5 Top Stock Trades for Wednesday — Trading Nike’s Earnings

Traders and investors continue to position themselves as the Federal Reserve begins its two-day meeting on Tuesday. On Wednesday, it’s expected that the Fed will announce a rate increase and many expect another increase in December. Meanwhile, Nike earnings will be broadcast shortly. Here are our top stock trades based on Tuesday’s action.

Top Stock Trades for Tomorrow #1: Nike

Nike (NYSE:NKE) will report earnings after the close on Tuesday. Already, NKE stock is one of the biggest winners in the Dow Jones Industrial Average so far this year so investors are watching this one closely.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Shares have been incredibly strong, even before the Kaepernick ad made its debut. I would love to put on a long position should shares pullback to the 50-day moving average ($80.57). I would be a buyer/adder near the 100-day moving average as well, with support just below between $75 and $76.

Nike has been strong, but if it moves higher post-earnings, see if it can close over its recent highs. If so, that should propel a move to $90 or more.

Top Stock Trades for Tomorrow #2: Facebook

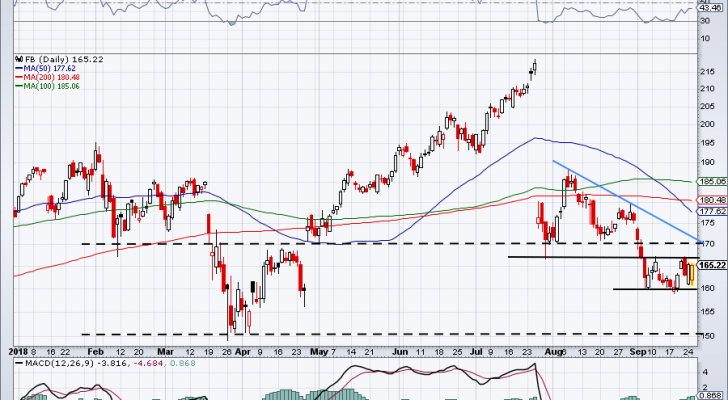

Shares puked down to $160 in early Tuesday trading on the announcement that Instagram’s founders are leaving, before Facebook (NASDAQ:FB) recovered a bulk of those losses.

That puts a clear line in the sand, as $160 continues to hold. If it can push out of its recent range (the top of which is near $167) I would expect $170 to be possible resistance. If the $160 floor gives way, look for a drop to that $150 to $155 area as the market digests the news that the segment Facebook stock has been dependent on for growth changes leadership.

Top Stock Trades for Tomorrow #3: Nvidia

After a quick reversal off its 50-day moving average, Nvidia (NASDAQ:NVDA) has been moving higher. That was the buy signal for bullish traders.

Now, see how it handles short-term downtrend resistance and the 20-day moving average near that $272 to $273 area. A push above likely sparks a rally in semiconductors and pushes Nvidia back to its highs. The action is similar to that in Adobe Systems (NASDAQ:ADBE), which we highlighted on Monday.

Top Stock Trades for Tomorrow #4: Ventas

We loved REITs as we came into summer, specifically Realty Income (NYSE:O), Digital Realty Trust (NYSE:DLR) and Ventas (NYSE:VTR). The space has been under pressure this month, as we come into a Fed decision that’s expected to bump rates higher.

That creates interest rate competition for REITs, which is viewed as a short-term negative. However, now yielding 5.8% and VTR continues to look quite attractive.

After rallying from $47 to just over $60, the pullback to sub-$55 may have some income-hunters looking to pounce. While over $55 would be more attractive, a test, hold and bounce off the 200-day moving average back over $55 could make it an attractive buy. Worth noting is that a full 50% retracement from this year’s lows to its highs would land VTR near $53.

Aggressive bulls can go long near current levels and use a close below the 200-day moving average as their stop-loss.

Top Stock Trades for Tomorrow #5: Salesforce

I pity the soul that’s visiting San Francisco while Salesforce (NASDAQ:CRM) is putting on its Dreamforce conference and that’s not the reason they’re in the city. I know, because it’s happened to me before!

In any regard, the company is hosting its big conference this week and has its investor day Wednesday. Can it help launch CRM to new highs?

Cloud stocks continue to trade well and CRM continues to hover right near its all-time highs. The conference could spur a few different moves. The most bullish would be an instant breakout over this $158 to $160 level. The second, another bullish reaction, would allow CRM to steadily grind higher along the top of channel resistance. That’s some of the most frustrating action for bears, by the way.

The third reaction is a pullback. Whether that’s down to the 20-day, 60-day or recent uptrend support is not yet known. We’ll have to see if and when it happens, but it helps to know your options.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long CRM, NVDA and O.

More From InvestorPlace

The post 5 Top Stock Trades for Wednesday — Trading Nike’s Earnings appeared first on InvestorPlace.