6 investing lessons from 2018 that will be very helpful in 2019

What a year.

Another 12 months have flown by for investors. The year that was 2018 saw two tech companies (Apple and Amazon) among the first entrants into the $1 trillion market cap club. Their time in that comfy confine was short-lived, though. The market endured two major beatings (late January to early February and early October to December end). Stocks quickly rebounded from the whooping in February, but are having more difficulty finding their footing during the latest punch to the face.

Facebook proved to complacent investors and enthusiastic pundits that it’s no longer a tech juggernaut. Instead it’s a tech company dealing with multiple internal crises seemingly each passing day and waning user interest.

In short, if you didn’t learn anything about investing in 2018 it’s very unfortunate. The lessons were plentiful. Even the battle-tested veterans that make up Wall Street were reminded of a few things in 2018.

“The volatility of the past few months reminds me that the ultimate driver of asset allocation is liability allocation. Investing is just an exercise in balance sheet management. In other words, your assets should be strategically allocated along the lines of what you need them to do for you,” Brown Brothers Harriman chief investment strategist Scott Clemons tells Yahoo Finance on what he learned this year. “Liabilities like retirement and kids’ educations are best balanced by equities (at least for younger investors), regardless of market conditions. I’ve been at this for close to 30 years, and I am more and more convinced that success is a matter of whether you invest, not when you invest.”

SunTrust chief market strategist Keith Lerner says how market psychology often works was one lesson he was reminded of in 2018. “When an investment is very out of favor and investors think it can only go one way, markets often do the reverse — for example, when the 10-year U.S. Treasury yield approached 3.25% in October, many investors thought that it only could go higher; however, that was the peak and we are closing the year near 2.70%,” Lerner says.

Here are six lessons yours truly digested this year that could help you navigate the market in 2019.

Lesson 1: Markets dislike Federal Reserve Chairman Jerome Powell

It’s not personal, just business. Whereas the often dovish former Fed Chair Janet Yellen was widely embraced by the market, that same market doesn’t view Powell as a friend. Neither does President Trump. Every time Powell spoke during post-Fed meeting press conferences or other events stocks usually came under pressure. (See the nifty chart below from our resident markets data wizard at Yahoo Finance Jared Blikre.)

That dislike is important for investors to remember ahead of what will be eight post-Fed meeting press conferences in 2019. Position yourself wisely.

$SPX performance day of #FOMC decision. Watch out for that drift into the announcement. #Powell presser tends to be a downer. @YahooFinance pic.twitter.com/VoLGpHjEAl

— Jared Blikre (@SPYJared) December 19, 2018

Lesson 2: Stop with the FAANG nonsense

Nothing reeks more of investor complacency in a bull market than uttering the term FAANG (and buying shares of each member of the group blindly). The catchphrase worked great when shares of component companies Facebook, Apple, Amazon, Netflix and Alphabet (Google) were roaring ahead, but now borders on dumb as they have all entered bear markets lately for one reason or another. Moreover, the performances of each component has varied this year as to reflect their different challenges and opportunities.

The FAANG investing acronym officially died a horrific death in 2018. Time to move on. Next year each component will have to string together a series of quarters with accelerating profit growth to regain investor confidence.

Lesson 3: When the president says you should consider buying stocks…

Love Trump or hate Trump, when the leader of the free world and ultimate insider suggests buying stocks after a mini market meltdown...give him a listen.

After the Dow notched its worst Christmas Eve on record with a 653-point plunge, Trump told reporters on Christmas Day that he thinks now is a “tremendous opportunity to buy” stocks. The Dow exploded 1,086 points the day after Christmas. In the session after that, the Dow erased a 600-point drop to finish higher by more than 250 points. While the news flow since Trump’s “recommendation” on stocks has been typical Trump administration – read: chaotic – stocks have begun to turn the corner on signs of thawing trade relations with China. Key administration officials have also thrown support behind Powell (after several Trump attacks) and Treasury Secretary Steven Mnuchin.

Lesson 4: Respect underlying fears of peak profit margins for Corporate America.

Yes, Mr. Market does still care about what a company may earn sometime in the future. It’s not all momentum trading based on computer models, people.

Keep in mind that it was on April 24 when Caterpillar CFO Brad Halverson spooked the market by saying first-quarter profits would be the “high water” mark for 2018. That sparked a sell-off in the major indices that lasted until May 3.

Investors remain concerned on the direction of corporate profits. The market is currently pricing in flat to slightly negative earnings growth in 2019 after double-digit gains in 2018. Proceed with caution ahead of each earnings season.

Lesson 5: If it smells like a bubble, it’s probably a bubble.

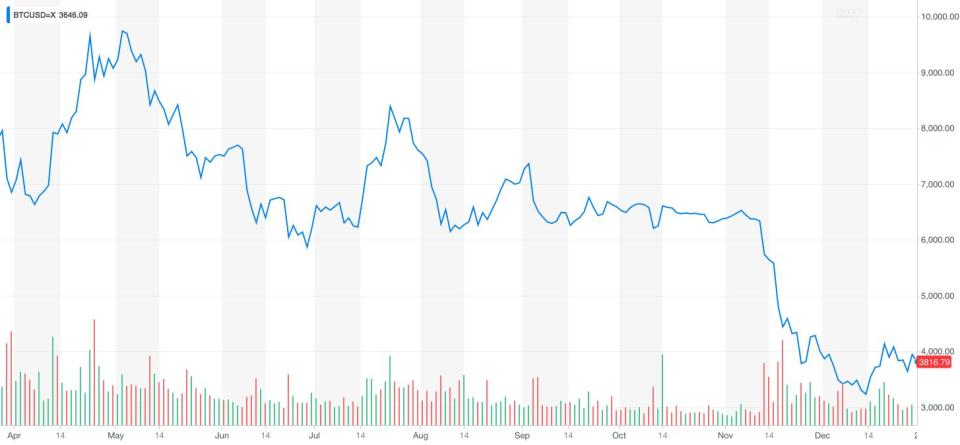

The cryptocurrency bubble that resulted in bitcoin prices hitting a $20,000 peak in December 2017 blew up in 2018. Bitcoin is now trading at $3,800 or so as it failed to live up to the hype as the next big thing among consumers (a cash replacement) and the big investment banks like Goldman Sachs (no crypto trading desks emerged). Gone are the bitcoin price pumpers that dominated business news in 2017. Gone are the internet pop-up ads from questionable looking folks imploring you to get into bitcoin.

Don’t forget the lesson from crypto’s rout as the cannabis space enters 2019 where bitcoin was entering 2018 -- surrounded by a ton of hype. Ludicrous valuations being paid by old-school companies to take stakes in pot companies with nascent operations. Tilray trading at a $7 billion market cap after inking a few distribution cannabis deals. New Aphria chairman and Hain Celestial founder Irwin Simon saying a $2.8 billion all-stock offer by Green Growth “significantly” undervalues the company.

Craziness.

Lesson 6: The banks aren’t sure bets when rates rise.

The old adage that “bank stocks do well when interest rates rise” could be put on the back-burner for a moment or two. Shares of Goldman Sachs, Bank of America, Wells Fargo, Morgan Stanley and JPMorgan Chase are down on average 23% this year despite rising interest rates, which are often seen as a good thing for net profit margins.

What the stock pundits forgot to tell you – and you should remember this for 2019 – is that higher rates don’t matter for the banks if the market perceives their operations as cooling down. For example, rising interest rates this year has continued to cause a slowdown in the housing and auto markets. Meanwhile, with higher interest rates triggering renewed volatility and downside in the markets, many banks have likely been caught on the wrong side of the trade.

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read Yahoo Finance’s Exclusives:

Hasbro CEO: We will return to growth in 2019

Macy’s CEO: Mobile shopping is surging

Procter & Gamble CEO: We aren’t splitting up the company

Coca-Cola CEO: Why we aren’t getting into the alcohol business