5 Undervalued Stocks With Positive Earnings Growth Estimates

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, the following stocks are trading at a discount and have positive three- to five-year future earnings estimates.

Warning! GuruFocus has detected 1 Warning Sign with ZNH. Click here to check it out.

The intrinsic value of ZNH

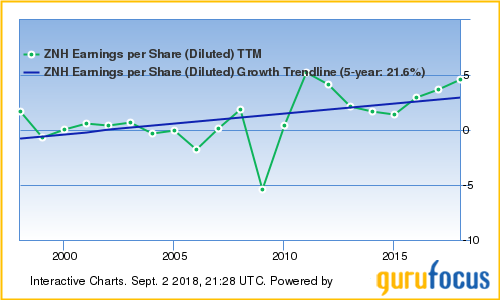

China Southern Airlines Co. Ltd. (ZNH) is trading around $33 per share. The discounted cash flow calculator gives the stock a fair value of $40 per share, suggesting it has a 17% margin of safety at current prices.

The airline has a GuruFocus profitability and growth rating of 8 out of 10. Its earnings per share have increased 24.1% over the last five years. Analysts project a three-year to five-year earnings growth rate of 19.12%. Its return on equity of 15.67% and return on assets of 3.57% are underperforming 60% of companies in the Global Airlines industry.

Jim Simons (Trades, Portfolio) is the company's largest guru shareholder with 0.3% of outstanding shares.

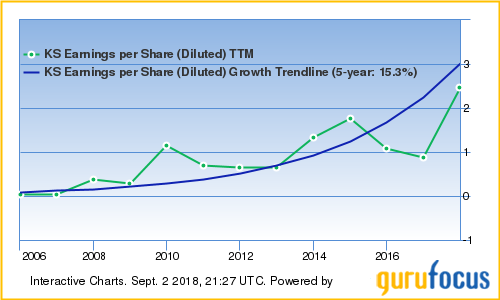

KapStone Paper and Packaging Corp. (KS) is trading around $34.35 per share. The discounted cash flow calculator gives the stock a fair value of $66.88 per share, suggesting it has a 49% margin of safety at current prices.

GuruFocus gave the producer of paper and paper products a profitability and growth rating of 9 out of 10. Its earnings per share have grown 16% over the past decade. Analysts project a three-year to five-year earnings growth rate of 5%. Its return on equity of 28.17% and return on assets of 9.04% are outperforming 7% of companies in the Global Paper & Paper Products industry.

Mario Gabelli (Trades, Portfolio) is the company's largest shareholder among the gurus with 0.16% of outstanding shares, followed by Simons with 0.14%.

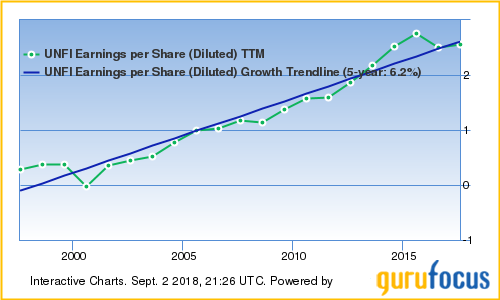

United Natural Foods Inc. (UNFI) is trading around $35.50 per share. The discounted cash flow calculator gives the stock a fair value of $49.39 per share, suggesting it has a 28% margin of safety.

The food distributor has a GuruFocus profitability and growth rating of 8 out of 10. Its earnings per share have grown 9.9% over the past decade. Analysts project a three-year to five-year earnings growth rate of 5%. Its return on equity of 10% and return on assets of 5.73% are outperforming 63% of companies in the Global Food Distribution industry.

Ken Fisher (Trades, Portfolio) is the largest guru shareholder of the company with 1.4% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio) with 0.92% and Chuck Royce (Trades, Portfolio) with 0.6%.

Ingles Markets Inc. (IMKTA) is trading around $36 per share. The discounted cash flow calculator gives the stock a fair value of $52 per share, suggesting it has a 31% margin of safety.

The supermarket chain has a GuruFocus profitability and growth rating of 7 out of 10. Its earnings per share have grown 4.4% over the last 12 months. Analysts project a three-year to five-year earnings growth rate of 10.10%. Its return on equity of 18.22% and return on assets of 5.59% are outperforming 60% of companies in the Global Grocery Stores industry.

Mario Gabelli (Trades, Portfolio) is the company's largest guru shareholder with 5.75% of outstanding shares.

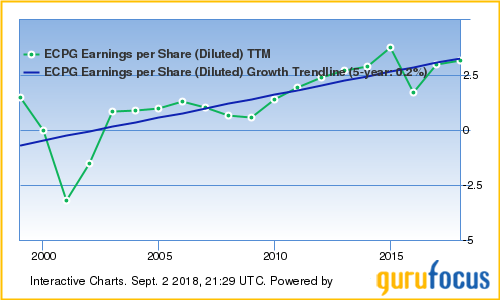

Encore Capital Group Inc. (ECPG) is trading around $38.75 per share. The discounted cash flow calculator gives the stock a fair value of $82.16 per share, suggesting it has a 53% margin of safety.

The company provides debt recovery solutions. It has a GuruFocus profitability and growth rating of 9 out of 10. Its earnings per share have grown 17.7% over the last five years. Analysts project a three-year to five-year earnings growth rate of 13%. While its return on equity of 15.13% is outperforming the sector, its return on assets of 2.04% is underperforming 56% of companies in the Global Asset Management industry.

With 0.02% of outstanding shares, Paul Tudor Jones (Trades, Portfolio) is the company's largest guru shareholder.

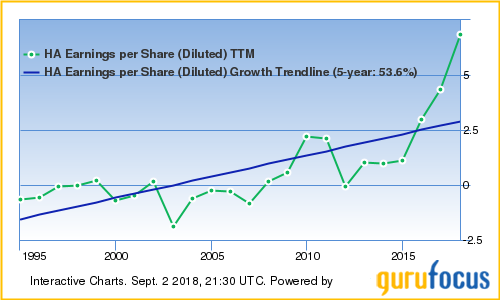

Hawaiian Holdings Inc. (HA) is trading around $41.50 per share. The discounted cash flow calculator gives the stock a fair value of $72.34 per share, suggesting it has a 43% margin of safety.

The airline company has a GuruFocus profitability and growth rating of 8 out of 10. Its earnings per share have grown 53.6% over the last five years. Analysts project a three-year to five-year earnings growth rate of 5%. Its return on equity of 40.75% and return on assets of 11.98% are outperforming 87% of companies in the Global Airlines industry.

Chuck Royce (Trades, Portfolio) is the largest guru shareholder of the company with 2% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 1.64%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with ZNH. Click here to check it out.

The intrinsic value of ZNH