5 Value Stocks to Buy for Safety Amid Market Volatility

We are approaching the end of first-quarter 2023. Severe volatility that hit U.S. stock markets in early 2022, continued till the first three months of this year. The inflation rate remained highly elevated despite declining from its peak in June 2022.

In its March FOMC meeting, the Fed raised the benchmark interest rate- by 25 basis points to 4.75% to 5%. This is the highest level of the Fed fund rate since late 2007. Fed Chairman Jerome Powell projected at least one more rate hike of 25 basis points to end the current higher rate regime.

Market participants are highly concerned about a recession in the near-term. The recent turmoil in the banking sectors in the United States and Eurozone has significantly dented investors’ sentiment highlighting concerns about a global liquidity crunch.

On Mar 28, the Conference Board released the U.S. consumer confidence Index for March 2023. The Expectations Index — based on consumers’ short-term outlook for income, business, and labor market conditions — came in at below 80 in 12 out of last 13 months. The Conference Board reported that this type of reading often signals a recession within the next year.

At this stage, investors should be prepared to minimize fluctuations in their portfolio and consequently rebalance it with suitable financial assets to maintain stability. It would be prudent to pick value stocks with a favorable Zacks Rank to cushion the portfolio as well as make some gains from the upside potential. These stocks could prove to be valuable once the rally resumes.

Our Top Picks

We have narrowed our search to five value stocks. Each of our picks carries a Zacks Rank #1 (Strong Buy) and a Value Score of A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

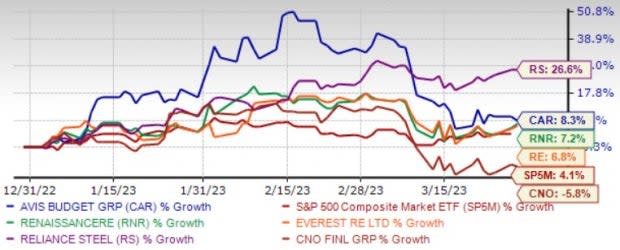

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Avis Budget Group Inc. CAR provides car and truck rentals, car sharing, and ancillary services to businesses and consumers. The ability of CAR to cater to a wide range of mobility demands helps it to expand and strengthen its global foothold through organic growth.

Avis Budget Group operates through distinct global brands that focus on different market segments and complement other brands in their respective regional markets. Fleet expansion and technology enhancement efforts by CAR are likely to enhance its offerings.

The forward P/E of Avis Budget Group for the current financial year is 6.33X, lower than the industry average of 15.72X. CAR has a PEG ratio of 0.26, lower than the industry average of 1.84. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 30 days.

RenaissanceRe Holdings Ltd. RNR has witnessed steady premium growth over the past few quarters. This upside is quite obvious from its seven-year CAGR (2014-2022) of 25%. RNR has been focusing on acquisitions and business expansions to sustain growth prospects.

RenaissanceRe Holdings has been undertaking divestitures to streamline its operations and get rid of low-return high-risk businesses. RNR’s balance sheet strength remains impressive. Its cash and cash equivalents are higher than its debt level. RNR is also engaged in the prudent deployment of capital.

The forward P/E of RenaissanceRe Holdings for the current financial year is 8.45X, lower than the industry average of 12.62X. RNR has a PEG ratio of 0.73, lower than the industry average of 1.11. The Zacks Consensus Estimate for current-year earnings has improved 7.4% over the last 60 days.

CNO Financial Group Inc.’s CNO continued investment in technology aims to significantly improve agent productivity, sales and advertising. The buyout of DirectPath is likely to bring enhanced benefits management services and enrollment capabilities to CNO.

CNO Financial is engaged in prudent capital deployment measures through frequent share buybacks and dividend payments. Under its cost containment program, CNO reduced its total expenses by 13.9% in 2022 due to lower insurance policy benefits and other operating costs and expenses. Improving annuity premiums collected and direct-to-consumer life sales poise CNO well for future growth.

The forward P/E of CNO Financial for the current financial year is 8.28X, lower than the industry average of 8.67X. CNO has a PEG ratio of 0.70, lower than the industry average of 0.97. The Zacks Consensus Estimate for current-year earnings has improved 4.3% over the last 30 days.

Everest Re Group Ltd.’s RE global presence, product diversification and capital adequacy bode well. Higher premiums earned by the Insurance segment will likely improve the expense and loss ratio. The Reinsurance segment of RE remains well-poised for leveraging opportunities, stemming from the continued disruption and evolution of the reinsurance market.

A strong capital position, with sufficient cash generation capabilities supports effective capital deployment. Everest RE is lowering exposure to areas not meeting the right risk-return profile, building a portfolio with a mix of product lines, better rate adequacy and higher long-term margins and repositioning its portfolio by moving up fixed-income credit quality.

The forward P/E of Everest RE for the current financial year is 9.35X, lower than the industry average of 12.62X. RE has a PEG ratio of 0.87, lower than the industry average of 1.11. The Zacks Consensus Estimate for current-year earnings has improved 8.2% over the last 60 days.

Reliance Steel & Aluminum Co. RS is seeing a strong rebound in non-residential construction, its largest market. Demand in this market is expected to remain strong in 2023 on healthy bidding activities. RS is also witnessing steady demand in automotive and a recovery in commercial aerospace and energy.

Reliance Steel & Aluminum is expected to gain from robust demand in the majority of its end markets in 2023. RS also remains focused on enhancing its operating results through the acquisition of high-margin businesses. Investments in new processing capabilities will also improve the service offerings to its customers. RS remains committed to offering incremental returns to its shareholders leveraging strong cash flows.

The forward P/E of Reliance Steel & Aluminum for the current financial year is 11.9X, lower than the industry average of 12X. RS has a PEG ratio of 1.33, lower than the industry average of 5.26. The Zacks Consensus Estimate for current-year earnings has improved 4.2% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report