5 Retail Stocks Crushing the Market on Bullish Outlook

Retailing, which is mostly making big business, is all geared up with revised rules and a new plan of action. From marketing, showcasing, store formats to delivery — everything in retail has evolved. However, focus on consumers remains a constant. In fact, consumers have gained more importance, which is why retail players depend on consumers’ feedback and buying patterns for framing marketing strategies or developing promotional pitches.

This clearly illustrates that the health of the retail sector is directly tied to the purchasing power of consumers. Lately, consumers have been more confident, thanks to robust job market and rising income levels. This has to a large extent translated into higher consumer spending, which is a major positive for retailers. Moreover, stocks in the sector are getting much support from strategies, including building an omni-channel platform, product innovation and cost curtailment.

No doubt, the overall tone for the retail sector’s recent reports has been encouraging. Per the Earnings Preview dated Aug 17, retail sector earnings increased 34.9% on sales growth of 9.7% in the second quarter of 2018. This represented nearly 91.7% EPS beat and 75% sales beat. The grand first-half 2018 show raised the spirits of most retailers, resulting in lifted guidance for the second half and 2018, which in turn perked up investors.

How the Retail Sector is Placed

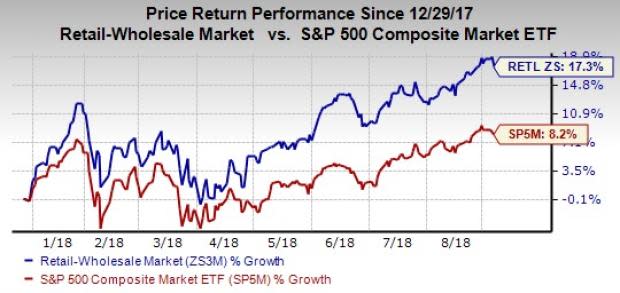

We note that the Retail-Wholesale Sector has outperformed the S&P 500 market lately. Year to date, the sector recorded 17.3% growth, steering past the S&P 500 Index’s 8.2%. However, it carries a Zacks Sector Rank of #11 (out of 16), placing it in the bottom 31% of the Zacks Classified sectors.

Making the Right Picks

That said, we bring to you five Retail-Wholesale stocks that are positioned to gain from the current sector trend. We have hand-picked some sector outperformers, with a Zacks Rank #1 (Strong Buy) or 2 (Buy), robust earnings surprise trend and strong fundamentals, to boost your returns. These companies have reported splendid earnings in the last reported quarter and provided a strong outlook for the full year. We are also considering rising estimates for this investment strategy.

Urban Outfitters Inc. URBN, a lifestyle specialty retailer that offers fashion apparel and accessories, footwear, home décor and gifts products, is a good bet. Second-quarter fiscal 2019 marked the company’s fifth consecutive earnings and sales beat. The company is gaining from the robust performance of its Urban Outfitters, Anthropologie Group and Free People brands. Based on current trends, management provided a favorable view for the third quarter and fiscal 2019. The Zacks Consensus Estimate for fiscal 2019 increased nearly 6% in the last 30 days. Further, the stock has gained 24.2% year to date, outperforming the sector & the S&P 500. The company has a long-term expected earnings growth rate of 12% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Another lucrative option is Minneapolis, MN-based Target Corp. TGT. The company operates as a general merchandise retailer in the United States offering an array of goods ranging from household essentials and electronics to toys and apparel for men, women and kids. The company delivered positive earnings and sales surprise in second-quarter fiscal 2018, mainly driven by strong traffic growth. This was the company’s fourth positive earnings surprise in the last six quarters and sixth consecutive sales beat. Further, the company raised the earnings view for fiscal 2018. The Zacks Consensus Estimate for fiscal 2018 rose 1.7% in the last 30 days. The stock has rallied 36.2% year to date, outperforming the sector and the S&P 500. Moreover, the company has a long-term expected earnings growth rate of 6.7% and a Zacks Rank #2.

Investors can also count on Zumiez Inc. ZUMZ, a leading specialty retailer of apparel, footwear, accessories and hardgoods for young men and women. The company delivered the second consecutive earnings beat and ninth straight sales beat in second-quarter fiscal 2018. The company is benefiting from solid comps growth backed by its differentiated merchandise offerings alongside authentic brand positioning and seamless multi-channel shopping experience. Zumiez provided outlook for the third quarter and fiscal 2018. The Zacks Consensus Estimate for fiscal 2018 moved up 3.7% in the last 30 days. The stock has advanced 40% year to date, outperforming the sector and the S&P 500. Moreover, the company sports a Zacks Rank #1.

We also suggest investing in Tractor Supply Company TSCO, the largest retail farm and ranch store chain in the United States. The company has displayed a robust surprise trend with earnings and sales topping estimates in three of the trailing four quarters. Tractor Supply is set to gain from its robust omni-channel efforts and rewards program. It is also working to strike a balance between initiatives and investments in stores and distribution centers, with strict cost disciplines and operational efficiencies. Moreover, the company raised the guidance for 2018. The Zacks Consensus Estimate for 2018 moved up by a cent in the last 30 days. The company’s long-term expected earnings growth rate of 12.8% shows potential. Moreover, the stock has returned 20.3% year to date, outperforming the sector and the S&P 500. The company currently carries a Zacks Rank #2.

Last but not the least, the leading off-price retailer of apparel and home fashions in the United States and worldwide The TJX Companies Inc. TJX is worth a bet. The company delivered its third consecutive positive earnings and sales surprise in the recently reported second-quarter fiscal 2019. Splendid comps drove sales, which along with efficient inventory management and benefits from tax reforms, aided earnings growth. Further, the company raised its comps and earnings guidance for fiscal 2019. The Zacks Consensus Estimate for fiscal 2019 increased by 4 cents in the last 30 days. The company has long-term expected earnings growth rate of 10.6%. Further, this Zacks Rank #2 stock has gained 44.7% year to date, outperforming the sector and the S&P 500.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research