6 Must-Buy Stocks on the Dip for a Likely Volatile October

The volatility that was seen in September, Wall Street is likely to continue this month. The factors that led to severe volatility last month are present in October too. Moreover, the news of President Donald Trump getting infected with the novel coronavirus last week made market participants all the more jitter.

Lack of Good News in Market

Since last month, the market is suffering from the absence of good news to boost investors' morale. Notably, stock price reflects market participants' expectations from the economy, various sectors and industries, and individual companies. Therefore, the lack of good news always dampens investors' sentiment, resulting in the market's decline.

The two major concerns of the market are the persisting spike in new coronavirus cases in several parts of the United States and the uncertainty over new fiscal stimulus. In fact, the COVID -19 infection of President Trump raises concerns about key decisions regarding the country's security, economic and political affairs, specifically, regarding his ongoing election campaign. Additionally, conflicting news on the availability of a vaccine for coronavirus made the situation worst.

A series of economic data for August and September clearly showed that the pace of U.S. economic recovery has slowed in the absence of a fresh trench of fiscal stimulus.

The first round of $2.2 trillion fiscal stimulus injected by the Trump administration terminated in July. Uncertainty regarding new stimulus owing to conflicting views of Republicans and Democrats on the size and scope of the package is undoubtedly taking a toll on the economy.

Moreover, the U.S. presidential election scheduled on Nov 3 is less than a month away. Historically, stock markets have remained volatile in the month before the election. Market participants generally choose to hold cash instead of investing in risky assets like equities while assessing the economic and financial consequences of the election result.

Possible Drivers of October

First, a Congressional settlement for the second round of coronavirus-aid package will immediately boost investors' confidence in risky assets like equities. Notably, the latest Conference Board data revealed that Americans expressed their highest level of confidence in the economy in September since March.

Second, in its latest projection on Oct 1, the Atlanta Fed estimated 34.6% growth for third-quarter U.S. GDP, up from 32% projected on Sep 25. Furthermore, projections for U.S. corporate earnings for third-quarter and full-year 2020 are rising since early July, indicating growing corporate profits.

The earnings trend is likely to improve going forward as large parts of the U.S. economy have started coming out of the pandemic-driven lockdown. Since the coronavirus-led lockdowns in March, the U.S. economy is operating at a sub-optimal level. The reopening of the economy will limit the stock market's downside potential.

Our Top Picks

At this stage, it will be prudent to invest in stocks with a Zacks Rank #1 (Strong Buy) that are also trading at a huge discount to their 52-week high prices. We have narrowed down our search to six such stocks all of which are regular dividend payers. Dividend will act as income stream in case of a market downturn. You can see the complete list of today’s Zacks #1 Rank stocks here.

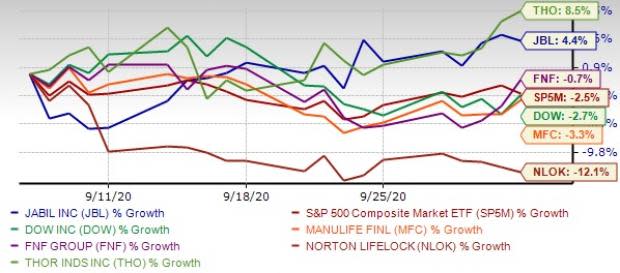

The chart below shows the price performance of our six picks in the past month.

Jabil Inc. JBL provides manufacturing services and solutions worldwide. It operates in two segments, Electronics Manufacturing Services and Diversified Manufacturing Services.

The company has an expected earnings growth rate of 39.3% for the current year (ending August 2021). The Zacks Consensus Estimate for the current year has improved by 14.1% over the last 30 days. The stock is currently trading at a 28.6% discount to its 52-week high price. The company has a current dividend yield of 0.93%.

Dow Inc. DOW provides various materials science solutions for consumer care, infrastructure, and packaging markets in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America. It operates through the Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials and Coatings segments.

Although the company's current-year expected earnings growth rate is negative, it has estimated earnings growth of more than 100% for next year. The Zacks Consensus Estimate for the current-year and next year has improved 32.1% and 9.9%, respectively, in the last 30 days. The stock is currently trading at an 18.9% discount to its 52-week high price. The company has a current dividend yield of 5.92%.

Manulife Financial Corp. MFC provides financial advice, insurance, and wealth and asset management solutions for individuals, groups, and institutions in Asia, Canada, and the United States.

Although the company's current-year expected earnings growth rate is negative, it has an estimated earnings growth rate of 11.8% for next year. The Zacks Consensus Estimate for the current-year has improved 2.1% in the last 30 days. The stock is currently trading at a 49.6% discount to its 52-week high price. The company has a current dividend yield of 5.89%.

Fidelity National Financial Inc. FNF provides various insurance products in the United States. It operates through Title, and Corporate and Other segments.

The company has an expected earnings growth rate of 15.6% for the current year. The Zacks Consensus Estimate for the current year has improved by 38.5% over the last 60 days. The stock is currently trading at a 49.1% discount to its 52-week high price. The company has a current dividend yield of 3.99%.

NortonLifeLock Inc. NLOK is one of the leading providers of cyber security solutions. It is known for some of the popular brands in security and utilities, including Norton Anti-Virus, Norton Internet Security and Norton System Works.

The company has an expected earnings growth rate of 47.8% for the current year (ending March 2021). The Zacks Consensus Estimate for the current year has improved by 20.9% over the last 60 days. The stock is currently trading at a 39.6% discount to its 52-week high price. The company has a current dividend yield of 2.43%.

Thor Industries Inc. THO designs, manufactures, and sells recreational vehicles (RV) and related parts and accessories in the United States, Canada and Europe. It is the largest manufacturer of RVs in the world.

The company has an expected earnings growth rate of 38.6% for the current year (ending July 2021). The Zacks Consensus Estimate for the current year has improved by 12.7% over the last 7 days. The stock is currently trading at a 21.4% discount to its 52-week high price. The company has a current dividend yield of 1.60%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Click to get this free report Manulife Financial Corp (MFC) : Free Stock Analysis Report Jabil, Inc. (JBL) : Free Stock Analysis Report Thor Industries, Inc. (THO) : Free Stock Analysis Report Dow Inc. (DOW) : Free Stock Analysis Report Fidelity National Financial, Inc. (FNF) : Free Stock Analysis Report NortonLifeLock Inc. (NLOK) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research