

Forthe first quarter, profitability of several machinery companies is at stake on account of several headwinds, including low industrial output, softness in workforce market, commodity inflation, higher freight charges and unfavorable movements in foreign currencies. Tariffs resulting from the U.S.-China trade war have also hurt growth.

Total manufacturing output in the United States remained unchanged in March, after declining in both January and February. Notably, industrial production was down 0.1% in March. Also, capacity utilization for the industrial sector declined 0.2% in March to 78.8%, 1% below its long-run (1972–2018) average. As a matter of fact, industrial production declined at an annual rate of 0.3% in the January-March quarter.

Moreover, the manufacturing industry also witnessed dearth of job opportunities. Notably, per the Department of Labor’s latest report published on Apr 5, the manufacturing sector witnessed a decline of 6,000 jobs in March. It’s worth noting here that most of the job losses were in motor vehicles and parts industries.

In the presence of these adversities, we still believe that machinery companies will gain from growth opportunities in emerging markets, favorable e-commerce trend and infrastructural developments. Further,increased capital spending coupled up with President Trump’s business-friendly policies, such as deregulatory measures and massive tax overhaul are likely to continue aiding manufacturing activities.

How to Make the Right Pick?

Investors looking for options in the machinery space can choose stocks with the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP.

Earnings ESP is the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. The combination of a favorable ranking and positive ESP points toward stocks with high probability of surpassing estimates in the quarter. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Below we have listed five machinery stocks, with the right combination of elements to post an earnings beat in the first quarter:

DXP Enterprises, Inc. DXPE:The company, with a market capitalization of $0.75 billion, provides leading products and service distributor that adds value and total cost savings solutions to industrial customers throughout the United States, Canada, Mexico and Dubai.

The company currently carries a Zacks Rank #1and has an Earnings ESP of +2.50%. The Zacks Consensus Estimate for the quarter has increased 2.6% to 40 cents in the past 30 days.You can see the complete list of today’s Zacks #1 Rank stocks here.

DXP Enterprises, Inc. Price and EPS Surprise

DXP Enterprises, Inc. Price and EPS Surprise | DXP Enterprises, Inc. Quote

DXP Enterprises will release results on May 7, after the market closes.

Acco Brands Corporation ACCO:The company, with a market capitalization of $0.94 billion, is a global leader in branded office products.

Acco Brands Corporation Price and EPS Surprise

Acco Brands Corporation Price and EPS Surprise | Acco Brands Corporation Quote

The company currently carries a Zacks Rank #3and has an Earnings ESP of +4.17%. The Zacks Consensus Estimate for the quarter has increased 25% to 5 cents in the past 30 days. It is set to release earnings on May 2, before the market opens.

Colfax Corporation CFX:The company, with a market capitalization of $3.6 billion, provides products and services related to air and gas handling, and fabrication technology. It serves customers in the power generation, oil, gas and petrochemical, mining, marine and general industrial end markets.

Colfax Corporation Price and EPS Surprise

Colfax Corporation Price and EPS Surprise | Colfax Corporation Quote

The company currently carries a Zacks Rank #3and has an Earnings ESP of +2.27%. The Zacks Consensus Estimate for the quarter has remained unchanged at 49 cents in the past 30 days.

Colfax will release results on May 8.

TPI Composites, Inc. TPIC:The company, with a market capitalization of $1.1 billion, manufactures composite wind blades for the wind energy market. It currently carries a Zacks Rank #2and has an Earnings ESP of +203.03%. The Zacks Consensus Estimate for the quarter has increased 14.3% to 8 cents in the past 30 days.

TPI Composites, Inc. Price and EPS Surprise

TPI Composites, Inc. Price and EPS Surprise | TPI Composites, Inc. Quote

TPI Composites is slated to release results on May 8, after market close.

Axon Enterprise, Inc.AAXN: The company manufactures conducted electrical weapon for law enforcement, federal, military and personal defense markets.

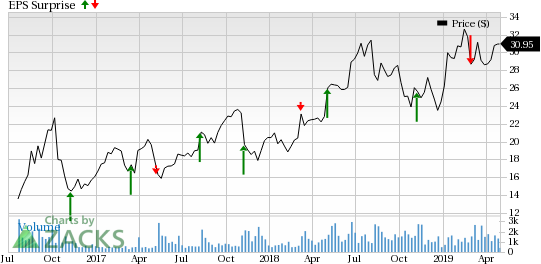

Axon Enterprise, Inc Price and EPS Surprise

Axon Enterprise, Inc Price and EPS Surprise | Axon Enterprise, Inc Quote

It has a market capitalization of $3.75 billion. The company currently carries a Zacks Rank #3and has an Earnings ESP of +6.99%. The Zacks Consensus Estimate for the quarter has remained unchanged at 16 cents in the past 30 days.

It will release results on May 9, after market close.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

Colfax Corporation (CFX) : Free Stock Analysis Report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Acco Brands Corporation (ACCO) : Free Stock Analysis Report

TPI Composites, Inc. (TPIC) : Free Stock Analysis Report

Axon Enterprise, Inc (AAXN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research