5 Utilities Trading With Low Price-Earnings Ratios

As of July 6, the GuruFocus All-in-One Screener, a Premium feature, found that the following retailers have low price-earnings ratios and have been bought by gurus. While some of them are great value investments, others may need to be researched more carefully, according to the discounted cash flow calculator.

ALLETE

With a market cap of $2.90 billion, ALLETE Inc. (ALE) has a price-earnings ratio of 15.98. According to the DCF calculator, the stock has a fair value of $39.41 while trading at $55.94.

The stock has lost 34.95% over the last 12 months and is now 36.86% below the 52-week high and 16.01% above the 52-week low.

The electric utility company has a GuruFocus profitability rating of 6 out of 10. While the return on equity of 8.16% is underperforming the sector, the return on assets of 3.39% is outperforming 56% of companies in the utilities, regulated industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.04 is above the industry median of 0.25.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.66% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.26% and HOTCHKIS & WILEY with 0.14%.

Centrais Eletricas

With a $4.91 billion market cap, Centrais Eletricas Brasileiras SA (EBR) is trading with a price-earnings ratio of 4.51. According to the DCF calculator, the stock has a fair value of $11.77 while trading at $6.

The share price has declined 33.02% over the past 12 months and is now 48.65% below the 52-week high and 103.05% above the 52-week low.

The company, which operates a portfolio of wind, thermal, hydro and nuclear power plants, has a GuruFocus profitability rating of 4 out of 10. The return on equity of 15.64% and return on assets of 5.35% are outperforming 76% of companies in the utilities, regulated industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.34 is above the industry median of 0.25.

Simons' firm is the company's largest guru shareholder with 0.06% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.02%.

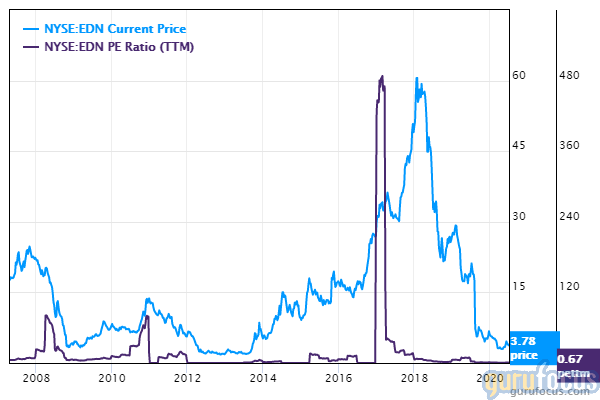

Empresa Distribuidora y Comercializadora

With a market cap of $16.40 million, Empresa Distribuidora y Comercializadora Norte SA (EDN) is trading with a price-earnings ratio of 1.67 and a price-book ratio of 0.28. According to the DCF calculator, the stock has a fair value of $61.11 while trading at about $3.78.

Shares have declined 80.77% over the last 12 months and are now 82.76% below the 52-week high and 48.82% above the 52-week low.

The electricity distribution company has a GuruFocus profitability rank of 5 out of 10. The company's return on equity of 21.82% and return on assets of 10.41% are outperforming 88% of competitors in the utilities, regulated industry. The cash-debt ratio of 0.4 is above the industry median of 0.25.

NRG

NRG Energy Inc. (NRG) has a market cap of $8 billion and is trading with a price-earnings ratio of 2.11. According to the DCF calculator, the stock has a fair value of $168.98 while trading at $32.79.

Shares have declined 8.43% over the last 12 months and are now trading 21.52% below the 52-week high and 67.81% above the 52-week low.

The independent power producer has a GuruFocus profitability rating of 5 out of 10. The return on assets of 38.05% is outperforming 99% of companies in the utilities, independent power producers industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.11 is close to the industry median of 0.18.

With 1.41% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.59%, HOTCHKIS & WILEY with 0.24% and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.21%.

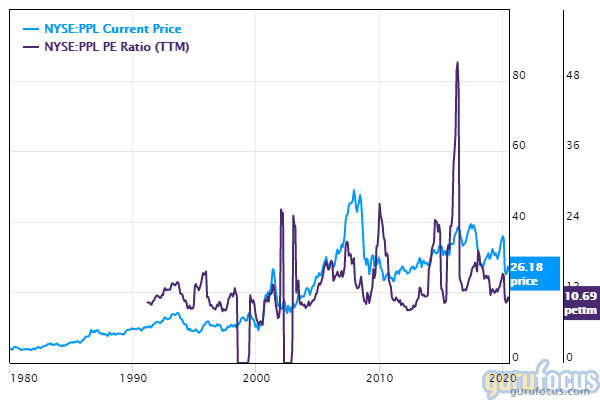

PPL

PPL Corp. (PPL) has a market cap of $20.13 billion. Its shares are trading with a price-earnings ratio of 10.70. According to the DCF calculator, the stock has a fair value of $26.22 while trading at $26.18.

Shares have declined 15.79% over the past 12 months and are currently trading 28.92% below the 52-week high and 44.48% above the 52-week low.

The company has a GuruFocus profitability rating of 6 out of 10. The return on equity of 14.71% and return on assets of 4.07% are outperforming 63% of competitors in the utilities, regulated industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.25.

The company's largest guru shareholder is HOTCHKIS & WILEY with 1.93% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.48%, Cohen's firm with 0.04% and John Hussman (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Undervalued Stocks With Profitable Business

6 Insurance Companies Trading With Low Price-Sales Ratios

6 Cheap Guru Stocks With Stable Dividend Yields

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.