These 5 Retail Stocks Are New Strong Buys

This year promises to be a much better one for retailers, with most projections calling for low single-digit growth this year over a low-single-digit decline in 2020. But all of this is expected to really hit in the second half of the year, when the Covid vaccines reach more people and pent-up demand driving people to stores.

Until then, we’ll see some more people moving out, but others preferring to stay in as new infection rates continue to rise.

Encouragingly, the U.S. Conference Board’s Consumer Confidence Index moved up to 89.3 in January, better than the forecasted 89.0 and up from 88.6 in December 2020. This means increased consumer confidence in the economy, which is seen in increased consumer spending, which is of course good news for retailers.

But not all retailers will be equally benefited. Those that are ahead in the adoption of digital technologies such as click and collect, cashierless checkout, contactless payment and digital signage will do better than others. Market researchers also expect increased consumer preference for a buy now-pay later option, as many people have not returned to work or are working at lower rates.

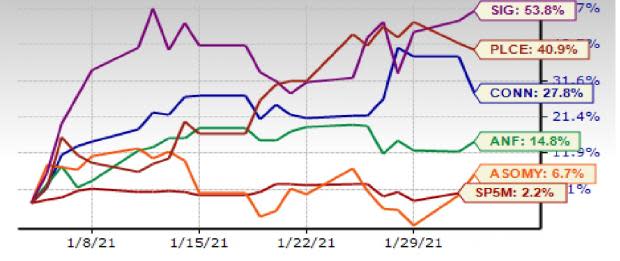

The following is a list of retailers that are seeing their estimates move up. As a result, they have just been upgraded to Zacks #1 (Strong Buy).

Conns, Inc. CONN is a specialty retailer of home appliances like refrigerators, freezers, washers, dryers and ranges; consumer electronics like projection, plasma and LCD televisions, camcorders, VCRs, DVD players and home theater products; and home office equipment, lawn and garden products and bedding. It currently operates retail locations in Texas and Louisiana.

In the last 30 days, the Zacks Consensus Estimate for 2021 (ending January) has gone from a loss of 72 cents to a loss of 65 cents while the estimate for 2022 moved from a profit of $1.15 to $1.30. While revenue and profits are expected to decline in 2021, the estimates for 2022 represent growth of 5.0% and 299.1%, respectively.

Abercrombie & Fitch Company ANF is a specialty retailer of premium, high-quality casual apparel for men, women, and kids through a network of approximately 850 stores across North America, Europe, Asia and the Middle East.

In the last 30 days, the Zacks Consensus Estimate for 2021 (ending January) has gone from a loss of $1.37 to a loss of $1.11 while the estimate for 2022 moved from a profit of $1.02 to $1.12. While revenue and profits are expected to decline in 2021, the estimates for 2022 represent growth of 10.7% and 201.4%, respectively.

ASOS plc ASOMY is a fashion retailer selling branded and own branded clothing, footwear, accessories, jewelry, beauty and streaming products to both men and women.

In the last 30 days, the Zacks Consensus Estimate for 2021 (ending in August) went from $1.37 to $1.59 while the estimate for 2022 went from $1.82 to $1.94. The company’s 2021 revenue is currently expected to grow 45.3% this year even as earnings decline 1.9%. The 2022 estimates for revenue and earnings represent growth of 17.0% and 22.0%, respectively.

Signet Jewelers Ltd. SIG sells diamond jewelry, watches as well as other products.

In the last 30 days, its estimated earnings for 2021 (ending January) moved up from 59 to $1.39 while the estimated earnings for 2022 moved from $3.39 to $3.91. While revenue and earnings are expected to decline in 2021, they are expected to be up a respective 10.5% and 181.5%.

The Childrens Place, Inc. PLCE is the largest pure-play children’s specialty apparel retailer in North America selling apparel, footwear, accessories and other items under the brand names “The Children’s Place,” “Place,” “Baby Place” and “Gymboree.”

In the last 30 days, the estimated loss for 2021 (ending January) went down from $2.49 to $2.41 while the estimated earnings for 2022 went from $3.04 to $3.23. 2021 revenue and earnings are expected to decline while 2022 numbers are expected to be up a respective 14.4% and 233.8%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

Conns, Inc. (CONN) : Free Stock Analysis Report

The Childrens Place, Inc. (PLCE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research