5 Stocks to Watch on Their Recent Dividend Hike

Wall Street concluded a solid March as well as first-quarter 2023. However, volatility reappeared in early April even though this month generally remains favorable to stock investors.

On Apr 3, the Organization of Petroleum Exporting Countries and its associate members decided to reduce aggregate production by 1.16 million barrels per day starting May. The new quota system will continue till the end of 2023.

This was followed by Russia’s decision to cut crude oil production by 500,000 barrels per day till the end of 2023. Saudi Arabia said the decision of OPEC+ is a “precautionary measure” aimed at stabilizing the global oil market in case of a recession in 2023.

Following the news, the future price of the U.S. benchmark — the West Texas Intermediate crude — and the global benchmark — the Brent crude — climbed to their highest level since April 2022. Several economists and financial researchers have indicated that crude oil prices could reach $100 per barrel in the near future.

Oil price is one of the major sources of inflation. Market participants are worried that inflation rate, which has declined considerably since its peak in June 2022, may spike once again. Despite the decline, the aggregate price level remains elevated.

Moreover, the resilient U.S. labor market has recently shown weakness. In its monthly Job Openings and Labor Turnover Survey, the Department of Labor reported that job openings in February came in at 9.93 million, declining 632,000 from January’s downwardly revised data. For the first time since May 2021, job vacancies fell below 10 million.

The ADP private payrolls for March were below the consensus estimate. The weekly jobless claims for the last two reported weeks came in at higher-than expected. The ISM reported that the manufacturing index for March dropped to 46.3%, marking its lowest level since May 2020 when the industrial sector was facing pandemic-related lockdowns.

Stocks in Watch

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe that one should consider stocks that have recently raised their dividend payments. Five such companies are The TJX Companies Inc. TJX, Cal-Maine Foods Inc. CALM, Sandstorm Gold Ltd. SAND, TIM S.A. TIMB and Bank OZK OZK.

The TJX Companies’ off-price business model, strategic store locations, impressive brands and fashion products and supply-chain management have been working well. TJX’s is benefiting from its solid store and e-commerce growth efforts.

TJX’s Marmaxx segment is doing particularly well, wherein comp store sales increased in the fourth quarter of fiscal 2023, backed by improved customer traffic. TJX expects an increase in pretax profit margin and overall comp sales growth in fiscal 2024. TJX currently carries a Zacks Rank #3 (Hold).

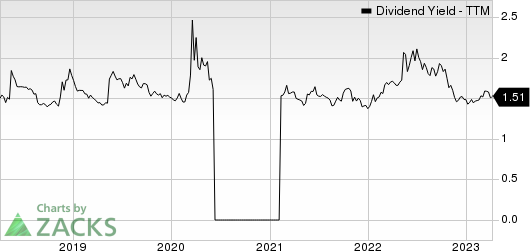

On Mar 28, 2023, The TJX Companies declared that its shareholders would receive a dividend of $0.3325 per share on Jun 1, 2023. It has a dividend yield of 1.8%. Over the past five years, TJX has increased its dividend five times, and its payout ratio presently stays at 38% of earnings. Check TJX’s dividend history here.

The TJX Companies, Inc. Dividend Yield (TTM)

The TJX Companies, Inc. dividend-yield-ttm | The TJX Companies, Inc. Quote

Cal-Maine Foods is primarily engaged in the production, grading, packing and sale of fresh shell eggs, including conventional, cage-free, organic and nutritionally-enhanced eggs. CALM is the largest producer and distributor of fresh shell eggs in the United States and sells most of its shell eggs in states across the southwestern, southeastern, mid-western and mid-Atlantic regions of the United States. CALM currently carries a Zacks Rank #3.

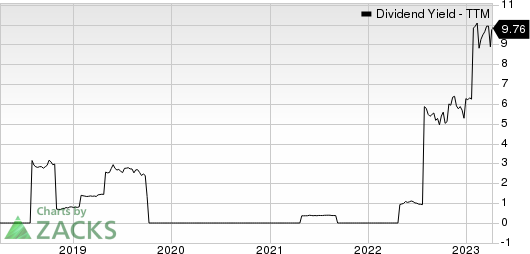

On Mar 28, 2023, Cal-Maine Foods declared that its shareholders would receive a dividend of $2.20 per share on May 11, 2023. It has a dividend yield of 15.2%. Over the past five years, CALM has increased its dividend eight times, and its payout ratio presently stays at 35% of earnings. Check CALM’s dividend history here.

Cal-Maine Foods, Inc. Dividend Yield (TTM)

Cal-Maine Foods, Inc. dividend-yield-ttm | Cal-Maine Foods, Inc. Quote

Sandstorm Gold is a gold streaming company engaged in providing upfront financing for gold mining companies. SAND focuses on completing gold purchase agreements with gold mining companies that have advanced-stage development projects or operating mines. SAND currently carries a Zacks Rank #3.

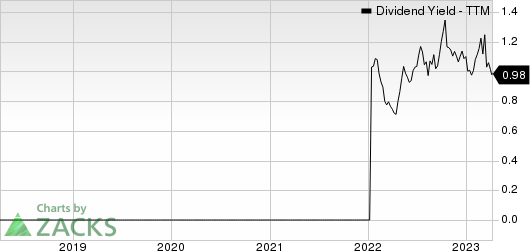

On Mar 31, 2023, Sandstorm Gold declared that its shareholders would receive a dividend of $0.015 per share on Apr 28, 2023. It has a dividend yield of 1%. Over the past five years, SAND has increased its dividend three times, and its payout ratio presently stays at 39% of earnings. Check SAND’s dividend history here.

Sandstorm Gold Ltd Dividend Yield (TTM)

Sandstorm Gold Ltd dividend-yield-ttm | Sandstorm Gold Ltd Quote

TIM is the only company in Brazil to offer mobile cellular service throughout the territory through its subsidiaries TIM Celular S.A. and TIM Nordeste S.A. Notably, TIMB is the largest GSM (global system for mobile communications) operator in the country, in terms of clients and revenues. TIMB currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

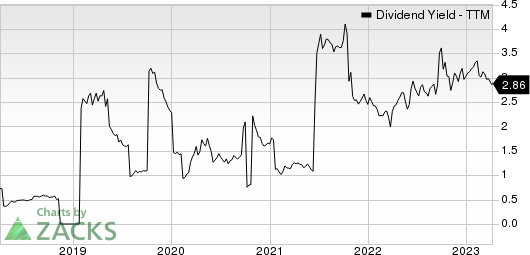

On Mar 31, 2023, TIM declared that its shareholders would receive a dividend of $0.2321 per share on Apr 25, 2023. It has a dividend yield of 5%. Over the past five years, TIMB has increased its dividend 11 times, and its payout ratio presently stays at 50% of earnings. Check TIM’s dividend history here.

TIM S.A. Sponsored ADR Dividend Yield (TTM)

TIM S.A. Sponsored ADR dividend-yield-ttm | TIM S.A. Sponsored ADR Quote

Bank OZK provides various retail and commercial banking services. OZK accepts various deposit products, including non-interest-bearing checking, interest-bearing transaction, business sweep, savings, money market, individual retirement, and other accounts, as well as time deposits.

OZK also offers real estate, consumer and business purpose, indirect recreational vehicle and marine, commercial and industrial, government-guaranteed, agricultural, small business, homebuilder, and affordable housing loans; business aviation and subscription financing services; and mortgage and other lending products. OZK currently carries a Zacks Rank #3.

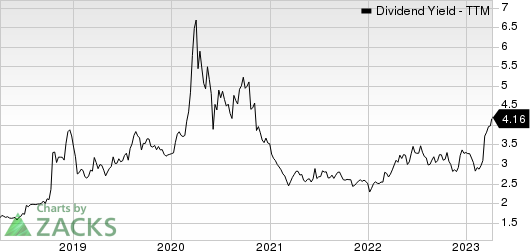

On Apr 3, 2023, Bank OZK declared that its shareholders would receive a dividend of $0.35 per share on Jan 21, 2023. It has a dividend yield of 4.2%. Over the past 5 years, OZK has increased its dividend 21 times, and its payout ratio presently stays at 29% of earnings. Check OZK’s dividend history here.

Bank OZK Dividend Yield (TTM)

Bank OZK dividend-yield-ttm | Bank OZK Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report

TIM S.A. Sponsored ADR (TIMB) : Free Stock Analysis Report