5 Must-Buy High-Beta Stocks Flying High in a Volatile Market

Wall Street has been reeling under severe volatility since the beginning of 2022 after witnessing astonishing rallies in the last two pandemic-ridden years. Volatility has been injected into stock markets by skyrocketing inflation, a more hawkish Fed and the ongoing war between Russia and Ukraine. Major stock indexes of Wall Street are in the red year to date even after more than a quarter.

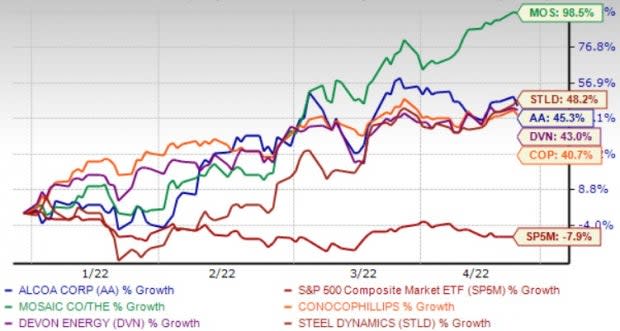

However, surprising many economists and financial experts, several high-beta stocks have popped year to date with more upside left. A handful of those stocks are currently carrying a favorable Zacks Rank. Investment in these stocks should bear fruit in the near term. Five of them are — ConocoPhillips COP, The Mosaic Co. MOS, Devon Energy Corp. DVN, Alcoa Corp. AA and Steel Dynamics Inc. STLD.

Q1 2022 At a Glance

The last quarter was not a good one for Wall Street. The year started with the resurgence of the Omicron variant of coronavirus, which was highly infectious but less deadly. Normal economic activities suffered to some extent in January due to Omicron.

However, the major concern for the U.S. economy was galloping inflation. Several measures of inflation like consumer price index, producer price index and personal consumption expenditure price index stayed at a 40-year high during the first quarter.

Moreover, the Russian military invasion over Ukraine, which started on Feb 24 and is continuing, has made the situation worse. The United States and the European Union have imposed several stringent financial sanctions on Russia including import restriction on crude oil and natural gas.

Russia is a major supplier of oil and gas and several basic materials in Europe. As a result, prices of crude oil, natural gas, platinum, palladium, coal, nickel and steel soared globally. These materials are a vital input to several finished products.

Finally, in order to combat skyrocketing inflation, the Fed systematically terminated the $120 billion bond-buy program in March and raised the benchmark by 25 basis points in its March FOMC. This was the first hike in interest rate in more than three years.

The March FOMC minutes also revealed that Fed officials almost unanimously agreed that the central bank must reduce the size of its $9 trillion balance sheet by around $95 per month starting May. Moreover, the minutes revealed that most officials have agreed that the Fed must raise the interest rate by 50 basis points in the next two FOMC’s in May and June.

As a result of these negatives, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have tumbled 3.9%, 6.4% and 13%, respectively.

U.S. Economy Remains Solid

Despite galloping inflation U.S. consumer spending, which accounts for nearly 70% of the economy remained steady. In March, retail sales grew 0.5% over the previous month and 6.9% year over year. February’s data was also revised upward from a gain of 0.3% to 0.8%.

Industrial production rose 0.9% in March beating the consensus estimate of 0.4%. Manufacturing, the major component of industrial production also grew by 0.9%. For first-quarter 2021, industrial production climbed 8.1% year over year.

The U.S. economy added 1.661 million jobs in the first quarter of 2022. Unemployment dropped to 3.6% in March. Moreover, the University of Michigan reported that the preliminary reading of U.S. consumer sentiment in April jumped to 65.7% from 59.4% in March.

Our Top Picks

We have selected five large-cap (market capital > $10 billion) high-beta (beta > 1) stocks that have appreciated more than 40% year to date with more upside left. These stocks have seen positive earnings estimate revisions within the last 30 days.

Moreover, these companies are regular dividend payers. Finally, each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

ConocoPhillips holds a bulk of acres in the three big unconventional plays, namely Eagle Ford shale, Delaware basin and Bakken shale, which are rich in oil. COP also has a foothold in Canada’s oil sand resources and exposure to developments related to liquefied natural gas.

ConocoPhillips announced an agreement to purchase all Royal Dutch Shell assets in the prolific Permian. The deal reflects COP’s aim of broadening its Permian presence. The transaction is highly accretive and involves the acquisition of roughly 225,000 net acres in the heart of the core Delaware basin.

ConocoPhillips has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2% over the last 7 days. COP has a current dividend yield of 2.2 and a beta of 1.41. The stock price has advanced 40.7% year to date.

Devon Energy aims for strong oil production from the Delaware Basin holdings. Devon Energy’s presence in Delaware has expanded due to its all-stock merger deal with WPX Energy. DVN is using new technology in production process to lower expenses.

Devon Energy’s divestiture of Canadian and Barnett Shale gas assets will allow it to focus on its five high-quality oil-rich U.S. basins assets. DVN’s stable free cash flow generation allows it to pay dividend and buy back shares. Devon Energy has ample liquidity to meet near-term debt obligations.

Devon Energy has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 7 days. DVN has a current dividend yield of 6.3% and a beta of 2.79. The stock price has surged 43% year to date.

The Mosaic is likely to gain from higher demand for fertilizers. Demand for phosphate and potash in North America was strong in 2021, and the momentum is likely to continue this year. Strong grower economics and crop commodity prices are driving potash demand globally.

The Vale Fertilizantes buyout is also expected to deliver significant synergies. Mosaic is also expected to benefit from its cost-reduction actions, leading to an improvement in its operating cost structure. MOS’ efforts to lower debt, streamline processes, centralize mining operations and automation are encouraging.

Mosaic has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.2% over the last 30 days. MOS has a current dividend yield of 0.58% and a beta of 1.62. The stock price has soared 98.5% year to date.

Alcoa produces and sells bauxite, alumina, and aluminum products in the United States, Spain, Australia, Brazil, Canada, and internationally. AA operates through three segments: Bauxite, Alumina, and Aluminum.

Alcoa is engaged in bauxite mining operations and processes bauxite into alumina and sells it to customers who process it into industrial chemical products. AA offers primary aluminum in the form of alloy ingot or value-add ingot to customers that produce products for the transportation, building and construction, packaging, wire, and other industrial markets and flat-rolled aluminum sheets to customers that produce beverage and food cans.

Alcoa has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.3% over the last 7 days. AA has a current dividend yield of 0.45% and a beta of 2.30. The stock price has climbed 45.3% year to date.

Steel Dynamics is expected to gain from acquisitions as well as strong liquidity and efforts to expand capacity. The acquisitions of Heartland and United Steel Supply have boosted Steel Dynamics' shipping capabilities. Moreover, the buyout of Zimmer will support its raw material procurement strategy at its new Texas flat roll steel mill.

STLD is also expected to gain from its investments to beef up capacity and upgrade facilities. Steel Dynamics is executing several projects that should add to capacity and boost profitability. The electric-arc-furnace flat roll steel mill will strengthen its steelmaking capacity and value-added product capability.

Steel Dynamics has an expected earnings growth rate of 18.3% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.4% over the last 30 days. STLD has a current dividend yield of 1.50% and a beta of 1.40. The stock price has jumped 48.2% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Alcoa (AA) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

To read this article on Zacks.com click here.