6 Guru Stocks Expected to Boost Earnings

According to the GuruFocus All-in-One Screener, a Premium feature, as of March 19, the following guru-held companies are trading at a discount and have positive three- to five-year future earnings estimates.

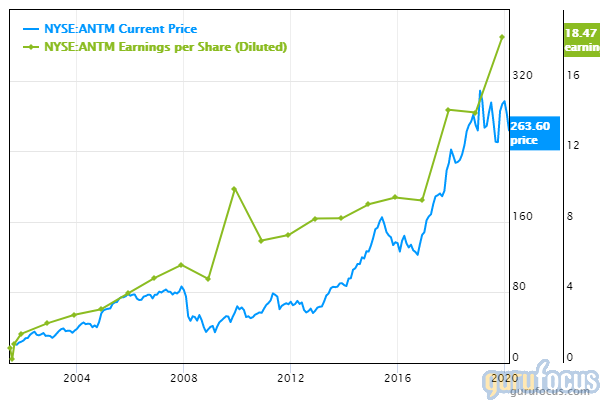

Anthem

Shares of Anthem Inc. (NYSE:ANTM) were trading around $206.96 on Thursday.

The health insurance company has a GuruFocus profitability rating of 7 out of 10. Its earnings per share have climbed 26.1% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 12.36%. The return on equity of 15.77% and return on assets of 6.37% are outperforming 55% of companies in the health care plans industry.

With 1.66% of outstanding shares, the Vanguard Health Care Fund (Trades, Portfolio) is the company's largest guru shareholder, followed by Andreas Halvorsen (Trades, Portfolio) with 1.22% and First Eagle Investment (Trades, Portfolio) with 0.79%.

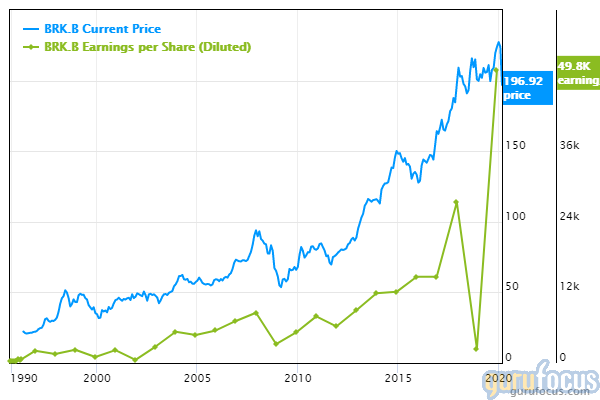

Berkshire Hathaway

On Thursday, Berkshire Hathaway Inc. (NYSE:BRK.B) was trading around $175 per share.

With a market cap of $418 billion, the insurance conglomerate has a GuruFocus profitability rating of 7 out of 10. Its earnings per share have climbed 50.4% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 60.60%. The return on equity of 21.17% and return on assets of 10.68% are outperforming 90% of companies in the insurance industry.

Bill Gates (Trades, Portfolio)' foundation trust is the company's largest guru shareholder with 2.19% of outstanding shares, followed by Bill Ackman (Trades, Portfolio) with 0.18% and Diamond Hill Capital (Trades, Portfolio) with 0.10%.

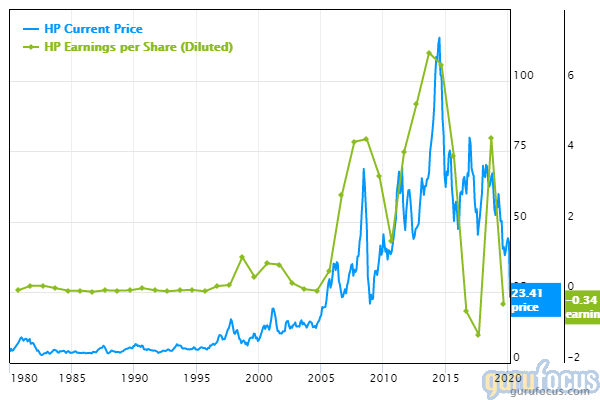

Helmerich & Payne

Helmerich & Payne Inc. (NYSE:HP) was trading around $13 per share on Thursday.

With a market cap of $1.43 billion, the owner of land drilling rigs has a GuruFocus profitability rating of 7 out of 10. Its earnings per share have climbed 12.9% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 14.35%. The return on equity of -0.61% and return on assets of -0.37% are underperforming 54% of companies in the oil and gas industry.

With 1.47% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder, followed by Ken Fisher (Trades, Portfolio) with 1.19% and Steven Cohen (Trades, Portfolio) with 0.76%.

Icon

Icon PLC (NASDAQ:ICLR) was trading around $118 per share on Thursday.

The company, which provides outsourced drug develompent and commercialization services, has a market cap of $6.32 billion and a GuruFocus profitability rating of 10 out of 10. Its earnings per share have grown 13.5% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 12.67%. The return on equity of 25.29% and return on assets of 14.02% are outperforming 90% of companies in the medical diagnostics and research industry.

With 4.38% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Ron Baron (Trades, Portfolio) with 1.36% and the Vanguard Health Care Fund with 0.32%.

Owens-Corning

On Thursday, Owens-Corning Inc. (NYSE:OC) was trading around $34.79 per share.

With a market cap of $3.78 billion, the company manufactures insulation, roofing and fiberglass composites. It has a GuruFocus profitability rating of 7 out of 10. Its earnings per share have risen 2.6% over the last three years.

Analysts project a three-year to five-year earnings growth rate of 13.24%. The return on equity of 9.18% and return on assets of 4.04% are outperforming 58% of companies in the construction industry.

With 1.15% of outstanding shares, Barrow, Hanley, Mewhinney & Strauss is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.55% and Chris Davis (Trades, Portfolio) with 0.29%.

TJX Companies

TJX Companies Inc. (NYSE:TJX) was trading around $42 per share on Thursday.

The retailer of apparel and home fashions has a market cap of $50.79 billion and a GuruFocus profitability rating of 10 out of 10.

Analysts project a three-year to five-year earnings growth rate of 13.42%. The return on equity of 60.65% and return on assets of 15.13% are outperforming 95% of companies in the retail, cyclical industry.

With 1.26% of outstanding shares, PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder, followed by Diamond Hill Capital with 0.55% and Jeremy Grantham (Trades, Portfolio) with 0.30%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Outperforming Defensive Stocks in Gurus' Portfolios

6 Airlines Trading With Low Price-Earnings Ratios

6 Utilities Gurus Are Buying

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.