6 Low Price-Sales Stocks

According to the GuruFocus All-in-One Screener, the following companies, as of Thursday, look cheap since they are trading with low price-sales ratios.

Shares of Baxter International Inc. (NYSE:BAX) are trading around $86 with a price-sales ratio of 4.17 and a price-earnings ratio of 28.91.

The medical products manufacturer has a market cap of $42.87 billion. The stock has risen at an annualized rate of 12.40% over the last 10 years.

The discounted cash flow calculator gives the stock a fair value of $31.89, suggesting it is overpriced by 170%. The Peter Lynch earnings line gives the stock a fair value of $44.25.

Daniel Loeb (Trades, Portfolio) is the company's largest guru shareholder with 4.51% of outstanding shares, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 1.39% and Bill Nygren (Trades, Portfolio) with 0.46%.

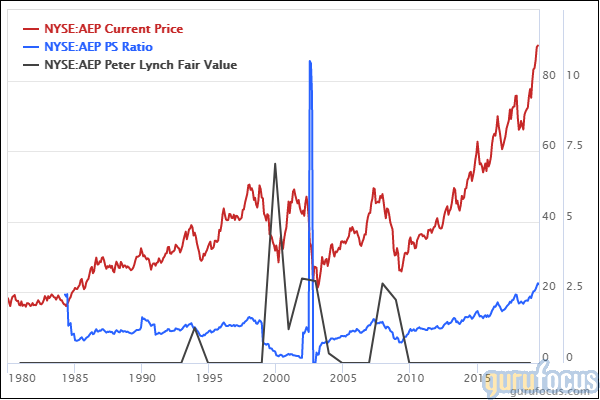

American Electric Power Co. Inc. (NYSE:AEP) is trading around $88.72 with a price-sales ratio of 2.78 and a price-earnings ratio of 22.24.

The company, which generates and distributes electricity, has a market cap of $43.81 billion. The stock has risen at an annualized rate of 13.59% over the past decade.

The DCF calculator gives the stock a fair value of $42.7, suggesting it is overpriced by 107%. The Peter Lynch earnings line gives the stock a fair value of $59.85

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.01% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.39% and Steven Cohen (Trades, Portfolio) with 0.05%.

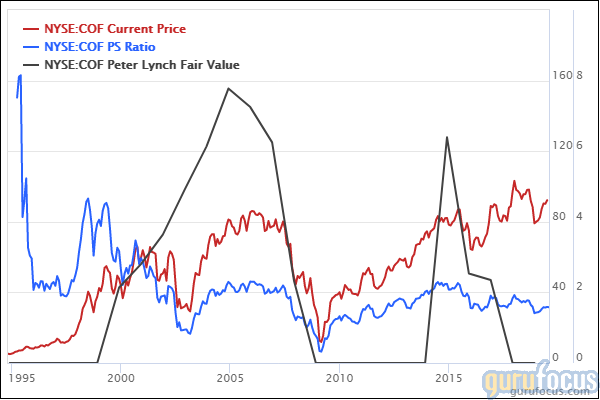

Capital One Financial Corp. (NYSE:COF) is trading around $91.21 with a price-sales ratio of 1.59 and price-earnings ratio of 7.89.

The company, which provides a broad spectrum of financial products and services, has a market cap of $42.90 billion. The stock has risen at an annualized rate of 12.77% over the last 10 years.

The DCF calculator gives the stock a fair value of $329, suggesting it is undervalued with a 72% margin of safety. The Peter Lynch earnings line gives the stock a fair value of $173.4.

With 8.79% of outstanding shares, Dodge & Cox is the company's largest guru shareholder, followed by Chris Davis (Trades, Portfolio) with 2.94%, Nygren with 1.21% and Richard Pzena (Trades, Portfolio) with 1.20%.

Royal Philips NV (NYSE:PHG) is trading around $47.70 with a price-sales ratio of 2.04 and a price-earnings ratio of 27.04.

The company, which operates in the health tech and personal health industry has a market cap of $42.73 billion. The stock has risen at an annualized rate of 9.73% over the past decade.

The DCF calculator gives the company a fair value of $19.05, suggesting it is overpriced by 148%. The Peter Lynch earnings line gives the stock a fair value of $25.5.

The company's largest guru shareholder is Hotchkis & Wiley with 0.12% of outstanding shares, followed by the Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) with 0.04% and Simons' firm with 0.02%.

Prudential Financial Inc. (NYSE:PRU) is trading around 91.53 with a price-sales ratio of 0.67 and a price-earnings ratio of 11.78.

The insurance company has a market cap of $37.58 billion. The stock has risen at an annualized rate of 11.04% over the last 10 years.

The DCF calculator gives the company a fair value of $91.82, suggesting it is fairly priced. The Peter Lynch earnings line gives the stock a fair value of $142.5.

The company's largest guru shareholder is Pioneer Investments with 0.61% of outstanding shares, followed by Robert Olstein (Trades, Portfolio) with 0.02%, Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.01% and George Soros (Trades, Portfolio) with 0.01%.

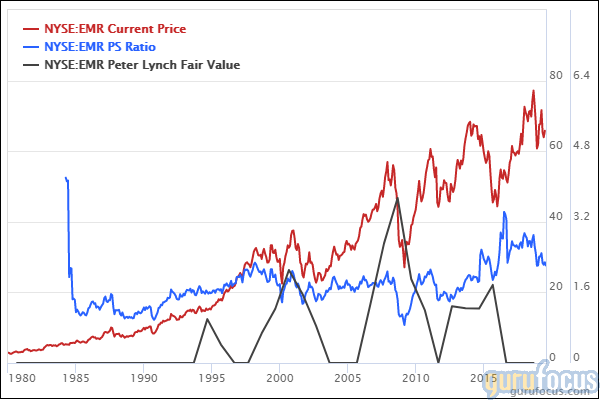

Emerson Electric Co. (NYSE:EMR) is trading around $64 with a price-sales ratio of 2.25 and a price-earnings ratio of 17.74.

The manufacturing company has a market cap of $40 billion. The stock has risen at an annualized rate of 8.58% over the past decade.

The DCF calculator gives the company a fair value of $39.27, suggesting it is overpriced by 67%. The Peter Lynch earnings line gives the stock a fair value of $55.05.

The company's largest guru shareholder is Pioneer Investments with 0.91% of outstanding shares, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.27% and Charles Brandes (Trades, Portfolio) with 0.17%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Undervalued Predictable Stocks

5 Stocks Boosting Earnings

Jerome Dodson Exits 3M, Charles Schwab

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.