5 Reasons Why Investors Should Invest in ITT Stock Now

ITT Inc. ITT is benefiting from strength in its end markets, innovations, acquired assets and a sound capital-deployment strategy.

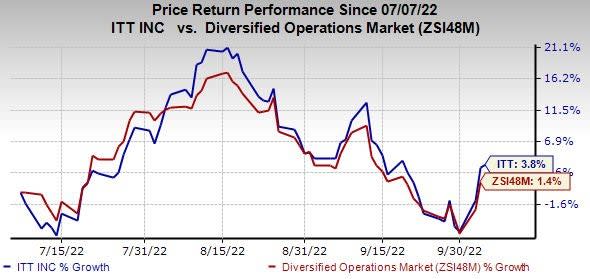

In the past three months, the stock has gained 3.8% compared with the industry’s growth of 1.4%.

Let’s delve into the factors that make the stock a smart investment choice at the moment.

Business Strength: ITT is poised to gain from strength in the end markets, including chemical and industrial pumps, commercial aerospace and defense, plus rail and electric vehicles in the quarters ahead. ITT’s organic orders grew 13% year over year in the second quarter of 2022, driven by strong demand for pumps, connectors and aerospace components. For 2022, organic sales are predicted to grow 10-12% from the year-ago reported figure. ITT’s focus on fulfilling customers’ needs, operational execution, and innovation and growth investments is also likely to be beneficial.

Innovation Initiatives: ITT intends to become more competent on the back of innovation investments. It has been investing in product innovation across its connectors, friction technologies and pump businesses for some time now. ITT also launched the third generation of its i-ALERT Condition Monitoring Solution in May 2022. Also, its connector business unveiled its ruggedized, modular circular series Veam MOVE-MOD in November 2021.

Acquisitions: ITT’s acquisition of Clippard Instrument Laboratories’ product lines in August 2022 expands its Compact Automation product offering in the robotics, packaging and automation end markets. The buyout of CRP Technology and CRP USA (jointly CRP) in June 2022 helped ITT acquire additive manufacturing technology capabilities and strengthen its position in the material science space. Also, ITT’s buyout of Habonim (April 2022) boosted its offerings in the cryogenic and hydrogen ball valve space apart from expanding into new end markets. It predicts the buyout to be accretive to its EBITDA margin.

Image Source: Zacks Investment Research

Rewards to Shareholders: During the first six months of 2022, ITT bought back shares worth $240.9 million and paid out dividends of $44.3 million. Also, the quarterly dividend rate was hiked 20% in February 2022.

Estimate Revision: In the past 60 days, the Zacks Consensus Estimate for 2022 earnings has moved 0.5% north.

Zacks Rank and Stocks to Consider

ITT currently carries a Zacks Rank #2 (Buy). Some other top-ranked companies are discussed below:

Applied Industrial Technologies, Inc. AIT presently has a Zacks Rank #1 (Strong Buy) and a trailing four-quarter earnings surprise of 22.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

AIT’s earnings estimates have increased 5.1% for fiscal 2023 (ending June 2023) in the past 60 days. Its shares have risen 19.3% in the past three months.

Carlisle Companies CSL has a Zacks Rank #2 (Buy), currently. CSL pulled off a trailing four-quarter earnings surprise of 28%, on average.

In the past 60 days, Carlisle’s earnings estimates have increased 0.1% for 2022. The stock has rallied 20.1% in the past three months.

Eaton Corporation plc ETN presently has a Zacks Rank of 2. ETN’s earnings surprise in the last four quarters was 1.4%, on average.

In the past 60 days, Eaton’s earnings estimates have increased 0.1% for 2022. The stock has rallied 12.9% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research