6 High-Yield Stocks

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, the following stocks have high dividend yields but performed poorly over the last 12 months.

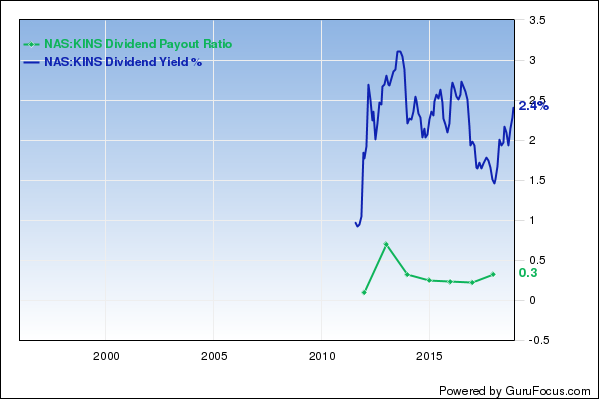

Kingstone Companies Inc.'s (KINS) dividend yield is 2.59% with a payout ratio of 70%. Over the last 52 weeks, the stock price has fallen 16.8%. The stock is trading with a price-earnings ratio of 29.8 and a price-sales ratio of 1.6.

Warning! GuruFocus has detected 4 Warning Signs with KINS. Click here to check it out.

The intrinsic value of KINS

The company, which provides insurance policies to small and mid-sized businesses as well as individuals, has a market cap of $169.53 million.

The profitability and growth rating is 7 out of 10. The return on equity of 6.47% and return on assets of 2.38% are outperforming the sector and are ranked higher than 50% of competitors. Its financial strength is rated 6 out of 10. The cash-debt ratio of 1.02 is underperforming 67% of competitors, and the equity-asset ratio of 0.35 is below the industry median of 0.54.

With 3.54% of outstanding shares, Chuck Royce (Trades, Portfolio) is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 2.34%.

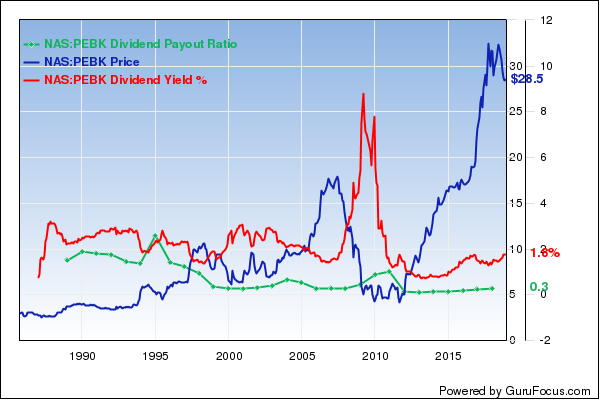

Peoples Bancorp of North Carolina Inc.'s (PEBK) dividend yield is 1.90% with a payout ratio of 25%. Over the last 52 weeks, the stock price has fallen 10.6%. The stock is trading with a price-earnings ratio of 13.8 and a price-sales ratio of 3.1.

The state-chartered commercial bank has a market cap of $170.69 million.

The company has a profitability and growth rating of 4 out of 10. The return on equity of 10.19% and return on assets of 1.08% are outperforming the sector and are ranked higher than 61% of competitors. Its financial strength is rated 4 out of 10. The cash-debt ratio of 2.77 is outperforming 69% of competitors.

Simons' firm is the company's largest guru shareholder with 0.64% of outstanding shares.

Adams Resources & Energy Inc.'s (AE) dividend yield is 2.26% with a payout ratio of 35%. Over the last 52 weeks, the stock price has fallen 19.4%. The stock is trading with a price-earnings ratio of 15.7 and a price-sales ratio of 0.10.

The company, which markets crude oil, natural gas and petroleum products, has a market cap of $170.81 million.

GuruFocus rated its profitability and growth 4 out of 10. The return on equity of 7.08% and return on assets of 3.66% are ranked lower than 80% of competitors. Its financial strength is rated 8 out of 10. The cash-debt ratio of 50.12 is outperforming 89% of competitors. The equity-asset ratio of 0.48 is above the industry median of 0.47.

Simons' firm is the company's largest guru shareholder with 7.21% of outstanding shares.

Escalade Inc.'s (ESCA) dividend yield is 4.18% with a payout ratio of 29%. Over the last 52 weeks, the stock price has fallen 10.7%. The stock is trading with a price-earnings ratio of 7.0 and a price-sales ratio of 0.97.

The manufacturer of sporting goods has a market cap of $171.11 million.

The company has a profitability and growth rating of 7 out of 10. The return on equity of 20.97% and return on assets of 16.03% are outperforming the sector and are ranked higher than 72% of competitors. Its financial strength is rated 9 out of 10 with no debt. The equity-asset ratio of 0.84 is above the industry median of 0.52.

Simons' firm is the company's largest guru shareholder with 1.35% of outstanding shares.

Hallador Energy Co.'s (HNRG) dividend yield is 2.78% with a payout ratio of 19%. Over the last 52 weeks, the stock price has fallen 9.8%. The stock is trading with a price-earnings ratio of 6.7 and a price-sales ratio of 0.6.

The coal mining company has a market cap of $173.82 million.

GuruFocus rated its profitability and growth 8 out of 10. The return on equity of 10.26% and return on assets of 5.06% are underperforming the sector and are ranked lower than 62% of competitors. Its financial strength is rated 5 out of 10. The equity-asset ratio of 0.48 is above the industry median of 0.40.

Royce is the company's largest guru shareholder with 0.09% of outstanding shares.

Riverview Bancorp Inc.'s (RVSB) dividend yield is 1.70% with a payout ratio of 20%. Over the last 52 weeks, the stock price has fallen 18.4%. The stock is trading with a price-earnings ratio of 12.8 and a price-sales ratio of 3.1.

The bank has a market cap of $171.95 million.

The company has a profitability and growth rating of 4 out of 10. The return on equity of 11.14% and return on assets of 1.15% are outperforming the sector and are ranked higher than 61% of competitors. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 1.07 that is outperforming 51% of competitors. The equity-asset ratio is 0.11.

With 1.77% of outstanding shares, Simons' firm is the company's largest shareholder among the gurus.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

6 Bargain Stocks Growing Book Value

5 Health Care Stocks Gurus Are Buying

6 Stocks Beating Mr. Market

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with KINS. Click here to check it out.

The intrinsic value of KINS