5 Predictable Stocks With Margin of Safety

According to the GuruFocus All-in-One Screener, a Premium feature, the following companies have high business predictability ratings and a wide margin of safety.

Intel

Intel Corp. (INTC) has a business predictability rank of 4 out of 5 stars and, according to the discounted cash flow calculator, a 26% margin of safety at an average price of $56 per share.

The chipmaker has a market cap of $239 billion and an enterprise value of $255 billion. Over the past five years, its revenue has grown 8.3% and its earnings per share have grown 16.9%.

Over the past 12 months, the stock price has increased 4% and is currently trading with a price-earnings ratio of 11.85. The share price has been as high as $69.29 and as low as $42.86 in the last year. As of March 4, the stock was trading 19.22% below its 52-week high and 30.59% above its 52-week low.

With 0.63% of outstanding shares, Ken Fisher (Trades, Portfolio) is the company's largest guru shareholder, followed by PRIMECAP Management (Trades, Portfolio) with 0.58% and Chris Davis (Trades, Portfolio) with 0.20%.

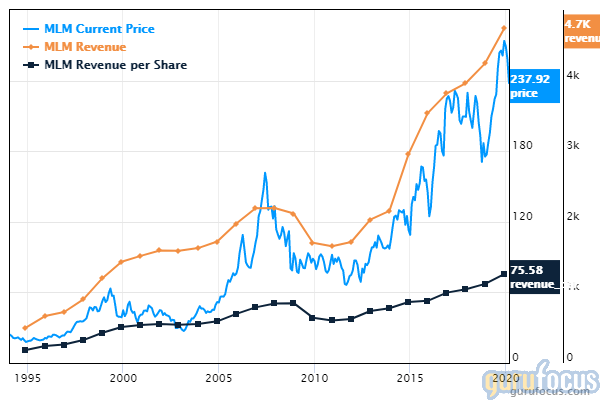

Martin Marietta Materials

Martin Marietta Materials Inc. (MLM) has a 3-star business predictability rank and, according to the DCF calculator, a 13.36% margin of safety at the average price of $238 per share.

The producer of construction aggregates has a market cap of $14.86 billion and an enterprise value of $18.10 billion. Over the past five years, its revenue has increased 7.9% and its earnings per share have grown 27.8%.

The stock has risen 24% over the last 12 months and shares are trading with a price-earnings ratio of 24.52. The share price has been as high as $281.82 and as low as $190.02 in the last 52 weeks. As of March 4, the stock was trading 15.22% below its 52-week high and 25.74% above its 52-week low.

With 2.7% of outstanding shares, Tom Russo (Trades, Portfolio) is the company's largest guru shareholder, followed by First Eagle Investment (Trades, Portfolio) with 0.29%, Ken Heebner (Trades, Portfolio)'s Capital Growth Management with 0.17% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.14%.

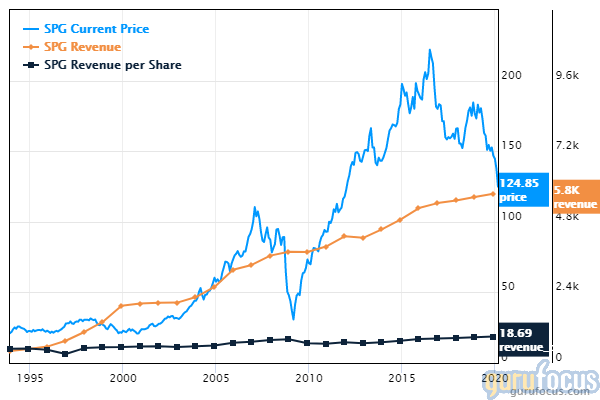

Simon Property Group

Simon Property Group Inc. (SPG) has a 4-star business predictability rank and, according to the DCF calculator, a 24.31% margin of safety at an average price of $122 per share.

The real estate investment trust has a $37.58 billion market cap and an enterprise value of $62 billion. Over the past five years, its revenue has increased 3.2% and its earnings per share have grown 9.2%.

The share price has fallen 30% over the past 12 months. The stock is trading with a price-earnings ratio of 17.99 and a price-book ratio of 15.13. The price has been as high as $186.4 and as low as $119.91 in the last 52 weeks. As of March 4, the stock was trading 34.30% below its 52-week high and 2.13% above its 52-week low.

With 0.68% of outstanding shares, Barrow, Hanley, Mewhinney & Strauss is the company's most notable shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.41%.

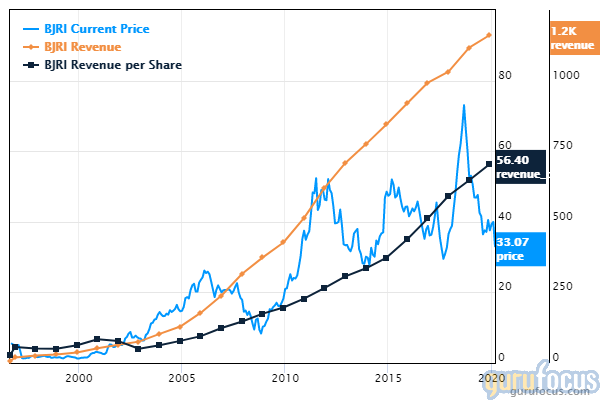

BJ's Restaurants

BJ's Restaurants Inc. (BJRI) has a business predictability rank of 5 out of 5 stars and, according to the DCF calculator, a 30.30% margin of safety at an average price of $32.36 per share.

The restaurants operator has a market cap of $621 million and an enterprise value of $1.2 billion. Over the past five years, its revenue has climbed 13.70% and its earnings per share have increased 15.70%.

Shares have dropped 31.68% over the past 12 months. The stock is currently trading with a price-earnings ratio of 14.64 and a price-book ratio of 2.17. The share price has been as high as $53 and as low as $31.53 in the last 52 weeks. As of March 4, the stock was trading 38.94% below its 52-week high and 2.63% above its 52-week low.

With 3.13% of outstanding shares, Ron Baron (Trades, Portfolio) is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.39% and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.17%.

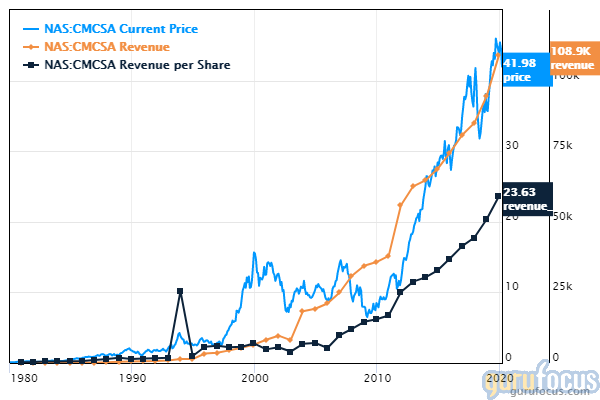

Comcast

Comcast Corp. (CMCSA) has a business predictability rank of 3.5 out of 5 stars and, according to the discounted cash flow calculator, a 47.18% margin of safety at an average price of $41.44 per share.

The company's core business is owning cable networks to provide services like television or internet access. It has a $188 bllion market cap and an enterprise value of $286 billion. Over the past five years, its revenue has grown 12% and its earnings per share have climbed 15.90%.

Share prices have increased 8.13% over the past year. The stock is trading with a price-earnings ratio of 14.64 and a price-book ratio of 2.28. The price has been as high as $47.74 and as low as $37.89 in the last 52 weeks. As of March 4, the stock was trading 11.98% below its 52-week high and 10.90% above its 52-week low.

With 1.86% of outstanding shares, Dodge & Cox is the company's largest guru shareholder, followed by First Eagle Investment (Trades, Portfolio) with 0.71% and Barrow, Hanley, Mewhinney & Strauss with 0.36%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Guru Stocks Trading With Low Price-Sales Ratios

5 Stocks Near 52-Week Highs

6 Companies Boosting Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.