6 Cheap Stocks Boosting Earnings

Companies that are growing their earnings are often good investments because they can return a solid profit to investors. According to the discounted cash flow calculator as of Tuesday, the following undervalued companies have grown their earnings per share over a five-year period.

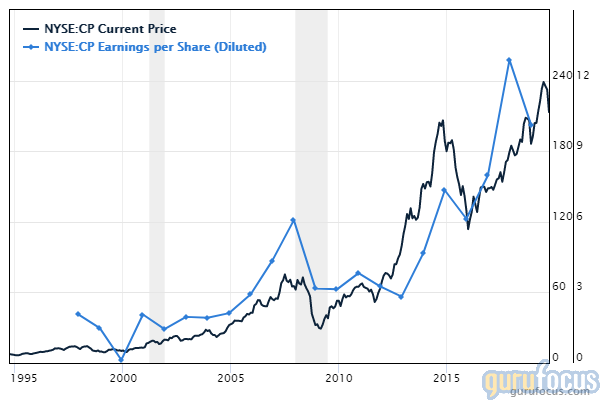

Canadian Pacific Railway Ltd.'s (CP) earnings per share have grown 23.10% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 32% margin of safety at $218 per share. The price-earnings ratio is 17.36. The share price has been as high as $247.52 and as low as $167.48 in the last 52 weeks; it is currently 12.73% below its 52-week high and 28.98% above its 52-week low.

The railroad operator has a market cap of $29.75 billion and an enterprise value of $36.15 billion.

With 1.95% of outstanding shares, Steve Mandel (Trades, Portfolio)'s Lone Pine Capital is the company's largest guru shareholder, followed by Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.25% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.11%.

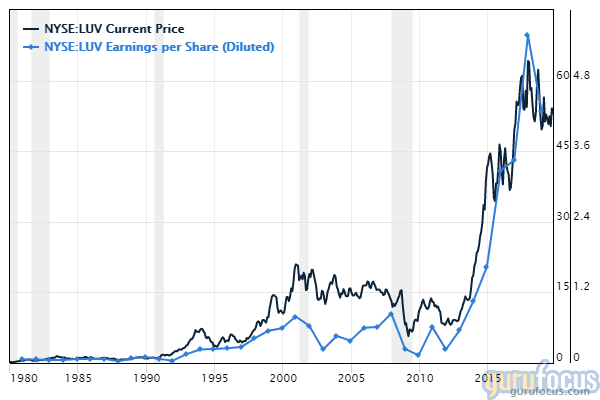

The earnings per share of Southwest Airlines Co. (LUV) have grown 54.68% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with an 56% margin of safety at $54 per share. The price-earnings ratio is 12.48. The share price has been as high as $60.86 and as low as $44.28 in the last 52 weeks; it is currently 11.40% below its 52-week high and 21.77% above its 52-week low.

The American domestic airline has a market cap of $28.98 billion and an enterprise value of $29.52 billion.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 13.61% of outstanding shares, followed by Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 9.98%, the Barrow, Hanley, Mewhinney & Strauss with 0.21% and T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.18%.

Fiat Chrysler Automobiles NV's (FCAU) earnings per share have grown 39.90% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 43% margin of safety at $13 per share. The price-earnings ratio is 6.05. The share price has been as high as $17.46 and as low as $12.11 in the last 52 weeks; it is currently 25.54% below its 52-week high and 7.35% above its 52-week low.

The passenger vehicles manufacturer has a market cap of $25.69 billion and enterprise value with $24.67 billion.

With 7.75% of outstanding shares, Chase Coleman (Trades, Portfolio)'s Tiger Global Management is the company's largest guru shareholder, followed by Bill Nygren (Trades, Portfolio)'s Oakmark Fund with 2.32%, Pioneer Investments (Trades, Portfolio) with 1.10% and Mohnish Pabrai (Trades, Portfolio)'s Dalal Street with 1.06%.

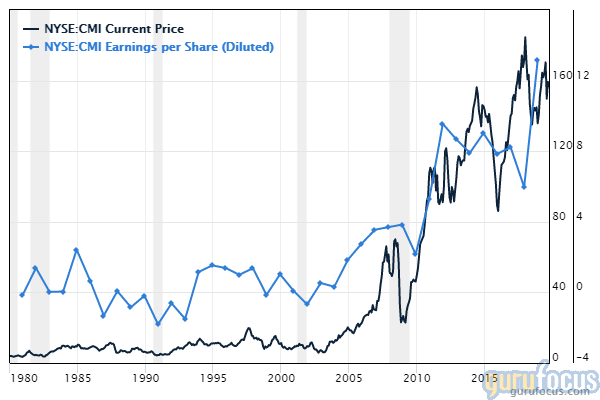

The earnings per share of Cummins Inc. (CMI) have grown 35.60% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 35% margin of safety at $167 per share. The price-earnings ratio is 9.94. The share price has been as high as $175.91 and as low as $124.40 in the last 52 weeks; it is currently 7.48% below its 52-week high and 30.84% above its 52-week low.

The company which provides diesel and natural gas engines and engine-related products, has a market cap of $25.68 billion and an enterprise value of $27.54 billion.

The company's largest guru shareholder is HOTCHKIS & WILEY (Trades, Portfolio) with 1.67% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 1.47% and Nygren with 1.09%.

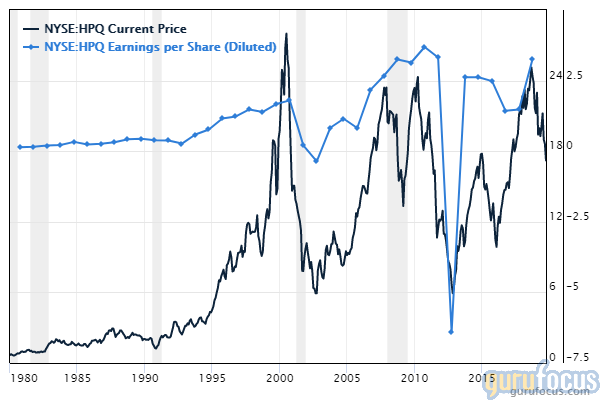

HP Inc. 's (HPQ) earnings per share have grown 44% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 44% margin of safety at $16.24 per share. The price-earnings ratio is 5.99. The share price has been as high as $25.72 and as low as $15.93 in the last 52 weeks; it is currently 36.86% below its 52-week high and 1.95% above its 52-week low.

The company, which provides computer systems, printing equipment, and printing supplies, has a market cap of $24.07 billion and an enterprise value of $24.21 billion.

With 7.77% of outstanding shares, Dodge & Cox (Trades, Portfolio) is the company's largest guru shareholder, followed by PRIMECAP Management (Trades, Portfolio) with 3.97% and Pioneer Investments (Trades, Portfolio) with 0.15%.

The earnings per share of PACCAR Inc. (PCAR) have grown 53.16% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 54% margin of safety at $70 per share. The price-earnings ratio is 10.18. The share price has been as high as $73 and as low as $53.43 in the last 52 weeks; it is currently 5.34% below its 52-week high and 29.33% above its 52-week low.

The company which operates in the truck manufacturing industry, has a market cap of $23.93 billion and an enterprise value of $30.23 billion.

The company's largest guru shareholder is HOTCHKIS & WILEY (Trades, Portfolio) with 0.44% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.32%, T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.24% and Mario Gabelli (Trades, Portfolio) with 0.12%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Predictable Stocks With an Attractive Margin of Safety

6 Guru Stocks Paying High Dividend Yields

Insiders Roundup: Facebook, American Defense Systems

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.