6 Energy Stocks Trading With Low Price-Sales Ratios

According to the GuruFocus All-In-One Screener, a Premium feature, the following energy stocks were trading with low price-sales ratios as of June 8.

DMC Global

Shares of DMC Global Inc. (NASDAQ:BOOM) were trading around $34.43 with a price-sales ratio of 1.37 and a price-earnings ratio of 22.80.

The petroleum refiner has a $688 million market cap. The stock has risen at an annualized rate of 9.26% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $31.47, suggesting it is undervalued by 23.96%, while the Peter Lynch fair value is $29.97.

The company's largest guru shareholder is Chuck Royce (Trades, Portfolio) with 1.99% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.55% and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.35%.

SEACOR

As of Monday, SEACOR Holdings Inc. (NYSE:CKH) was trading around $33.84 per share with a price-sales ratio of 0.88 and a price-earnings ratio of 32.23.

The provider of equipment for the oil and gas industry has a market cap of $688 million. The stock has risen at an annualized rate of 5.9% over the past 10 years.

The Peter Lynch earnings line gives the stock a fair price of $15.75.

With 6.85% of outstanding shares, Royce is the company's largest guru shareholder, followed by Renaissance Technologies with 6.38% and Hotchkis & Wiley with 0.21%.

Cabot Oil & Gas

Cabot Oil & Gas Corp. (NYSE:COG) was trading around $20.42 on Monday with a price-sales ratio of 4.65 and a price-earnings ratio of 17.91.

The independent exploration company has a market cap of $8.1 billion. The stock has risen at an annualized rate of 9.55% over the past decade.

The Peter Lynch Value gives the stock a fair price of $90.65.

With 1.24% of outstanding shares, PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder, followed by Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.78% and Simons' firm with 0.30%.

ConocoPhillips

ConocoPhillips (NYSE:COP) was trading around $48.59 with a price-sales ratio of 1.82 and a price-earnings ratio of 15.23.

The refining company has a market cap of $52 billion. The stock has climbed at an annualized rate of 6.08% over the past 10 years.

The Peter Lynch earnings line gives the stock a fair price of $47.85.

Some notable guru shareholders are Ken Fisher (Trades, Portfolio) with 0.42% outstanding shares, Cohen with 0.17% and Tweedy Browne (Trades, Portfolio) with 0.15%.

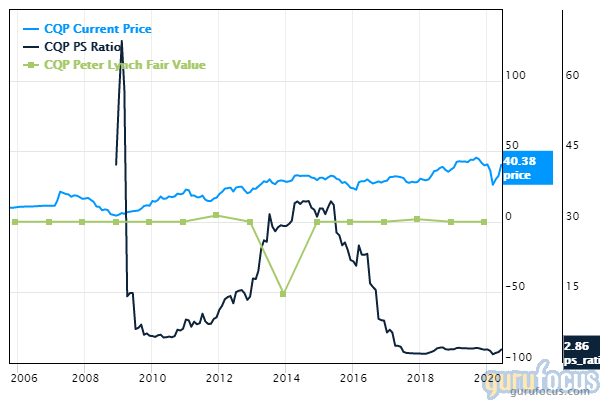

Cheniere Energy

Cheniere Energy Partners LP (CQP) was trading around $39.28 with a price-sales ratio of 2.79 and a price-earnings ratio of 16.79.

The owner of regasification facilities has a market cap of $19 billion. The stock has risen at an annualized rate of 14.11% over the past decade.

The Peter Lynch earnings line gives the stock a fair price of $35.1.

The company's largest guru shareholder is BP Capital Fund Advisors (Trades, Portfolio) with 0.01% of outstanding shares.

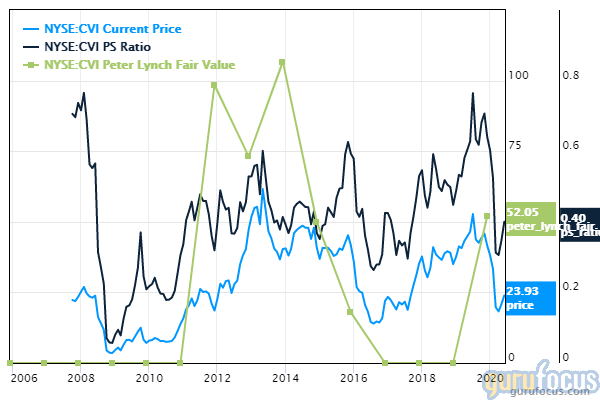

CVR Energy

CVR Energy Inc. (NYSE:CVI) was trading around $24.39 with a price-sales ratio of 0.41 and a price-earnings ratio of 12.77.

The company has a market cap of $2.4 billion. The stock has risen at an annualized rate of 22.16% over the past decade.

The Peter Lynch earnings line gives the stock a fair price of $28.65.

The company's largest guru shareholder is Carl Icahn (Trades, Portfolio) with 70.82% of outstanding shares, followed by Simons' firm with 2.75% and Pioneer Investments (Trades, Portfolio) with 0.35%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Profitable Companies With a Margin of Safety

Insiders Roundup: Avid Technology, Nebula

5 Predictable Stocks With a Margin of Safety

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.