6 Guru Stocks Beating the Market

According to the GuruFocus All-in-One Screener, the following stocks have outperformed the Standard & Poor's 500 Index over the past 12 months.

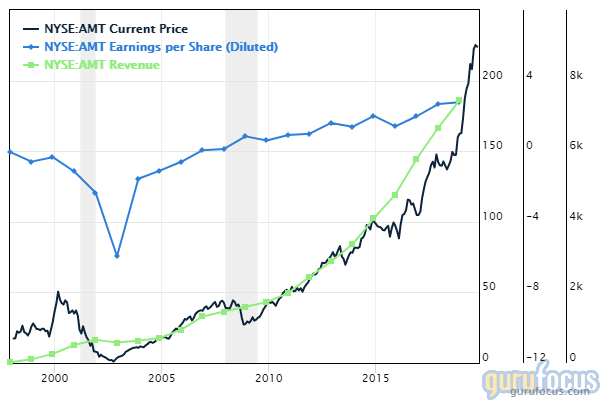

American Tower Corp. (NYSE:AMT) has a market cap of $95.69 billion. It has outperformed the S&P 500 by 26.61% over the past year.

Shares are trading with a price-earnings ratio of 65.50. According to the discounted cash flow calculator, the stock is overpriced by 186% at $218. As of Thursday, the price was 44.84% above the 52-week low and 10.68% below the 52-week high.

The real estate investment trust has a profitability and growth rating of 9 out of 10. The return on equity of 27.18% and return on assets of 4.15% are outperforming 64% of companies in the REITs industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.06.

Chuck Akre (Trades, Portfolio) is the company's largest guru shareholder with 1.62% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.40% and Spiros Segalas (Trades, Portfolio) with 0.23%.

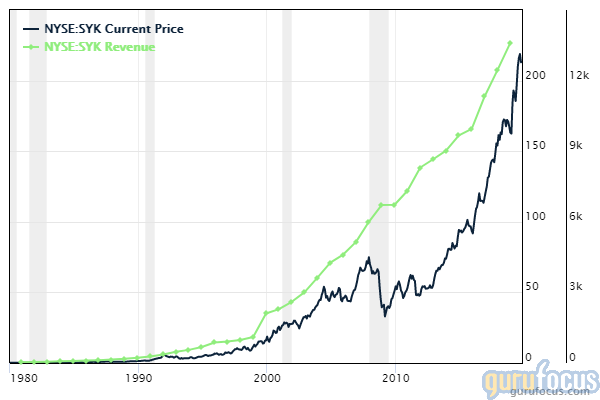

With a market cap of $82.50 billion, Stryker Corp. (NYSE:SYK) has outperformed the S&P 500 by 20.43% over the past 12 months.

Shares are trading with a price-earnings ratio of 23.61. According to the DCF calculator, the stock is overpriced by 107% at $215. As of Thursday, the price was 52.35% above the 52-week low and 1.31% below the 52-week high.

The company, which manufactures medical equipment and instruments, has a profitability and growth rating of 9 out of 10. The return on equity of 29.77% and return on assets of 13.36% are underperforming 93% of companies in the Medical Devices industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.22 is below the industry median of 2.14.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.14% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.06% and Simons' firm with 0.04%.

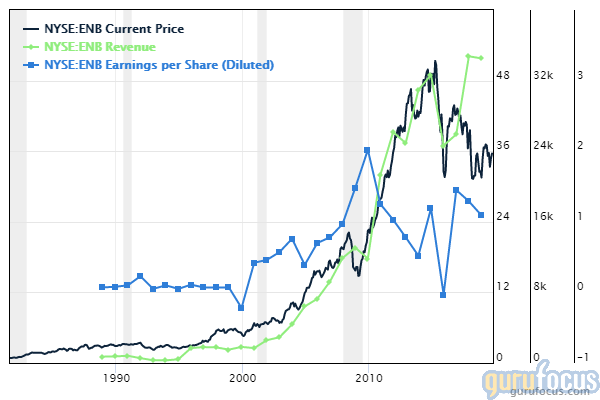

Fidelity National Information Services Inc. (NYSE:ENB) has a market cap of $74 billion. It has outperformed the S&P 500 by 9.40% over the past year.

Shares are trading with a price-earnings ratio of 20.08. According to the DCF calculator, the stock is overpriced by 92% at $36.43. As of Thursday, the price was 26.41% above the 52-week low and 4.23% below the 52-week high.

The American energy generation and transportation company has a profitability and growth rating of 7 out of 10. The return on equity of 6.97% and return on assets of 3.03% are underperforming 57% of companies in the Oil and Gas - Midstream industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.01 is below the industry median of 0.06.

The company's largest guru shareholder is Simons' firm with 0.19% of outstanding shares, followed by Pioneer Investments with 0.04%.

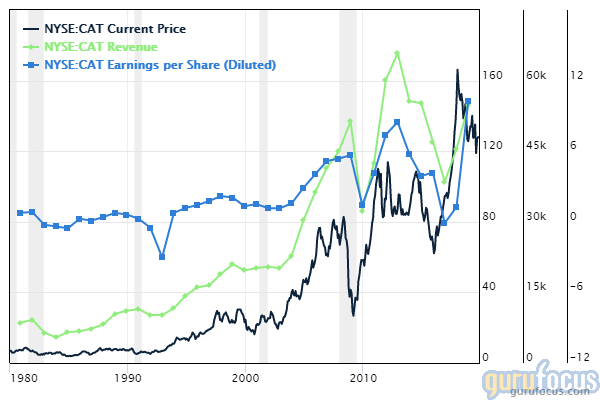

With a market cap of $79.51 billion, Caterpillar Inc. (NYSE:CAT) has outperformed the S&P 500 by 10.11% over the past 12 months.

Shares are trading with a price-earnings ratio of 13.43. According to the DCF calculator, the stock is overpriced by 23.52% at $137 per share. As of Thursday, the price was 26.47% above the 52-week low and 2.38% below the 52-week high.

The company, which manufactures specialized heavy construction and mining equipment, has a profitability and growth rating of 7 out of 10. The return on equity of 40.22% and return on assets of 7.7% are outperforming 82% of companies in the Farm and Construction Machinery industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.21 is below the industry median of 0.62.

Bill Gates (Trades, Portfolio)' foundation trust is the company's largest guru shareholder with 2.0% of outstanding shares, followed by PRIMECAP Management with 1.67% and Ken Fisher (Trades, Portfolio) with 0.96%.

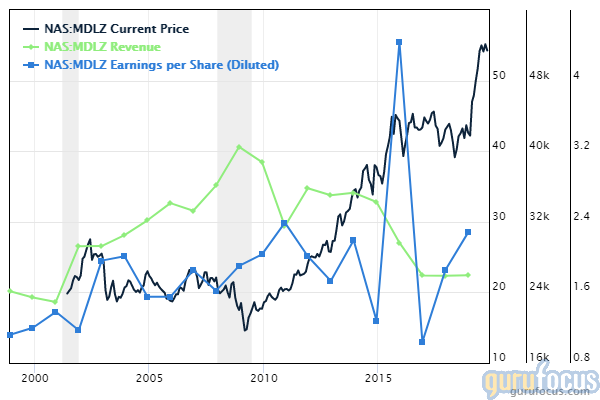

Mondelez International Inc. (NASDAQ:MDLZ) has a market cap of $76.19 billion. It has outperformed the S&P 500 by 17.17% over the past 12 months.

Shares are trading with a price-earnings ratio of 20.72. According to the DCF calculator, the stock is overpriced by 45% at $52.83 per share. As of Thursday, the price was 36.21% above the 52-week low and 6.86% below the 52-week high.

The confectionery company has a profitability and growth rating of 7 out of 10. The return on equity of 14.58% and return on assets of 5.89% are outperforming 69% of companies in the Consumer Packaged Goods industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.06 is below the industry median of 0.41.

The company's largest guru shareholder is Simons' firm with 0.44% of outstanding shares, followed by Hotchkis & Wiley with 0.28%, Pioneer Investments with 0.28% and Sarah Ketterer (Trades, Portfolio) with 0.18%.

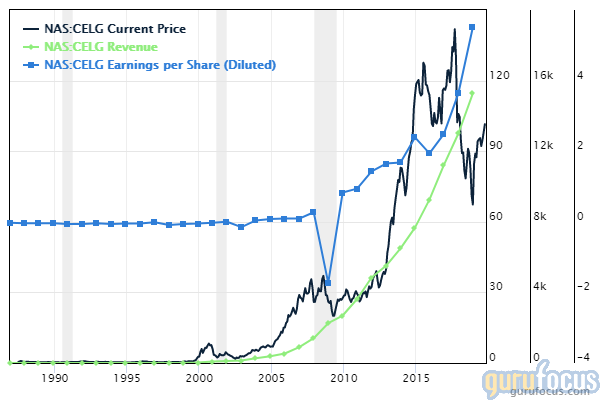

With a market cap of $75.34 billion, Celgene Corp. (NASDAQ:CELG) has outperformed the S&P 500 by 31.62% over the past 12 months.

Shares are trading with a price-earnings ratio of 14.56. According to the DCF calculator, the stock is overpriced by 36% at $108 per share. As of Thursday, the price was 82.43% above the 52-week low and 1.03% below the 52-week high.

The biopharmaceutical company has a profitability and growth rating of 9 out of 10. The return on equity of 80.68% and return on assets of 14.64% are underperforming 89% of companies in the Drug Manufacturers industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.47 is below the industry median of 1.17.

Simons' firm is the company's largest guru shareholder with 1.26% of outstanding shares, followed by David Abrams (Trades, Portfolio) with 0.95%, John Paulson (Trades, Portfolio) with 0.47% and Paul Tudor Jones (Trades, Portfolio) with 0.16%.

Disclosure: I do not own any of the stocks mentioned.

Read more here:

Ken Fisher Continues to Buy PayPal, Caterpillar

6 Companies Growing Earnings

6 Stocks With Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.