6 Banks Trading With Low Price-Sales Ratios

According to the GuruFocus All-In-One Screener, a Premium feature, the following companies were trading with low price-sales ratios as of March 30.

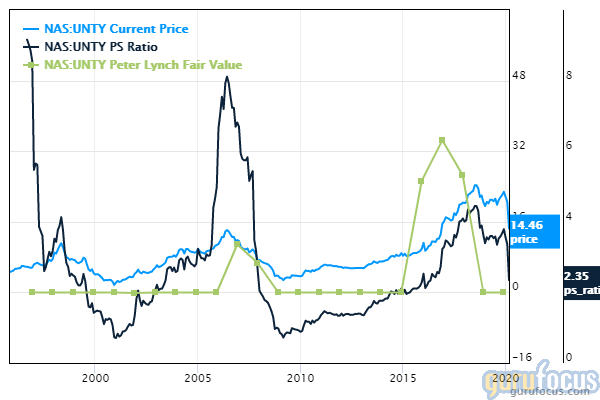

Unity Bancorp

Unity Bancorp Inc. (UNTY) was trading around $11.29 per share with a price-sales ratio of 1.85 and a price-earnings ratio of 5.28.

The bank holding company has a market cap of $122 million. The stock has risen at an annualized rate of 10.08% over the past decade.

The discounted cash flow calculator gives the company a fair value of $22.90, suggesting it is undervalued with a 50% margin of safety, while the Peter Lynch earnings line gives the stock a fair price of $32.01.

The company's largest guru shareholder is Chuck Royce (Trades, Portfolio) with 4.75% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.5%.

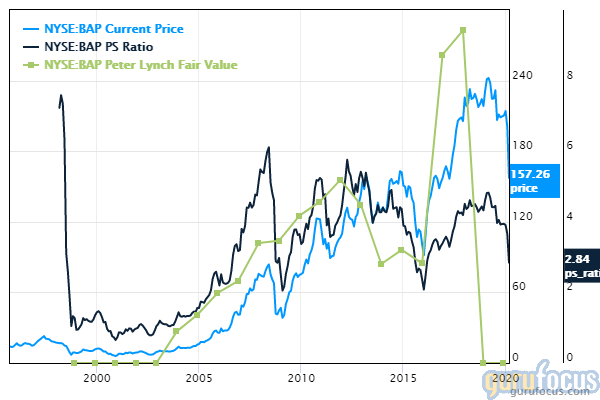

Credicorp

As of Monday, Credicorp Ltd. (BAP) was trading around $125.85 per share with a price-sales ratio of 2.39 and a price-earnings ratio of 8.17.

The Peruvian provider of financial services has a market cap of $10.04 billion. The stock has risen at an annualized rate of 6.47% over the past 10 years.

The DCF calculator gives the stock a fair value of $274, suggesting it is undervalued with 54% of margin of safety. The Peter Lynch earnings line gives the stock a fair price of $237.

With 1.71% of outstanding shares, Al Gore (Trades, Portfolio) is the company's largest guru shareholder, followed by Ken Fisher (Trades, Portfolio) with 1.30% and Sarah Ketterer (Trades, Portfolio)'s Causeway Capital Management with 0.38%.

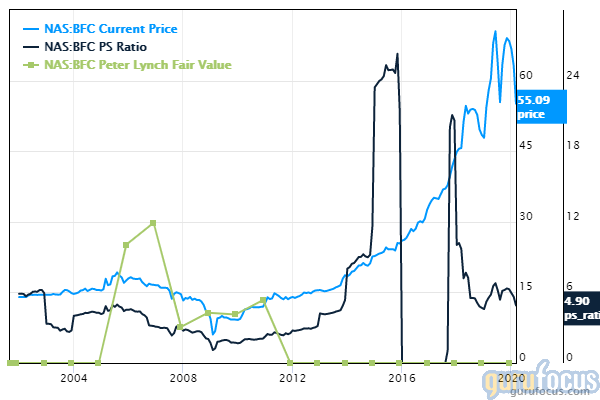

Bank First

Bank First Corp. (BFC) was trading around $51.50 on Monday with a price-sales ratio of 4.59 and a price-earnings ratio of 13.31.

The U.S. provider of financial services has a market cap of $364 million. The stock has risen at an annualized rate of 17.79% over the past decade.

The DCF calculator gives the company a fair value of $78.15, suggesting it is undervalued with a 34% margin of safety. The Peter Lynch earnings line gives the stock a fair price of $58.

Commerce Bancshares

Commerce Bancshares Inc. (CBSH) was trading around $49.38 with a price-sales ratio of 4.17 and a price-earnings ratio of 13.75.

The regional bank that provides business and personal banking services has a market cap of $5.53 billion. The stock has climbed at an annualized rate of 8.73% over the past 10 years.

The DCF calculator gives the company a fair value of $49.50, suggesting it is undervalued with a 37.56% margin of safety. The Peter Lynch earnings line gives the stock a fair price of $53.70.

Some notable guru shareholders are the Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.02% of outstanding shares and Pioneer Investments (Trades, Portfolio) with 0.01%.

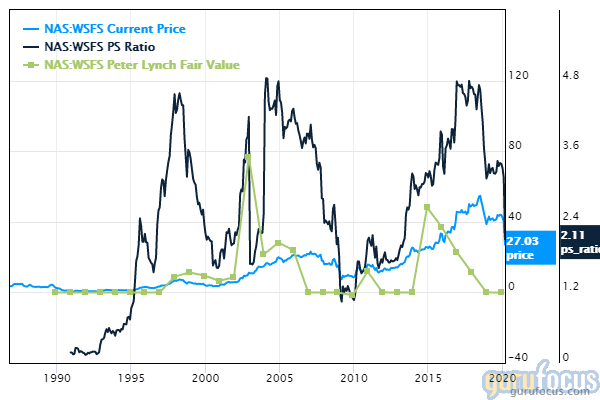

WSFS Financial

WSFS Financial Corp. (WSFS) was trading around $24.20 with a price-sales ratio of 1.89 and a price-earnings ratio of 8.32.

The savings holding company has a market cap of $1.23 billion. The stock has risen at an annualized rate of 7.61% over the past decade.

The DCF calculator gives the company a fair value of $31.14, suggesting it is undervalued with a 22.30% margin of safety. The Peter Lynch earnings line gives the stock a fair price of $43.

The company's largest guru shareholder is Simons' firm with 4.19% of outstanding shares, followed by Richard Pzena (Trades, Portfolio) with 1.47%

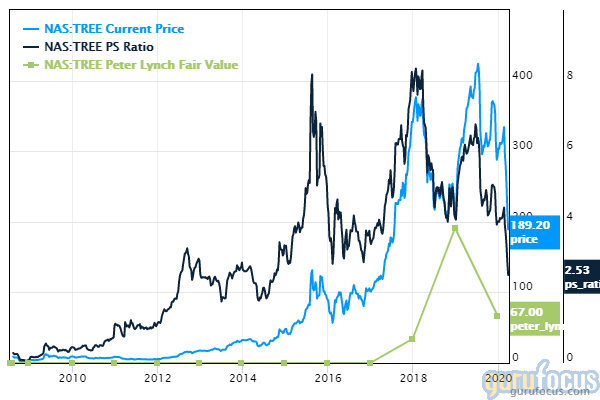

LendingTree

Shares of LendingTree Inc. (TREE) were trading around $192 on Monday with a price-sales ratio of 2.53 and a price-earnings ratio of 71.

The online loans marketplace has a market cap of $2.51 billion. The stock has climbed at an annualized rate of 35% over the past decade.

The DCF calculator gives the company a fair value of $28, suggesting it is overpriced with a 570% margin of safety. The Peter Lynch earnings line gives the stock a fair price of $40.

With 1.01% of outstanding shares, Ron Baron (Trades, Portfolio) is the company's largest guru shareholder, followed by Simons' firm with 0.45% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management 0.08%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 High-Yielding Stocks Trading With Low Price-Earnings Ratios

5 Retailers Predicted to Boost Earnings

6 Restaurants Trading With Low Price-Earnings Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.