6 Bargain Stocks Boosting Earnings

- By Tiziano Frateschi

Companies growing their earnings per share (EPS) are often good investments as they can return a solid profit to investors. According to the discount cash flow (DCF) calculator, the following are undervalued companies that have grown EPS over a five-year period.

Warning! GuruFocus has detected 2 Warning Signs with GBT. Click here to check it out.

The intrinsic value of TSCO

The EPS of Tractor Supply Co. (TSCO) grew 17% over the past five years.

The retail chain has a market cap of $7.98 billion and enterprise value of $8.4.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 33.6% at $62.99 per share. The price-earnings (P/E) ratio is 18.96; the stock price has been as high as $78.25 and as low as $49.87 in the last 52 weeks. It is currently trading 19.50% below its 52-week high and 26.31% above its 52-week low.

The company's largest shareholder among the gurus is David Rolfe (Trades, Portfolio) with 2.02% of outstanding shares, followed by Jim Simons (Trades, Portfolio) with 1.19% and Columbia Wanger (Trades, Portfolio) with 0.4%.

Banco Macro SA's (BMA) EPS grew 44% over the past five years.

The Latin American commercial bank has a market cap of $8.02 billion and enterprise value of $6.59 million.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 37.3% at $119.79 per share. The forward P/E ratio is 17.80; the price has been as high as $120.66 and as low as $61.12 in the last 52 weeks. It is currently trading 0.72% below its 52-week high and 95.99% above its 52-week low.

With 1.34% of outstanding shares, Daniel Loeb (Trades, Portfolio) is the company's largest guru shareholder, followed by Ron Baron (Trades, Portfolio) with 0.58%, Simons with 0.1%, Caxton Associates (Trades, Portfolio) with 0.07% and Manning & Napier Advisors Inc. with 0.06%.

The EPS of Snap-on Inc. (SNA) grew 15% over the past five years.

The tool manufacturer has a market cap of $8.52 billion and enterprise value of $9.55 billion.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 29.7% at $147.90 per share. The P/E ratio is 15.29; the price has been as high as $181.73 and as low as $140.83 in the last 52 weeks. It is currently trading 18.62% below its 52-week high and 5.02% above its 52-week low.

The company's largest shareholder among the gurus is John Rogers (Trades, Portfolio) with 1.11% of outstanding shares, followed by Simons with 0.76%, Columbia Wanger with 0.67%, Mairs and Power (Trades, Portfolio) with 0.64% and Joel Greenblatt (Trades, Portfolio) with 0.25%.

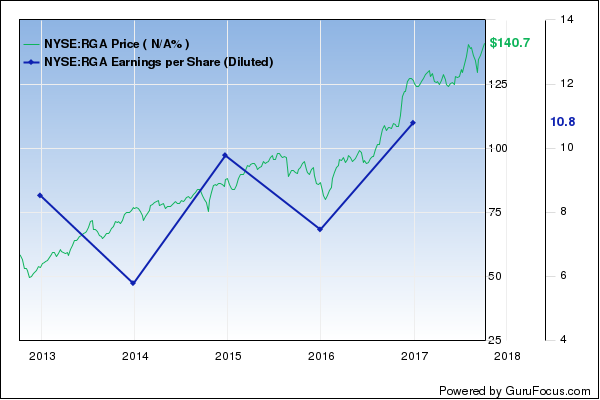

Reinsurance Group of America Inc. 's (RGA) EPS grew 6% over the past five years.

The insurance and reinsurance company has a market cap of $9.07 billion and enterprise value of $11.39 billion.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 15.8% at $140.60 per share. The P/E ratio is 11.91; the price has been as high as $141.89 and as low as $106.12 in the last 52 weeks. It is currently trading 0.91% below its 52-week high and 32.49% above its 52-week low.

With 0.73% of outstanding shares, Diamond Hill Capital (Trades, Portfolio) is the company's largest investor among the gurus, followed by Chuck Royce (Trades, Portfolio) with 0.33%, NWQ Managers (Trades, Portfolio) with 0.19%, Simons with 0.13% and Keeley Asset Management Corp (Trades, Portfolio) with 0.02%.

The EPS of American Financial Group Inc. (AFG) grew 9% over the past five years.

The property and casualty insurance company has a market cap of $9.19 billion and enterprise value of $8.36 billion.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 9.2% at $104.43 per share. The P/E ratio is 11.70; the price has been as high as $105.58 and as low as $73.38 in the last 52 weeks. It is currently trading 1.09% below its 52-week high and 42.31% above its 52-week low.

The company's largest shareholder among the gurus is Simons with 0.19% of outstanding shares, followed by Royce with 0.12% and Steven Cohen (Trades, Portfolio) with 0.11%.

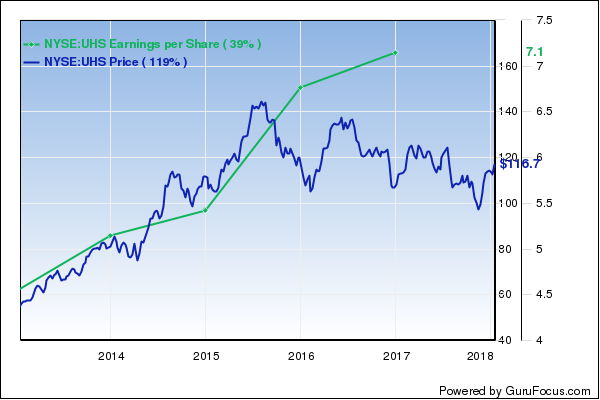

Universal Health Services Inc.'s (UHS) EPS grew 12% over the past five years.

The medical care provider has a market cap of $10.74 billion and enterprise value of $14.85 billion.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 42.3% at $112.23 per share. The P/E ratio is 15.26; the price has been as high as $129.74 and as low as $99.72 in the last 52 weeks. It is currently trading 13.50% below its 52-week high and 12.55% above its 52-week low.

With 5.67% of outstanding shares, Lee Ainslie (Trades, Portfolio) is the company's largest guru shareholder, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 0.42%, Larry Robbins (Trades, Portfolio) with 2.06%, Andreas Halvorsen (Trades, Portfolio) with 1.82% and Jana Partners (Trades, Portfolio) with 1.42%.

Disclosure: I do not own any shares of any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with GBT. Click here to check it out.

The intrinsic value of TSCO