5 Things Eaton Corp. Management Wants You to Know

Industrial giant Eaton Corp. (NYSE: ETN) reported solid earnings in 2017. The top line rose by roughly 3%, with adjusted earnings growing by 10%. However, there was a lot going on beyond those headline numbers. Here are five things from its earnings call, in particular, that CEO Craig Arnold wants you to know about the key drivers of Eaton's results and his expectations for another good year in 2018.

1. The industrial sector has turned a corner

Eaton had been working through a difficult period for its power management products, largely driven by a cyclical downturn in the industrial sector. That started to change in a notable way in 2017. According to Arnold, "our markets returned to growth with modest acceleration as we saw in the second half of the year. This resulted in 3% organic growth for the year."

Image source: Getty Images.

That's a significant improvement over Eaton's expectations coming into 2017. In fact, at the start of the year, Arnold was calling for organic growth to be flat year over year. As the company heads into 2018, it is expecting organic growth of around 4%. So, clearly, Eaton thinks the industrial space has passed a key inflection point, with the CEO explaining that the world is in "a period of we call it synchronous global growth."

2. Cash is king

Although the 10% adjusted earnings growth per share was a nice number to see, cash is the real lifeblood of any company. And on that score, Eaton had a great year in 2017. According to Arnold, "we continue to generate strong operating cash flow of $2.7 billion, 2017 was a record year for the company and this by the way is after making a $350 million voluntary contribution to our U.S. qualified pension plan, so very strong cash flow during the year."

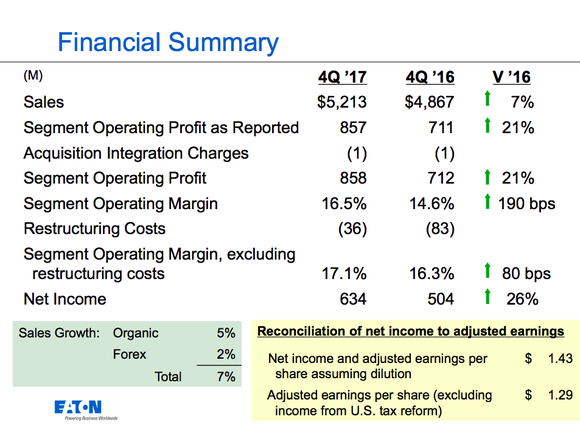

A quick overview of Eaton's fourth quarter. Image source: Eaton Corp.

Generating a record amount of cash flow not only allowed Eaton to fund its U.S. pension plans (hitting an impressive level of 95% funded), but the company also bought back 2.5% of its outstanding shares and increased the dividend. The 5% dividend hike in 2017 brought the company to nine consecutive annual increases. Its streak would be longer had it not held the dividend steady for a year after a major acquisition about a decade ago. Still, it's clear that Eaton is using its strong cash flow generation to reward investors and make the company stronger.

3. Stop asking about restructuring

A key goal for Eaton over the last few years was the successful execution of a large, multiyear restructuring program. It spent $116 million on this effort in 2017 alone. The goal was to increase margins throughout the business. For example, operating margins were up 80 basis points in the fourth quarter. Not surprisingly, the company's restructuring efforts have been a major topic of conversation during quarterly conference calls over the last couple of years.

During the fourth-quarter 2017 call, however, Arnold noted that "embedded in our guidance for 2018 we are going to spend $90 million." In other words, this is no longer a separate item. He added, "The reality is we simply see lots of opportunities to continue to improve the company and we continue to make those investments that have very attractive returns." Basically, Eaton's not done tweaking its business, but it isn't going to pull these numbers out as a special item. Improving operations via ongoing restructuring should be viewed as just a normal part of what it does now.

4. A trouble spot rebounds

One area of particular concern over the last few years was Eaton's hydraulics business. With the downturn in the commodity sector, it saw a material drop in demand for the products it sells here, which go into the massive machines used to dig up and process everything from coal to gold. Sales in this segment were down roughly 10% in 2016.

But hydraulics was a much better business in 2017, with Arnold explaining that "we are also very pleased with the improvements that we are seeing in our hydraulics business. We continue to generate strong growth, 18% in the quarter, 17% of which was organic and 1% from currency. And the improvement I can only say [that it's] very broad based with both distribution and OEM sales up."

The improvement doesn't appear to be over, either. According to Arnold in the call, "[f]or hydraulics, we really anticipate another very strong year of double digit organic growth of approximately 10%. The 10% organic growth compared to 12% in '17 and is certainly supported by the order book in the backlog that we carry into 2018." So this one-time trouble spot now appears to be well along the recovery path.

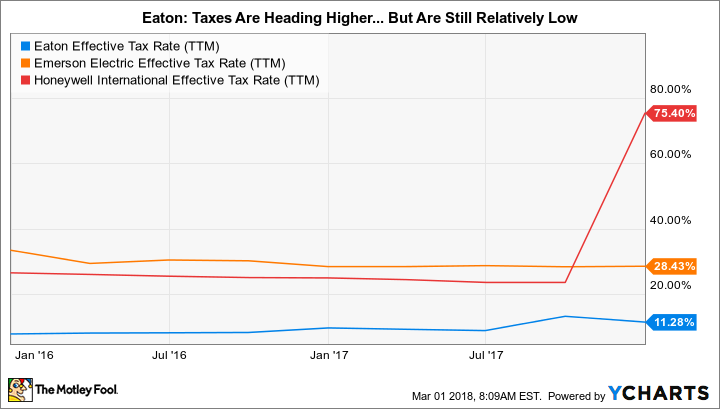

5. The impact of tax reform

A number of years ago, Eaton moved to Ireland to help reduce the impact of taxes on its business. It took a fair amount of heat for this at the time and during the last presidential election. That said, with the United States recently making big tax law changes, including reducing its corporate tax rate, the move to Ireland no longer has the same benefits.

ETN effective tax rate (TTM). Data by YCharts.

Looking forward, though, Arnold said that in 2018, "we expect our tax rate to be between 13% and 15% instead of the 14% to 16% previously announced. And importantly here, very important here, I think, we expect our tax rate for 2019 onwards to stabilize in the 14% to 16% range." He added later in the call that "the 14% to 16% range seems to us to be a pretty good result and will be, we think, relative to most other multinationals an attractive rate." And it won't require any corporate changes, like shifting Eaton's manufacturing footprint. Therefore, the tax reform will increase the company's tax rate but won't derail its long-term plans.

A strong year, with another on tap

All in all, 2017 was a good year for Eaton, with solid earnings and cash flows driven by a broad industrial upturn, and it's noteworthy that that recovery included a rebound in the once-troubled hydraulics sector. Despite these positives, the company has no plans to rest easy, with restructuring activity simply being worked into the day-to-day operations of the business after a few years of focusing on this effort. Also, while the U.S. tax overhaul will lead to higher taxes for the company, its move to Ireland appears likely to remain a net positive. While Eaton shares aren't cheap today, current shareholders should be pleased with the quarterly update.

More From The Motley Fool

Reuben Gregg Brewer owns shares of Eaton. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.